Bitcoin a ethereum včera zavreli v oblasti kladných hodnôt, takže vyhliadky na zmenu trendu na rastúci zostali vysoké.

Predstavitelia Fedu sa o kryptomenách vyjadrujú len zriedkavo, preto stojí za pozornosť spomenúť včerajší rozhovor s Michaelom Barrom, podpredsedom Federálneho rezervného systému pre dohľad.

Barr odmietol tvrdenia, že kryptopriemysel je vylúčený z bankového sektora, a uviedol, že Federálny rezervný systém nebráni aktivitám súvisiacim s kryptomenami.

Predstaviteľ Fedu zdôraznil, že regulačné orgány sa snažia zachovať neutrálny postoj k integrácii kryptomien do bankovníctva.

"Neustále zdôrazňujeme náš záväzok byť transparentní a ponúkať jasné usmernenia, čím zabezpečujeme, aby banky, ktoré majú záujem o túto činnosť, mohli postupovať v súlade s predpismi a boli dobre informované. Teraz však nie je ten správny čas," uviedol Barr. "Nehovoríme im, že by to mali robiť, a nehovoríme im, že by to nemali robiť," dodal počas podujatia na právnickej fakulte v Georgetowne.

Obmedzenia bankových služieb pre podnikateľov v oblasti kryptomien sú naďalej široko diskutovanou témou

Otázka obmedzení bankových služieb pre podnikateľov v oblasti kryptomien je v posledných týždňoch hlavnou témou, najmä za novej Trumpovej administratívy. Vedúci predstavitelia tohto odvetvia, zákonodarcovia, generálni riaditelia bánk a regulačné orgány aktívne pracujú na riešení problémov spojených s integráciou kryptomien do bankového systému. Kryptospoločnosti medzitým stále hlásia problémy s otváraním a vedením bankových účtov v USA.

V minulom roku Coinbase prostredníctvom poradenskej spoločnosti History Associates podala žalobu na Federálnu korporáciu pre poistenie vkladov, podľa ktorej sa agentúra snažila obmedziť prístup kryptopriemyslu k bankovým službám. Mnohí vedúci predstavitelia významných bánk odvtedy verejne vyjadrili svoje obavy z boja s kryptopriemyslom.

Barrove štvrtkové pripomienky nadväzovali na podobné vyhlásenia predseda Fedu, Jeroma Powella, ktorý nedávno počas zasadnutia senátneho výboru pre bankovníctvo začiatkom tohto mesiaca vyzval na opätovné preskúmanie tejto problematiky.

Barr, ktorý koncom mesiaca odstúpi z funkcie podpredsedu pre dohľad, uviedol, že Fed sa naďalej zameriava na ochranu spotrebiteľov a prevenciu nezákonného financovania. Naďalej však bude pôsobiť ako guvernér Rady federálnych rezerv.

"Náš postoj bol počas môjho pôsobenia vo Federálnom rezervnom systéme konzistentný: bankám nehovoríme, s kým majú alebo nemajú obchodovať," zopakoval Barr.

Hoci zatiaľ neexistujú žiadne konkrétne riešenia, tieto diskusie nevyhnutne povedú k pokroku - z dlhodobého hľadiska sú teda pre trh s kryptomenami pozitívnym vývojom.

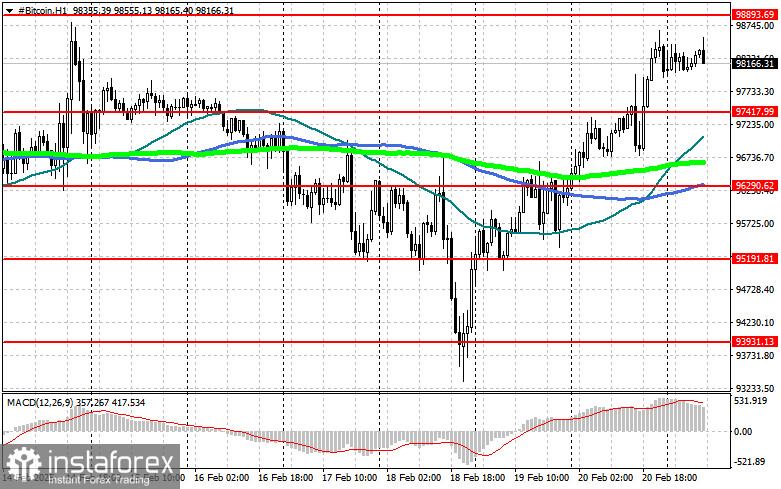

Technická analýza bitcoinu

Kupujúci sa teraz pokúšajú vrátiť na úroveň 98 800 USD, čo by viedlo k vytvoreniu cesty k úrovni 100 200 USD a potom k 101 200 USD. Konečný cieľ sa nachádza v blízkosti úrovne 102 200 USD a jeho prelomenie by potvrdilo návrat na strednodobý býčí trh.

Ak bitcoin klesne, kupujúci by mohli dosiahnuť úroveň 97 400 USD. Po prerazení pod túto úroveň by sa bitcoin mohol rýchlo posunúť k úrovni 96 300 USD, pričom ďalšia hlavná podpora by mohla byť na úrovni 95 200 USD. Posledným cieľom v prípade poklesu je oblasť úrovne 93 900 USD.

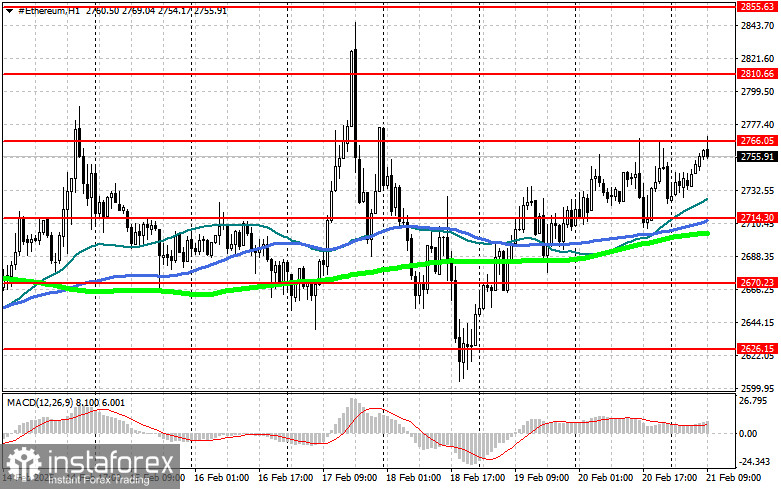

Technická analýza etherea

Jasné prerazenie nad úroveň 2 766 USD otvorí cestu k úrovni 2 810 USD, pričom konečným cieľom je ročné maximum na úrovni 2 855 USD. Posun nad túto úroveň potvrdí obnovenie strednodobého býčieho trhu.

V prípade korekcie očakávame, že kupujúci dosiahnu úroveň 2 714 USD. Pokles pod túto oblasť by mohol viesť k poklesu na úroveň 2 670 USD, pričom konečná úroveň podpory by sa mohla nachádzať na úrovni 2 626 USD.