Bitcoin and Ethereum experienced a significant decline yesterday, each losing around 3.5%. Bitcoin found strong buying interest around the $93,000 level, while Ethereum dropped to the key support zone of $2,600. However, the fact that both assets were actively bought on the decline suggests that market demand remains.

In addition, news emerged yesterday that the SEC has once again accepted Bitwise's application for a spot XRP ETF for review. This decision came as a surprise to many market participants, considering the regulator's previous cautious stance on such products and the ongoing legal battle between the SEC and Ripple. Experts believe that recent court rulings in the Ripple case, which determined that XRP is not a security, may have influenced the SEC's decision.

Bitwise's application proposes creating an exchange-traded fund (ETF) that directly holds XRP, allowing investors to gain exposure to the cryptocurrency without the need for direct purchase or storage. Such an instrument could attract a broader range of investors, including institutional players, potentially boosting XRP's price. However, accepting the application for review does not guarantee approval. The SEC will thoroughly evaluate the risks associated with XRP and ensure the security and management framework of the ETF. The decision is expected in several months, and the market will closely monitor developments. It would mark a significant milestone for XRP and the entire crypto industry if approved.

As for the intraday strategy on the cryptocurrency market, I will maintain my focus on significant pullbacks in Bitcoin and Ethereum, as I expect the medium-term bullish trend to remain intact.

The strategy and conditions for short-term trading are outlined below.

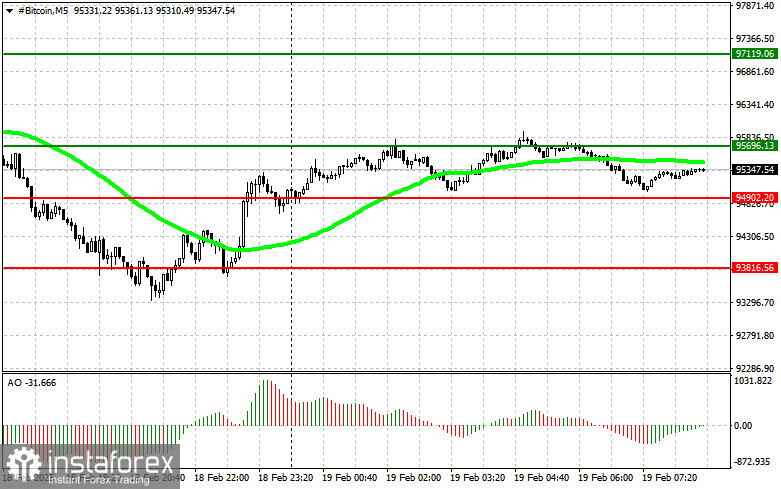

Bitcoin

Buy Scenario

Scenario #1: I will buy Bitcoin at $95,600, targeting a rise to $97,200. At $97,200, I will exit purchases and sell on a pullback. Before buying on a breakout, I will ensure that the 50-day moving average is below the current price and that the Awesome Indicator is in positive territory.

Scenario #2: I will also consider buying Bitcoin from the lower boundary at $94,900, provided there is no market reaction to break below this level. I aim for $95,600 and $97,200.

Sell Scenario

Scenario #1: I will sell Bitcoin at $94,900, targeting a drop to $93,800. At $93,800, I will exit short positions and buy on a pullback. Before selling on a breakout, I will ensure that the 50-day moving average is above the current price and that the Awesome Indicator is in negative territory.

Scenario #2: I will also consider selling Bitcoin from the upper boundary at $95,600, provided there is no market reaction to break above this level. I aim for $94,900 and $93,800.

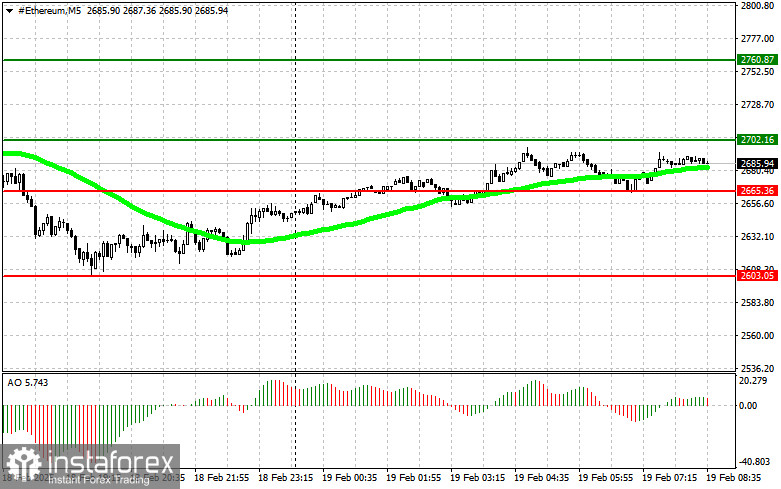

Ethereum

Buy Scenario

Scenario #1: I will buy Ethereum at $2,702, targeting a rise to $2,760. At $2,760, I will exit purchases and sell on a pullback. Before buying on a breakout, I will ensure that the 50-day moving average is below the current price and that the Awesome Indicator is in positive territory.

Scenario #2: I will also consider buying Ethereum from the lower boundary at $2,665, provided there is no market reaction to break below this level. I aim for $2,702 and $2,760.

Sell Scenario

Scenario #1: I will sell Ethereum at $2,665, targeting a drop to $2,603. At $2,603, I will exit short positions and buy on a pullback. Before selling on a breakout, I will ensure that the 50-day moving average is above the current price and that the Awesome Indicator is in negative territory.

Scenario #2: I will also consider selling Ethereum from the upper boundary at $2,702, provided there is no market reaction to break above this level. I aim for $2,665 and $2,603.