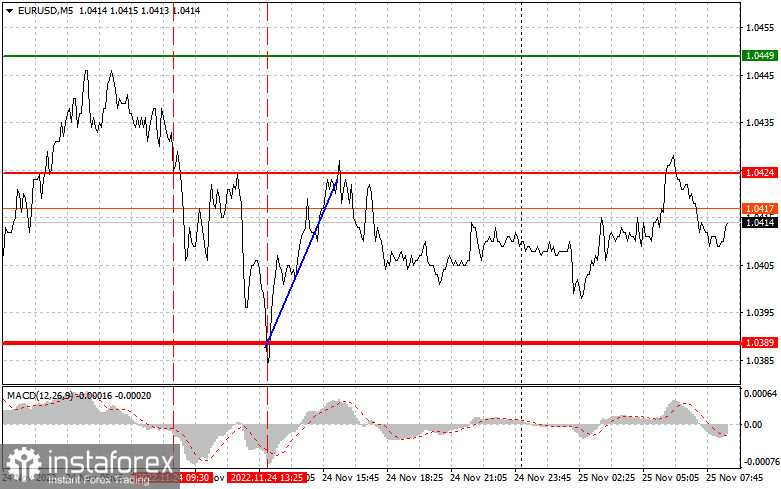

The level of 1.0424 was tested when the MACD indicator had moved considerably from the zero level. This capped the downward potential of the instrument. For this reason, I didn't sell the euro. However, the pair dropped to 1.0389 where I advised speculators open long positions at a bounce. So, I managed to take about 35 pips of profit. There were no other entry points.

The Ifo Business Climate Index and the Germany Ifo Expectations turned out to be rather mixed. Some indicators advanced, while others showed a decline. However, this is hardly surprising given that inflation in the euro area remains high, hurting economic expansion and households. Today, German will unveil its third-quarter GDP report. It may adversely affect the euro if the reading turns out to be worse than economists' forecasts. The GfK German Consumer Climate Index for December may also limit the pair's upward potential. Apart from that, Kerstin af Jochnick, a member of the ECB Supervisory Board, and other ECB policymakers will deliver speeches. However, traders are likely to ignore them as they will hardly say anything new. Trading floors in the US are closed on the occasion of Thanksgiving Day. Trading volume in the afternoon will remain low. I would advise you not to trade during the American session.

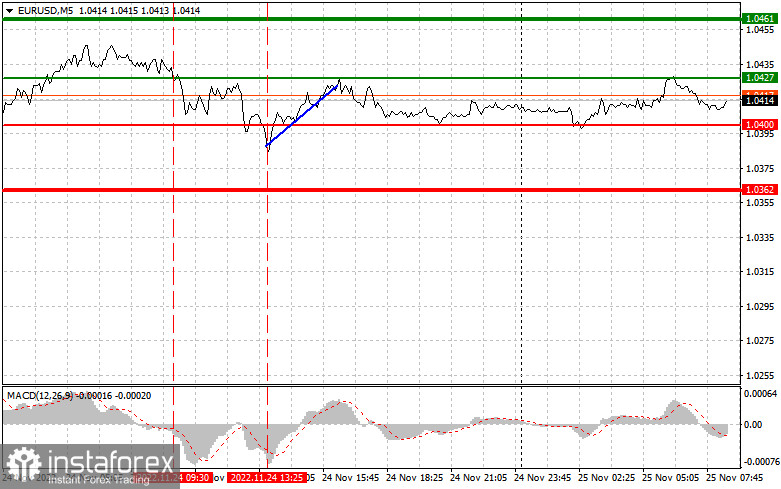

Buy signal

Scenario No.1: you could open long positions on the euro today if the price reaches 1.0427 plotted by the green line on the chart with the upward target at 1.0461. The level of 1.0461 is the market exit point. Then, you could sell the euro in the opposite direction, bearing in mind a 30-35-pips downward move from the entry point. The is unlikely to climb significantly. Now, investors are awaiting the economic reports from Germany, which could increase trading volumes. Important! Before opening long positions, make sure that the MACD indicator is above the zero level and it has just started to rise from it.

Scenario No.2: it is also possible to buy the euro today if the price hits 1.0400. At this moment, the MACD indicator should be in the oversold area. It could limit the downward potential of the pair and trigger an upward reversal of the market. The pair is expected to climb to the levels of 1.0427 and 1.0461.

Sell signal

Scenario No.1: you could open short positions on the euro if the price drops to 1.0400 plotted by the red line on the chart. The target level is seen at 1.0362 where I recommend profit-taking. Then, we could go long on EUR/USD in the opposite direction, bearing in mind a 20-25 pip upward move. The pressure on the pair will return if the pair fails to rise above the monthly high and Germany reveals weak data. Important! Before opening short positions, make sure that the MACD indicator is below the zero level and it has just started to decline from it.

Scenario No.2: it is also possible to sell the euro today if the price decreases to 1.0427. At this moment, the MACD indicator should be in the overbought area. It could limit the upward potential of the pair and trigger a downward reversal of the market. The pair is projected to edges lower to levels of 1.0400 and 1.0362.

What's on the chart

The thin green line is the key level at which you can place long positions in the EUR/USD pair.

The thick green line is the target price as the price is unlikely to move above this level.

The thin red line is the level at which you can place short positions in the EUR/USD pair.

The thick red line is the target price as the price is unlikely to move below this level.

MACD line. When entering the market, it is important to adjust trading decisions to the overbought and oversold zones.

Important: Novice traders need to be very careful when making decisions about entering the market. Before the release of important reports, it is best to stay out of the market to avoid losses due to sharp fluctuations in market quotes. If you decide to trade during the release of news, then always place Stop Loss orders to minimize losses. Without placing Stop Loss orders, you can very quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

Remember that for successful trading, you need to have a clear trading plan. Spontaneous trading decisions based on the current market situation will inevitably lead to losses for an intraday trader.