Analýza obchodov a tipy na obchodovanie s britskou librou

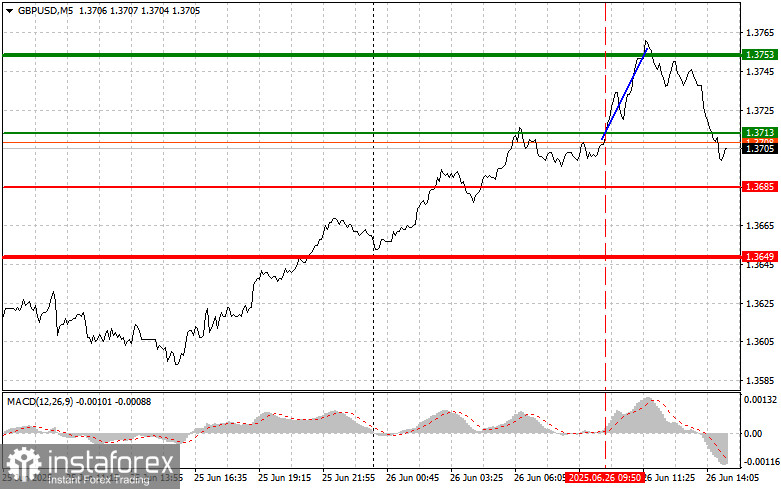

Cena otestovala úroveň 1,3713, keď indikátor MACD začal rásť z nuly, čo bolo potvrdením, že táto úroveň je vhodným vstupným bodom na nákup libry. V dôsledku toho pár vzrástol na cieľovú úroveň 1,3753. Predaj na tejto úrovni viedol k zisku 20 bodov.

Libra rozšírila svoje zisky na základe včerajšieho impulzu. Investori si to vysvetlili ako náznak možného zmiernenia rázneho postoja Fedu, čo oslabilo americký dolár a podporilo britskú menu. Keďže v súčasnosti sa neočakáva, že v Spojenom kráľovstve budú zverejnené udalosti, ktoré by mohli ovplyvniť libru, dominantnými zostávajú externé faktory.

Pred zverejnením údajov o HDP za 1. štvrťrok sa finančné trhy dostali do vyčkávacieho režimu, čo viedlo k menšej korekcii a vyberaniu ziskov. Tieto údaje, ktoré odrážajú celkovú hospodársku aktivitu, sú kľúčovými ukazovateľmi ekonomického zdravia a budú formovať náladu investorov do budúcnosti. Zároveň zverejnenie nových týždenných žiadostí o podporu v nezamestnanosti poskytne pohľad na podmienky na trhu práce, ktoré tiež ovplyvňujú rozhodovanie Fedu o menovej politike. Ďalším dôležitým faktorom je obchodná bilancia. Kladná obchodná bilancia naznačuje ekonomickú silu, zatiaľ čo deficit môže signalizovať zraniteľnosť a závislosť od dovozu. Vzhľadom na prebiehajúcu obchodnú vojnu sa neočakáva, že tento údaj bude priaznivý.

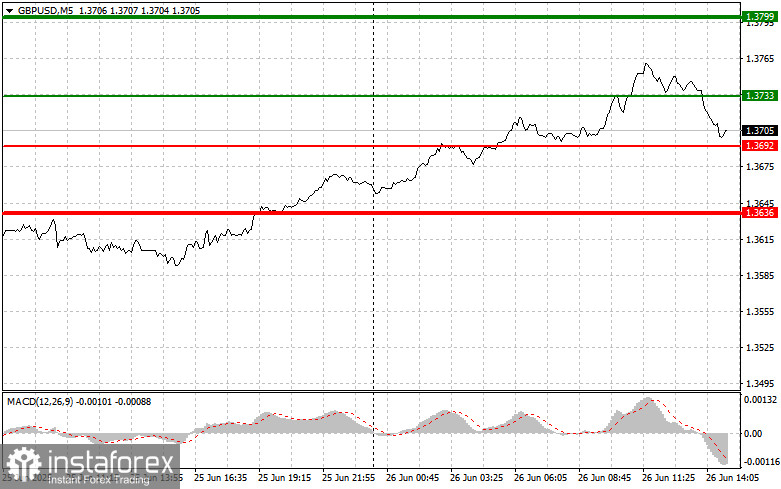

Pokiaľ ide o intradenné obchodovanie, plánujem postupovať na základe scenárov č. 1 a č. 2.

Nákupný signál

Scenár č. 1: dnes plánujem kúpiť libru, keď cena dosiahne oblasť úrovne 1,3733 (zelená čiara na grafe), pričom očakávam, že vzrastie na úroveň 1,3799 (hrubšia zelená čiara). Na tejto úrovni zatvorím dlhé pozície a otvorím krátke pozície v opačnom smere, pričom počítam s pohybom nadol vo veľkosti 30 ‒ 35 bodov. Rast libry dnes môžeme očakávať v prípade slabých údajov. Dôležité: pred nákupom sa uistite, že indikátor MACD je nad nulovou hodnotou a práve z nej začína rásť.

Scenár č. 2: nákup libry dnes plánujem aj v prípade, že cena dvakrát po sebe otestuje úroveň 1,3692, keď sa indikátor MACD bude nachádzať v prepredanej oblasti. To obmedzí potenciál páru klesať a povedie k obratu. Môžeme očakávať rast k úrovniam 1,3733 a 1,3799.

Predajný signál

Scenár č. 1: dnes plánujem predať libru po prelomení pod úroveň 1,3692 (červená čiara na grafe), čo povedie k rýchlemu poklesu páru. Hlavný cieľ predávajúcich bude úroveň 1,3636, kde zavriem krátke pozície a okamžite otvorím dlhé pozície v opačnom smere, pričom počítam s odrazom vo veľkosti 20 ‒ 25 bodov. Predávajúci budú aktívnejší, ak údaje budú silné. Dôležité: pred predajom sa uistite, že indikátor MACD sa nachádza pod nulovou hodnotou a práve z nej začína klesať.

Scenár č. 2: dnes plánujem predať libru, keď cena dvakrát po sebe otestuje úroveň 1,3733, keď sa indikátor MACD bude nachádzať v prekúpenej oblasti. To obmedzí rastový potenciál páru a povedie k obratu trhu smerom nadol k úrovniam 1,3692 a 1,3636.

Vysvetlivky ku grafu:

- Tenká zelená čiara: nákupná cena.

- Hrubá zelená čiara: úroveň take profit pri dlhých pozíciách (ďalší rast za týmto bodom je nepravdepodobný).

- Tenká červená čiara: predajná cena.

- Hrubá červená čiara: úroveň take profit pri krátkych pozíciách (ďalší pokles je za týmto bodom nepravdepodobný).

- Indikátor MACD: kľúčový pre podmienky prekúpenosti/predpredanosti.

Dôležité poznámky pre začínajúcich obchodníkov

Začínajúci forexoví obchodníci by mali robiť rozhodnutia o vstupe na trh veľmi opatrne. Aby ste predišli prudkým cenovým výkyvom, je najlepšie nevstupovať na trh pred zverejnením dôležitých fundamentálnych správ. Ak sa rozhodnete obchodovať počas zverejňovania správ, vždy nastavte príkazy stop, aby ste minimalizovali straty. Bez príkazov stop môžete rýchlo prísť o celý svoj vklad, najmä ak nevyužívate money management a obchodujete veľké objemy.

Nezabúdajte, že na úspešné obchodovanie potrebujete jasný obchodný plán, ako je napríklad ten, ktorý je uvedený vyššie. Prijímanie spontánnych obchodných rozhodnutí na základe aktuálnej situácie na trhu je pre intradenného obchodníka vo svojej podstate stratová stratégia.