FX.co ★ AI bubble and dot-com crash: déjà vu or new reality?

AI bubble and dot-com crash: déjà vu or new reality?

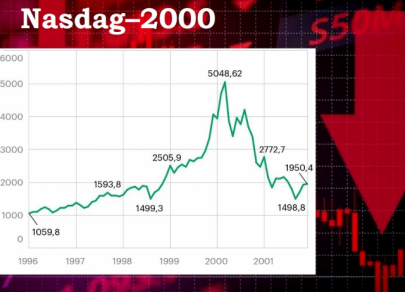

Peak and beginning of Nasdaq’s slide

By March 2000, the Nasdaq had doubled, reaching 5,048 points. Investors dreamed of endless internet expansion and poured billions into unprofitable startups. But the stock market collapsed on March 11: news of a recession in Japan and a rate hike by the Federal Reserve struck like lightning. By April, the index had lost 34%, and by October 2002, it had plummeted by 78%, wiping out $5 trillion. Traders watched in shock as red screens flashed before them, as if they were witnessing the end of the world. Photos from those days resembled scenes from a thriller: chaos on trading floors, faces in despair, and plummeting red charts.

Investors overwhelmed by panic

Traders on the Nasdaq in March 2000 were as frantic as bees in a disturbed hive: screens blazed red, phones rang off the hook, and stocks dropped like rocks into an abyss. One day saw a 9% slump; a week brought a quarter of losses. Investors, who had been reveling in champagne the day before, suddenly clutched their heads in shock. Their trillions evaporated in weeks. It was a crash of illusions: unprofitable dot-coms collapsed, taking with them dreams of easy money. Yet amid the turmoil, reality emerged—the market was cleansed like a forest after a fire.

Layoffs in Silicon Valley

Silicon Valley turned into a ghost town in 2001: thousands of laid-off employees wandered the streets with boxes in hand, as if after a locust invasion. Dot-coms, once paper billionaires, shuttered en masse. Pets.com, Webvan, and eToys vanished in an instant, taking with them 200,000 jobs in the Valley alone. Offices filled with foosball tables and free beer could become empty overnight. This was not just a company crash; it was the shattering of dreams for a generation that believed in the "new economy." Investors lost trillions, and young geniuses suddenly found themselves unemployed.

Collapse of Pets.com: symbol of dot-com era

Pets.com, with its charming sock puppet, became an icon of the crash: in 2000, the company burned out just nine months after its IPO, losing $300 million. Promises of delivering pet food within an hour turned into empty warehouses and shattered dreams. Its stock plummeted from $11 to zero. Empty shelves illustrated the sad ending and added employees to the ranks of the unemployed. This was not an isolated case—hundreds of dot-coms burst, carrying trillions away. The primary lesson was understanding that profit is more important than hype.

Survivors: Amazon after storm

Amazon also fell like a stone in 2000. The company’s stock tumbled from $107 to $7, losing an incredible 90%. But Amazon CEO Jeff Bezos stood firm, like a captain in a storm. While dot-coms sank, Amazon focused on customers, surviving the crash and becoming a giant. As competitors' warehouses emptied, Amazon replenished its stock. Patience and reliance on market laws prevailed. From the ruins of 2000, an empire grew, now ranking first in revenue and market capitalization in the global e-commerce and public cloud computing markets.