Analýza obchodov a tipy na obchodovanie s eurom

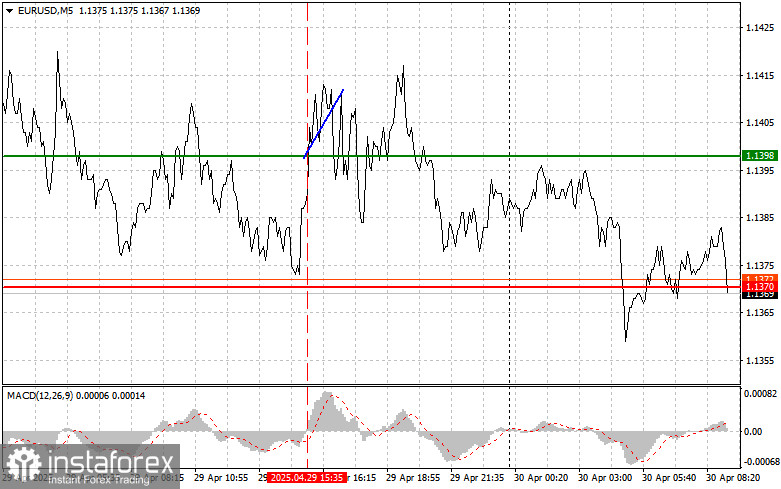

Cena otestovala úroveň 1,1398 v druhej polovici dňa, keď indikátor MACD začal rásť z nuly, čo bolo potvrdením, že táto úroveň je vhodným vstupným bodom na nákup eura. V dôsledku toho pár vzrástol o 15 pipov a potom sa rastúce momentum zmenilo.

Včerajšie zverejnenie neuspokojivých údajov o spotrebiteľskej dôvere v USA malo negatívny vplyv na dolár, čo naopak podporilo euro. Index dôvery bol výrazne nižší, ako očakávali analytici, čo signalizuje zvýšené obavy amerických spotrebiteľov v súvislosti s ekonomickým výhľadom. Súvisí to predovšetkým s Trumpovými obchodnými clami, ktoré by mohli spôsobiť výrazné zvýšenie cien tovarov. Pokles dolára vytvoril priaznivé podmienky pre rast eura. Európsku menu dodatočne podporili aj povzbudivé údaje z úverového trhu v eurozóne.

Dnešný deň prináša množstvo údajov, ktoré by mohli zmeniť aktuálnu situáciu na trhu. V prvej polovici dňa budú zverejnené údaje o HDP eurozóny za 1. štvrťrok, index spotrebiteľských cien v Nemecku, údaje o zamestnanosti a dynamike maloobchodných tržieb. Zverejnenie údajov o HDP eurozóny umožní trhom posúdiť, do akej miery sa ekonomika po zimných mesiacoch zotavila, a pomôže formovať očakávania ďalšieho vývoja - najmä vo svetle nedávneho zníženia sadzieb Európskou centrálnou bankou.

Rovnako dôležité sú aj údaje z Nemecka. Index spotrebiteľských cien pomôže zhodnotiť vývoj inflácie v najväčšej ekonomike eurozóny. Údaje o zamestnanosti budú odrážať situáciu na trhu práce a výsledky maloobchodných tržieb naznačia úroveň spotrebiteľských výdavkov. Tieto údaje budú spoločne vytvárať širší obraz o hospodárskej situácii v regióne a ovplyvňovať výhľad vývoja eura.

Pokiaľ ide o intradenné obchodovanie, plánujem postupovať na základe scenárov č. 1 a č. 2.

Nákupný scenár

Scenár č. 1: dnes plánujem kúpiť euro, keď cena dosiahne úroveň 1,1386 (zelená čiara na grafe), pričom očakávam, že vzrastie na úroveň 1,1440. Na tejto úrovni zatvorím nákupné pozície a otvorím predajné pozície v opačnom smere, pričom počítam s pohybom vo veľkosti 30 ‒ 35 bodov od bodu vstupu na trh. V prvej polovici dňa môžeme počítať s rastom eura iba v prípade priaznivých údajov.

Dôležité: pred nákupom sa uistite, že indikátor MACD je nad nulovou hodnotou a práve z nej začína rásť.

Scenár č. 2: nákup eura dnes plánujem aj v prípade, že cena dvakrát po sebe otestuje úroveň 1,1365, keď sa indikátor MACD bude nachádzať v prepredanej oblasti. To obmedzí potenciál páru klesať a povedie k obratu trhu smerom nahor. Môžeme očakávať rast k úrovniam 1,1386 a 1,1440.

Predajný scenár

Scenár č. 1: dnes plánujem predať euro, keď dosiahne úroveň 1,1365 (červená čiara na grafe). Cieľ bude na úrovni 1,1313, kde ukončím predaj, a okamžite otvorím nákupné pozície, pričom počítam s pohybom vo veľkosti 20 ‒ 25 bodov. Tlak na predaj páru sa môže kedykoľvek obnoviť.

Dôležité: pred predajom sa uistite, že indikátor MACD sa nachádza pod nulovou hodnotou a práve od nej začína klesať.

Scenár č. 2: dnes plánujem predať euro aj v prípade, že cena dvakrát po sebe otestuje úroveň 1,1386, keď sa indikátor MACD bude nachádzať v prekúpenej oblasti. To obmedzí rastový potenciál páru a povedie k obratu trhu smerom nadol. Môžeme očakávať pokles smerom k úrovniam 1,1365 a 1,1313.

Čo je na grafe:

- Tenká zelená čiara predstavuje vstupnú cenu, za ktorú môžete kúpiť obchodný nástroj.

- Hrubá zelená čiara je odhadovaná cena, pri ktorej môžete nastaviť take profit alebo manuálne vybrať zisky, pretože ďalší rast nad túto úroveň je nepravdepodobný.

- Tenká červená čiara označuje vstupnú cenu, pri ktorej môžete obchodný nástroj predať.

- Hrubá červená čiara je odhadovaná cena, pri ktorej môžete nastaviť take profit alebo manuálne vybrať zisky, keďže ďalší pokles pod túto úroveň je nepravdepodobný.

- Indikátor MACD sa používa pri identifikácii prekúpených a prepredaných zón s cieľom urobiť rozhodnutie o vstupe na trh.

Dôležité poznámky:

- Začínajúci forexoví obchodníci by mali robiť rozhodnutia o vstupe na trh veľmi opatrne. Aby ste predišli prudkým cenovým výkyvom, je najlepšie nevstupovať na trh pred zverejnením dôležitých fundamentálnych správ. Ak sa rozhodnete obchodovať počas zverejňovania správ, vždy nastavte príkazy stop, aby ste minimalizovali straty. Bez príkazov stop môžete rýchlo prísť o celý svoj vklad, najmä ak nevyužívate money management a obchodujete veľké objemy.

- Nezabúdajte, že na úspešné obchodovanie potrebujete jasný obchodný plán, ako je napríklad ten, ktorý je uvedený vyššie. Prijímanie spontánnych obchodných rozhodnutí na základe aktuálnej situácie na trhu je pre intradenného obchodníka vo svojej podstate stratová stratégia.