Analýza obchodov a tipy na obchodovanie s britskou librou

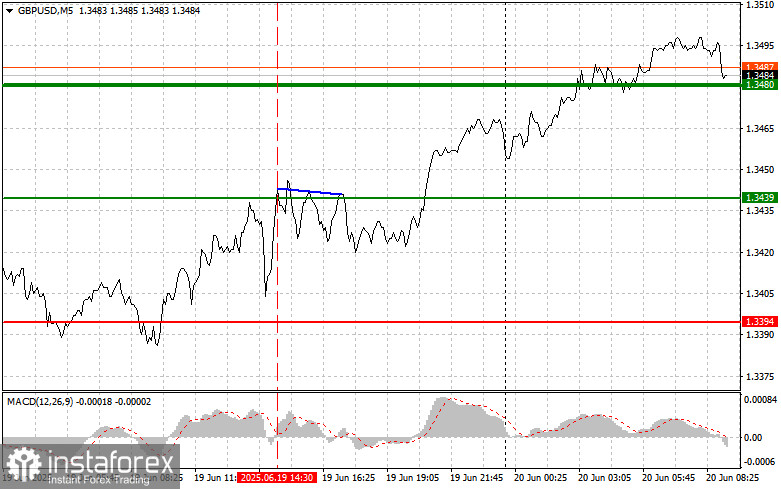

Cena otestovala úroveň 1,3439, keď indikátor MACD začal rásť z nuly, čo bolo potvrdením, že táto úroveň je vhodným vstupným bodom na nákup libry. K výraznejšiemu rastu však nedošlo.

Bank of England ponechala úrokovú sadzbu na úrovni 4,25 %. Tvorcovia politiky však vyjadrili obavy z poklesu na britskom trhu práce. Rozhodnutie banky bolo očakávané a odráža jej snahu o dosiahnutie rovnováhy medzi obmedzením inflácie a zabránením rizikám vyplývajúcim z hospodárskeho poklesu. Udržanie sadzby na stabilnej úrovni poskytne čas na vyhodnotenie vplyvu predchádzajúceho zníženia sadzieb a zabráni nadmernému zaťaženiu ekonomiky, ktorá je už teraz vystavená viacerým negatívnym vplyvom. Centrálnu banku znepokojuje najmä situácia na trhu práce. Pokles počtu voľných pracovných miest a nárast nezamestnanosti by mohli byť predzvesťou hlbšej hospodárskej krízy. Vážny problém predstavuje aj slabý hospodársky rast. Geopolitické napätie zvyšuje neistotu a zhoršuje ekonomické vyhliadky. Sankcie, obchodné vojny a politická nestabilita negatívne ovplyvňujú svetovú ekonomiku a vyvíjajú tlak na Spojené kráľovstvo.

Dnes sa očakáva zverejnenie údajov o zmene objemu maloobchodných tržieb v Spojenom kráľovstve, ktoré zahŕňajú náklady na pohonné hmoty a čisté pôžičky verejného sektora. Tieto údaje budú slúžiť ako dôležité ukazovatele súčasného stavu britskej ekonomiky, najmä vzhľadom na pretrvávajúce problémy s infláciou a potenciálom recesie. Objem maloobchodných tržieb upravený o náklady na pohonné látky odráža spotrebiteľskú aktivitu, ktorá je kľúčovým faktorom hospodárskeho rastu. Pokles tohto ukazovateľa by mohol naznačovať zníženú kúpyschopnosť spotrebiteľov v dôsledku rastúcich cien a neistoty v budúcnosti. Čisté pôžičky verejného sektora medzitým ukážu, do akej miery musí vláda financovať svoje výdavky prostredníctvom dlhu. Vysoká úroveň zadlženosti by mohla znamenať zvýšenie vládnych výdavkov na podporu hospodárstva, ale môže tiež vyvolávať obavy o dlhodobú udržateľnosť verejných financií.

Pokiaľ ide o intradenné obchodovanie, plánujem postupovať na základe scenárov č. 1 a č. 2.

Nákupný scenár

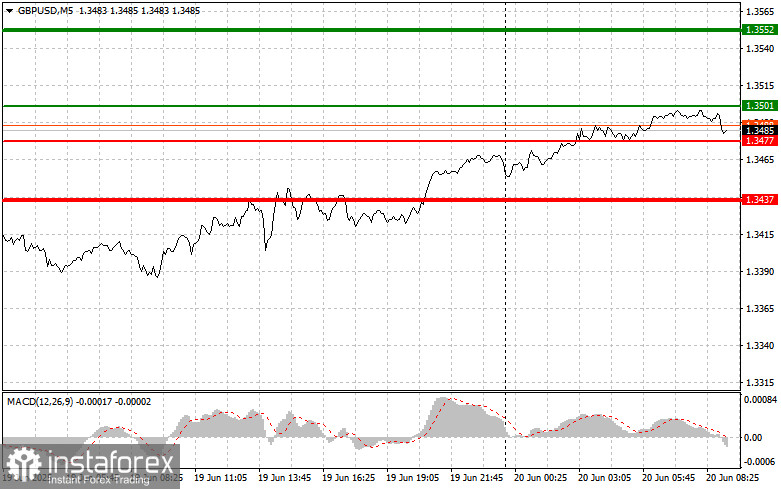

Scenár č. 1: dnes plánujem kúpiť libru, keď cena dosiahne bod vstupu v oblasti úrovne 1,3501 (zelená čiara na grafe), pričom očakávam, že vzrastie na úroveň 1,3552 (hrubšia zelená čiara). Na tejto úrovni zatvorím dlhé pozície a otvorím krátke pozície v opačnom smere (počítam s pohybom vo veľkosti 30 ‒ 35 pipov z tejto úrovne). Rast libry dnes môžeme očakávať v prípade silných údajov.

Dôležité: pred nákupom sa uistite, že indikátor MACD je nad nulovou hodnotou a práve z nej začína rásť.

Scenár č. 2: nákup libry dnes plánujem aj v prípade, že cena dvakrát po sebe otestuje úroveň 1,3477, keď sa indikátor MACD bude nachádzať v prepredanej oblasti. To obmedzí potenciál páru klesať a povedie k obratu trhu smerom nahor. Môžeme očakávať rast k úrovniam 1,3501 a 1,3552.

Predajný scenár

Scenár č. 1: dnes plánujem predať libru po prelomení pod úroveň 1,3477 (červená čiara na grafe), čo povedie k rýchlemu poklesu páru. Hlavný cieľ predávajúcich bude úroveň 1,3437, kde zavriem krátke pozície a okamžite otvorím dlhé pozície v opačnom smere (počítam s odrazom vo veľkosti 20 ‒ 25 pipov od tejto úrovne). Libru môžete predať, ak údaje budú slabé.

Dôležité: pred predajom sa uistite, že indikátor MACD sa nachádza pod nulovou hodnotou a práve z nej začína klesať.

Scenár č. 2: dnes plánujem predať libru, keď cena dvakrát po sebe otestuje úroveň 1,3501, keď sa indikátor MACD bude nachádzať v prekúpenej oblasti. To obmedzí rastový potenciál páru a povedie k obratu trhu smerom nadol k úrovniam 1,3477 a 1,3437.

Čo je na grafe:

- Tenká zelená čiara predstavuje vstupnú cenu, za ktorú môžete kúpiť obchodný nástroj.

- Hrubá zelená čiara je odhadovaná cena, pri ktorej môžete nastaviť take profit alebo manuálne vybrať zisky, pretože ďalší rast nad túto úroveň je nepravdepodobný.

- Tenká červená čiara označuje vstupnú cenu, pri ktorej môžete obchodný nástroj predať.

- Hrubá červená čiara je odhadovaná cena, pri ktorej môžete nastaviť take profit alebo manuálne vybrať zisky, keďže ďalší pokles pod túto úroveň je nepravdepodobný.

- Indikátor MACD sa používa pri identifikácii prekúpených a prepredaných zón s cieľom urobiť rozhodnutie o vstupe na trh.

Dôležité poznámky:

- Začínajúci forexoví obchodníci by mali robiť rozhodnutia o vstupe na trh veľmi opatrne. Aby ste predišli prudkým cenovým výkyvom, je najlepšie nevstupovať na trh pred zverejnením dôležitých fundamentálnych správ. Ak sa rozhodnete obchodovať počas zverejňovania správ, vždy nastavte príkazy stop, aby ste minimalizovali straty. Bez príkazov stop môžete rýchlo prísť o celý svoj vklad, najmä ak nevyužívate money management a obchodujete veľké objemy.

- Nezabúdajte, že na úspešné obchodovanie potrebujete jasný obchodný plán, ako je napríklad ten, ktorý je uvedený vyššie. Prijímanie spontánnych obchodných rozhodnutí na základe aktuálnej situácie na trhu je pre intradenného obchodníka vo svojej podstate stratová stratégia.