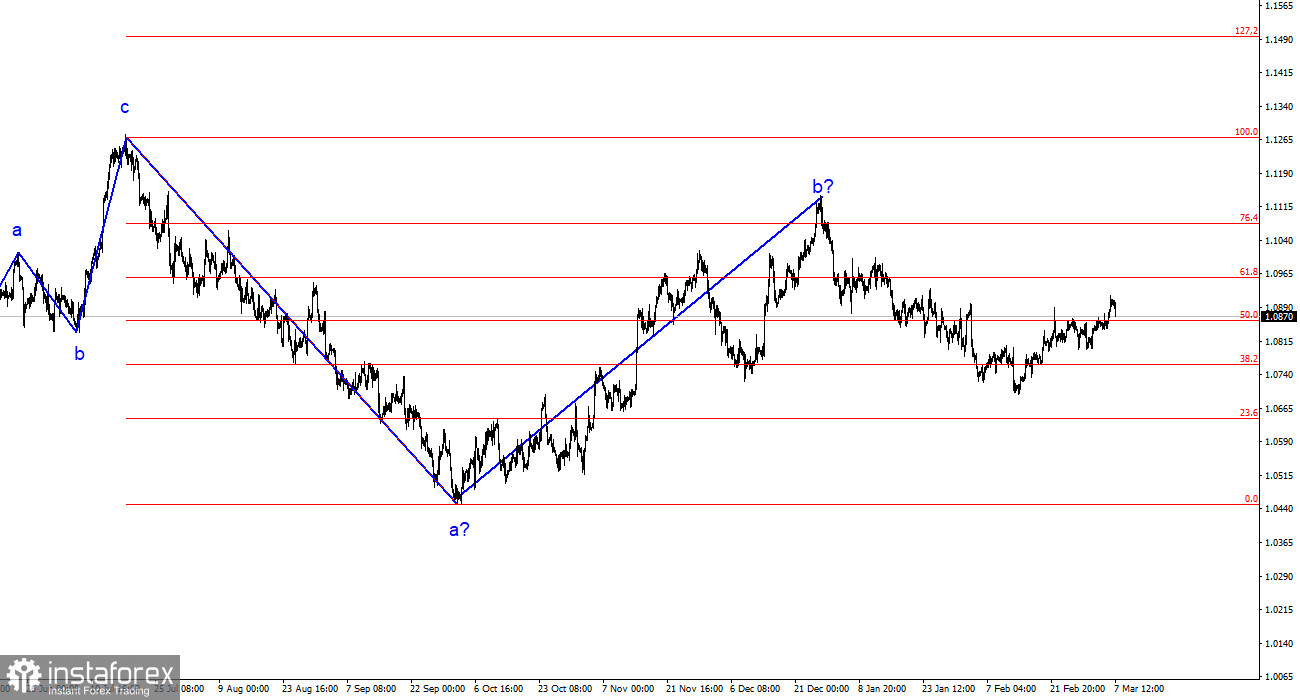

The wave analysis of the 4-hour chart for the EUR/USD pair remains unchanged. Over the past year, we have seen only three larger-scale wave structures that constantly alternate with each other. At the moment, the construction of another three-wave downward structure is ongoing, starting on July 18 of the previous year. The presumed wave 1 is complete; wave 2 or b has become more complicated three or four times, but at the moment, it is also complete as the pair's decline has been ongoing for more than two months.

The ascending trend section may still be resumed, but its internal structure will be absolutely unreadable in this case. I remind you that I try to highlight clear and unambiguous wave structures that do not tolerate dual interpretation. If the current wave analysis is correct, the market has moved on to form wave 3 or c. At the moment, the presumed wave 2 in 3 or c is being built. If this is indeed the case, the construction of this wave may be completed in the near future, as it has already taken on a clearly expressed three-wave form. In any case, the decline in the quotes of the pair should not be completed at this point. Alternatively, wave analysis may become much more complex.

The hit parade of reports in the US begins.

The exchange rate of the EUR/USD pair increased by 40 basis points on Wednesday and rose even more on Thursday. Although it is clear to me that the outcomes of the ECB meeting were the cause of today's decline, I want to remind you that the most interesting is yet to come. The results of the meeting could not surprise anyone, as the softening of monetary policy will begin later. Everyone knows this; members of the European regulator's Governing Council have talked about it repeatedly. Accordingly, only Christine Lagarde can share information about her vision of the timing of the policy-easing process. Her speech will start in about an hour.

As for yesterday, the increase in demand for the euro was most likely associated with today's ECB meeting. In the European Union, the news background was practically absent yesterday. Only one report on retail trade volumes for January was released, the value of which coincided with market expectations. In America, the news background was much more interesting. The ADP report on changes in the number of people employed in the non-agricultural sector showed an increase of 140 thousand, with market expectations of 120–150 thousand. Therefore, the market could not conclude that this report was weak. The JOLTS report on the number of job openings in the US as of January showed 8.869 million, against market expectations of 8.9 million. As we can see, the indicator turned out to be slightly worse, but not to the extent that the demand for the American currency continued to decline. And what the market expects from the ECB and Christine Lagarde is very difficult to say. I am inclined to believe that yesterday's increase in the pair was not justified. The situation should clarify tomorrow or on Monday.

General conclusions.

Based on the analysis of EUR/USD, I conclude that the construction of a bearish wave set continues. Wave 2 or b has taken on a completed form, so in the near future, I expect the continuation of the construction of an impulsive downward wave 3 or c with a significant decline in the pair. At the moment, an internal correctional wave is being built, which may be completed this week. I continue to consider only sales with targets around the calculated level of 1.0462, corresponding to 127.2% according to Fibonacci.

On a larger wave scale, it can be seen that the presumed wave 2 or b, which in length exceeded 61.8% according to Fibonacci from the first wave, may be completed. If this is indeed the case, then the scenario with the construction of wave 3 or c and a decline in the pair below the 4-figure mark has begun to be realized.

Basic principles of my analysis:

- Wave structures should be simple and understandable. Complex structures are difficult to play with; they often bring changes.

- If there is no confidence in what is happening in the market, it is better not to enter it.

- There is never 100% certainty in the direction of movement. Don't forget about protective stop-loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.