Analýza obchodov a tipy na obchodovanie s britskou librou

Cena otestovala úroveň 1,3305, keď indikátor MACD začal klesať z nuly, čo bolo potvrdením, že táto úroveň je vhodným vstupným bodom na predaj libry, v dôsledku čoho pár klesol o viac ako 50 bodov.

Na trhu sa objavili predávajúci libry po vyhláseniach Reevesa o snahe nadviazať užšie vzťahy s EÚ, pričom krajina sa práve zotavila z brexitu, čo ovplyvnilo náladu medzi kupujúcimi. Pokles páru GBP/USD pokračoval aj počas ázijskej seansy, keďže nezhody vo Federálnom rezervnom systéme začali ovplyvňovať obchodníkov s rizikovými aktívami.

Dnes ráno budú zverejnené údaje o počte schválených žiadostí o hypotéky v Spojenom kráľovstve, objeme spotrebiteľských úverov a veľkosti peňažnej zásoby M4. Tieto ukazovatele môžu poskytnúť určité informácie o spotrebiteľských úveroch a menovej politike štátu. Údaje o hypotékach môžu najmä naznačovať trendy na trhu s bývaním, ktorý čelí problémom v dôsledku vysokých úrokových sadzieb. Objem čistých úverov fyzickým osobám odzrkadľuje ochotu občanov požičiavať si, čo je dôležitým ukazovateľom spotrebiteľských výdavkov. Napokon, peňažný agregát M4 môže poskytnúť pohľad na objem peňazí v ekonomike a následne na inflačné riziká. Je však potrebné zdôrazniť, že vplyv týchto správ na kurz britskej libry môže byť v súčasnosti oslabený, keďže pozornosť trhu sa sústreďuje na globálne faktory, a to: nezhody vo Federálnom rezervnom systéme týkajúce sa budúcej menovej politiky a možnosť posilnenia vzťahov medzi Spojeným kráľovstvom a Európskou úniou. Reakcie trhu na ekonomické údaje Spojeného kráľovstva budú preto pravdepodobne krátkodobé a obmedzené, pokiaľ sa nebudú výrazne líšiť od prognózovaných hodnôt.

Pokiaľ ide o intradenné obchodovanie, plánujem postupovať na základe scenárov č. 1 a č. 2.

Nákupný scenár

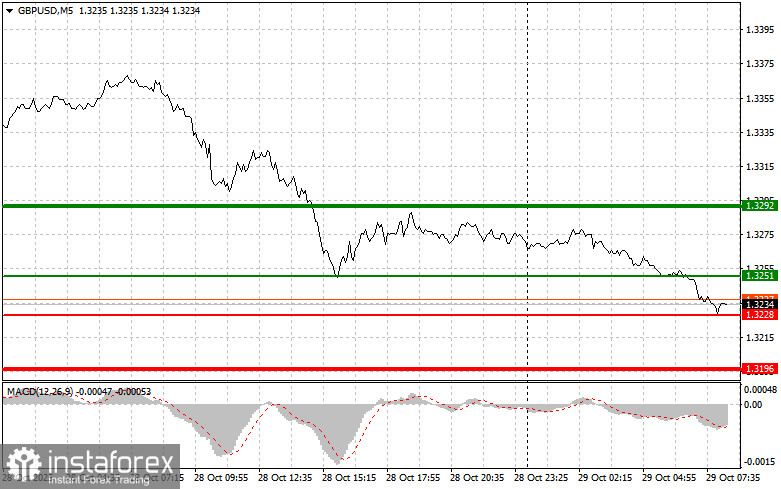

Scenár č. 1: dnes plánujem kúpiť libru, keď cena dosiahne bod vstupu na trh v oblasti úrovne 1,3251 (zelená čiara na grafe), pričom očakávam, že vzrastie na úroveň 1,3292 (hrubšia zelená čiara). V blízkosti tejto úrovne zatvorím dlhé pozície a otvorím krátke pozície v opačnom smere (počítam s pohybom vo veľkosti 30 ‒ 35 pipov v opačnom smere od tejto úrovne). Dnes môžeme očakávať, že rast libry bude pokračovať v rámci korekcie. Dôležité! Pred nákupom sa uistite, že indikátor MACD je nad nulovou hodnotou a práve z nej začína rásť.

Scenár č. 2: nákup libry dnes plánujem aj v prípade, že cena dvakrát po sebe otestuje úroveň 1,3228, keď sa indikátor MACD bude nachádzať v prepredanej oblasti. To obmedzí potenciál páru klesať a povedie k obratu trhu smerom nahor. Môžeme očakávať rast k úrovniam 1,3251 a 1,3292.

Predajný scenár

Scenár č. 1: dnes plánujem predať libru po dosiahnutí úrovne 1,3228 (červená čiara na grafe), čo povedie k rýchlemu poklesu páru. Hlavný cieľ predávajúcich je na úrovni 1,3196, kde zavriem krátke pozície a okamžite otvorím dlhé pozície v opačnom smere (počítam s pohybom vo veľkosti 20 ‒ 25 bodov v opačnom smere od tejto úrovne). Predávajúci libry by sa mohli vrátiť na trh v ktorejkoľvek chvíli. Dôležité! Pred predajom sa uistite, že indikátor MACD sa nachádza pod nulovou hodnotou a práve z nej začína klesať.

Scenár č. 2: dnes plánujem predať libru, keď cena dvakrát po sebe otestuje úroveň 1,3251, keď sa indikátor MACD bude nachádzať v prekúpenej oblasti. To obmedzí rastový potenciál páru a povedie k obratu trhu smerom nadol k úrovniam 1,3228 a 1,3196.

Čo je na grafe:

- Tenká zelená čiara: nákupná cena.

- Hrubá zelená čiara: úroveň take profit pri dlhých pozíciách (ďalší rast za týmto bodom je nepravdepodobný).

- Tenká červená čiara: predajná cena.

- Hrubá červená čiara: úroveň take profit pri krátkych pozíciách (ďalší pokles je za týmto bodom nepravdepodobný).

- Indikátor MACD: kľúčový pre podmienky prekúpenosti/predpredanosti.

Dôležité: Začínajúci forexoví obchodníci by mali robiť rozhodnutia o vstupe na trh veľmi opatrne. Aby ste predišli prudkým cenovým výkyvom, je najlepšie nevstupovať na trh pred zverejnením dôležitých fundamentálnych správ. Ak sa rozhodnete obchodovať počas zverejňovania správ, vždy nastavte príkazy stop, aby ste minimalizovali straty. Bez príkazov stop môžete rýchlo prísť o celý svoj vklad, najmä ak nevyužívate money management a obchodujete veľké objemy.

Nezabúdajte, že na úspešné obchodovanie potrebujete jasný obchodný plán, ako je napríklad ten, ktorý je uvedený vyššie. Prijímanie spontánnych obchodných rozhodnutí na základe aktuálnej situácie na trhu je pre intradenného obchodníka vo svojej podstate stratová stratégia.