Trade analysis and advice on trading the European currency

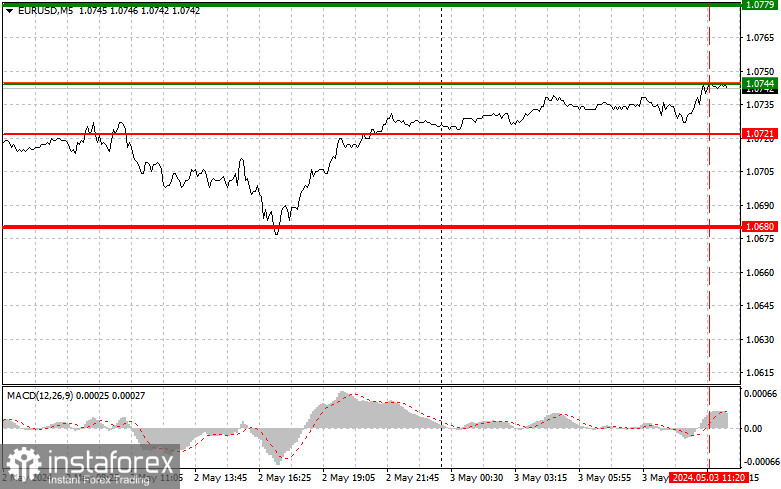

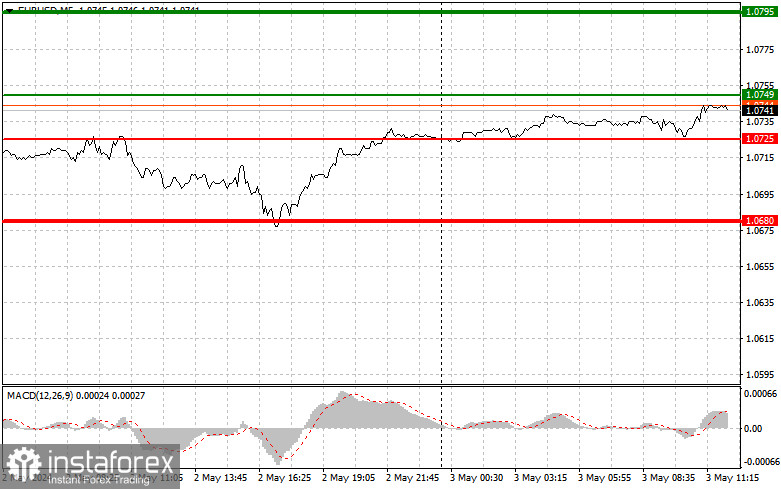

The test of the price at 1.0744 in the first half of the day coincided with the moment when the MACD indicator had surged significantly above the zero mark, limiting the further upward potential of the pair – especially ahead of the release of important US statistics. For this reason, I did not buy it. Data on the Eurozone labor market was predictably ignored, so now all traders' attention will surely be focused on the US labor market reports. In the second half of the day, figures on the unemployment rate, nonfarm payrolls change, average hourly earnings change, and ISM services purchasing managers' index are expected. Strong reports imply a strong economy and, consequently, high inflation, which the Fed is still actively combating, having lost to it in the first quarter of this year. If the data disappoints traders and turns out worse than economists' forecasts – I sell the dollar and buy the euro. Regarding the intraday strategy, I plan to act based on the realization of Scenario #1, even despite the MACD indicator readings, as I expect a strong and directional movement.

Buy Signal

Scenario #1: Today, I plan to buy the euro when the price reaches around 1.0749 (green line on the chart), with a target for growth to the level of 1.0795. At point 1.0795, I will exit the market and also sell the euro in the opposite direction, expecting a movement of 30–35 points from the entry point. Today, euro growth can only be expected after weak US labor market statistics and job cuts. Important! Before buying, make sure that the MACD indicator is above the zero mark and is just starting to rise from it.

Scenario #2: I also plan to buy the euro today in case of two consecutive tests of the price at 1.0725 when the MACD indicator is in oversold territory. This will limit the downward potential of the pair and lead to a reverse market turn upward. Expect growth towards the opposite levels of 1.0749 and 1.0795.

Sell Signal

Scenario #1: I will sell the euro after reaching the level of 1.0725 (red line on the chart). The target will be the level of 1.0680, where I plan to exit the market and buy the euro immediately in the opposite direction (expecting a movement of 20–25 points in the opposite direction from the level). Pressure on the pair will return in the event of a lack of buyer activity around the daily maximum and strong US data. Important! Before selling, make sure that the MACD indicator is below the zero mark and is just starting to decline from it.

Scenario #2: I also plan to sell the euro today in case of two consecutive tests of the price at 1.0749 when the MACD indicator is in overbought territory. This will limit the upward potential of the pair and lead to a reverse market turn downward. Expect a decline towards the opposite levels of 1.0725 and 1.0680.

Chart Elements:

Thin green line – entry price, at which the trading instrument can be bought.

Thick green line – the expected price where Take Profit can be set, or profits can be fixed independently, as further growth above this level is unlikely.

Thin red line – entry price at which the trading instrument can be sold.

Thick red line – the expected price where Take Profit can be set, or profits can be fixed independently, as further decline below this level is unlikely.

MACD indicator. When entering the market, it is important to refer to overbought and oversold zones.

Important. Beginner traders in the forex market need to be very cautious when making decisions to enter the market. It is best to stay out of the market before the release of important fundamental reports to avoid being caught in sharp exchange rate fluctuations. If you decide to trade during news releases, always set stop orders to minimize losses. You need to set stop orders to avoid losing your entire deposit, especially if you do not use money management and trade with large volumes.

And remember, for successful trading, it is necessary to have a clear trading plan similar to the one I presented above. Spontaneous trading decisions based on the current market situation are initially a losing strategy for an intraday trader.