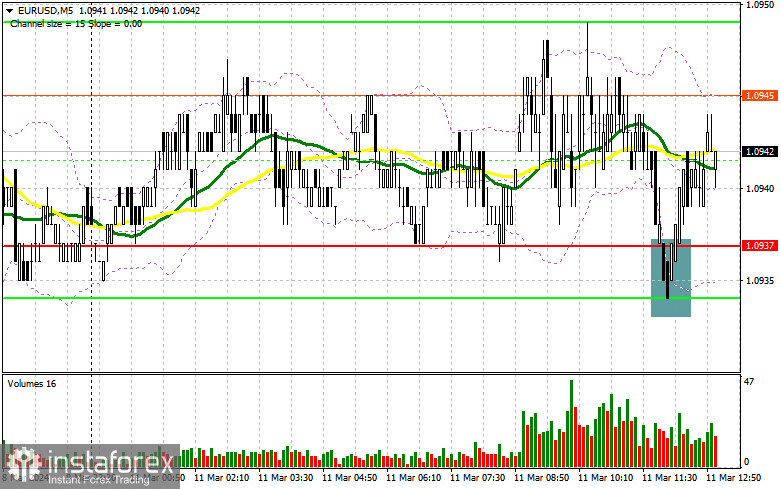

In my morning forecast, I paid attention to the 1.0937 level and planned to make decisions on entering the market from it. Let's look at the 5-minute chart and figure out what happened there. The decline and the formation of a false breakdown at 1.0937 led to a buy signal, however, due to the ultra-low volatility of the market, it was not possible to achieve normal growth of the pair. For the second half of the day, the technical picture has not been revised and all levels are relevant.

To open long positions on EURUSD, you need:

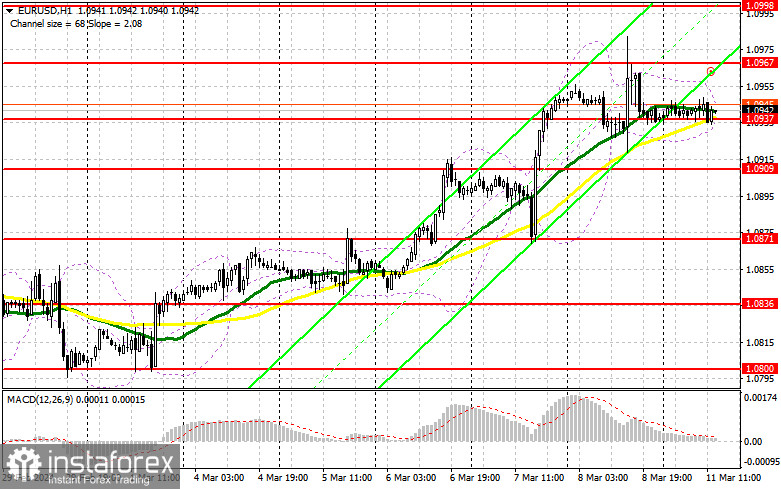

The lack of statistics has affected market volatility. Most likely, a similar story awaits us in the second half of the day, so be cautious when making decisions. I prefer to act under the conditions of an upward trend on the decline after forming a false breakout near the nearest support at 1.0937, similar to what I discussed above. There, the moving averages, favoring buyers, also intersect. This will be a suitable option for buying with the expectation of the pair's further growth towards 1.0967. Breaking and updating this range from top to bottom will strengthen the bullish trend with a chance to buy and a surge to 1.0998. The ultimate target will be the maximum of 1.1035, where I will take profits. In the case of a decline in EUR/USD and a lack of activity around 1.0937 in the second half of the day, pressure on the euro will increase, leading to a larger decline with the prospect of updating to 1.0909. I plan to enter the market only after the formation of a false breakout. I will consider opening long positions immediately on the rebound from 1.0871 with the target of an upward correction of 30-35 points within the day.

To open short positions on EUR/USD:

Bears continue to stay on the sidelines. Only an unsuccessful consolidation above 1.0967 will be a suitable condition for sales with the prospect of an update to 1.0937 – support, which has already been tested repeatedly during the European session. Therefore, a breakout and consolidation below this range, as well as a reverse test from bottom to top, will provide another selling point with the collapse of the pair to around 1.0909, where buyers will become more active. The ultimate target will be the minimum of 1.0871, where I will take profits. In the event of further upward movement of EUR/USD in the second half of the day, continuing the bullish trend, and the absence of bears at 1.0967, buyers will maintain an advantage. In this case, I will postpone sales until testing the next resistance at 1.0998. I will also sell there, but only after an unsuccessful consolidation. I plan to open short positions immediately on the rebound from 1.1035 with the target of a downward correction of 30-35 points.

Indicator signals:

Moving averages

Trading is conducted around the 30 and 50-day moving averages, which indicates the lateral nature of the market.

Note: The period and prices of the moving averages are considered by the author on the hourly chart H1 and differs from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

In case of a decline, the lower limit of the indicator around 1.0935 will act as support.

Description of the indicators

• Moving average (moving average, determines the current trend by smoothing volatility and noise). Period 50. It is marked in yellow on the chart.

• Moving average (moving average, determines the current trend by smoothing volatility and noise). Period 30. It is marked in green on the chart.

• MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Fast EMA period 12. Slow EMA period 26. SMA period 9

• Bollinger Bands. Period 20

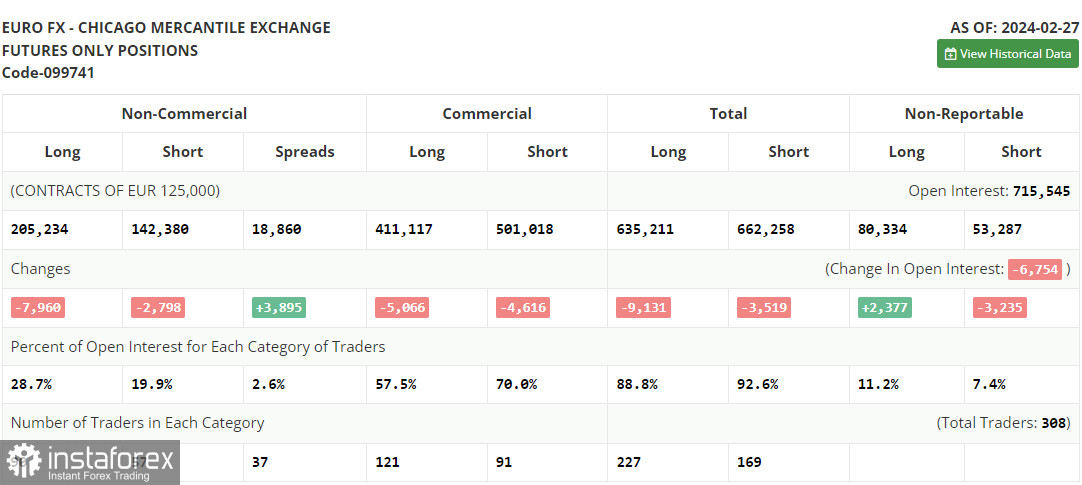

• Non-profit speculative traders, such as individual traders, hedge funds and large institutions that use the futures market for speculative purposes and meet certain requirements.

• Long non-commercial positions represent the total long open position of non-commercial traders.

• Short non-commercial positions represent the total short open position of non-commercial traders.

• The total non-commercial net position is the difference between the short and long positions of non-commercial traders.