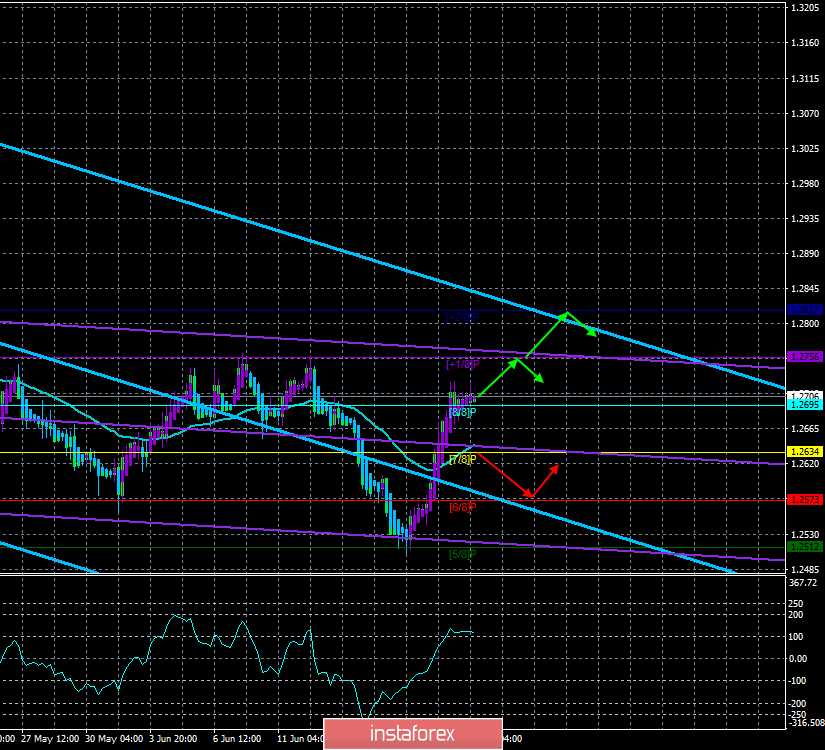

4-hour timeframe

Rincian teknikal:

Saluran regresi linier yang lama: arah - turun.

Saluran regresi linier yang terbaru: arah - turun.

Rata-rata pergerakan (20; diperhalus) - naik.CCI: 108.9764

The British pound stopped yesterday like the euro currency on June 20 in its defense during the American trading session. A corrective movement has not yet begun and the previous local maxima are not updated. Therefore, we can say that there is every chance to see in the near future not only a downward correction but also a resumption of the downtrend for the GBP/USD pair. The outcome of yesterday's meeting of the Bank of England, by and large, comes down to: "since it's not known how Brexit will end, we'll not change anything and wait. As we said earlier, it is Brexit that makes the pound. The Bank of England and the whole of Great Britain remain in limbo. In the case of a "tough" scenario, the British regulator does not rule out easing of monetary policy. Yesterday, the second place was taken by the current foreign minister, Jeremy Hunt, in the last round of elections for the post of leader of the Conservative Party, wherein Boris Johnson won again. Now, there will be a final vote, where 160,000 party members will take part, and it will be known around July 20–22 who won. It is after this date that Brexit becomes active again and the new prime minister will begin work in this direction. What exactly will make the new prime minister, it is difficult to say. In general, all the complexity in the situation with Brexit remains the same.

Level Support Terdekat:

S1 - 1,2695

S2 - 1.2634

S3 - 1.2573

Level resistance terdekat:

R1 - 1.2756

R2 - 1.2817

Rekomendasi Trading:

Pasangan GBP/USD telah mengatasi pergerakan namun saat ini dapat mulai disesuaikan. Mengingat kelemahan dari bulls pada berbagai kasus, kami menyarankan pembelian yang sangat hati-hati dari pound sterling, yang harus ditutup saat indikator Heiken Ashi berubah turun.

Menjual pasangan pound/dolar akan memungkinkan tidak awal dari konsolidasi pembalikkan dibawah pergerakan dengan target di 1.2573 dan 1.2512. Dalam hal ini, kelanjutan dari tren turun memungkinkan.

Selain pada gambaran teknikal, trader juga harus mempertimbangkan data fundamental dan waktu rilis mereka.

Penjelasan ilustrasi:

Saluran regresi linear lebih lama adalah garis biru dari pergerakan searah.

Saluran linear junior merupakan garis ungu dari pergerakan searah.

CCI adalah garis biru dalam jendela regresi indikator.

Rata-rata pergerakan (20; diperhalus) merupakan garis merah dari grafik harga.

Rata-rata pergerakan (20; diperhalus) merupakan garis biru dari grafik harga.

Level Murray - garis horizontal multi-warna.

Heiken Ashi merupakan sebuah indikator dimana bar warna biru atau ungu.