Analýza obchodov a tipy na obchodovanie s eurom

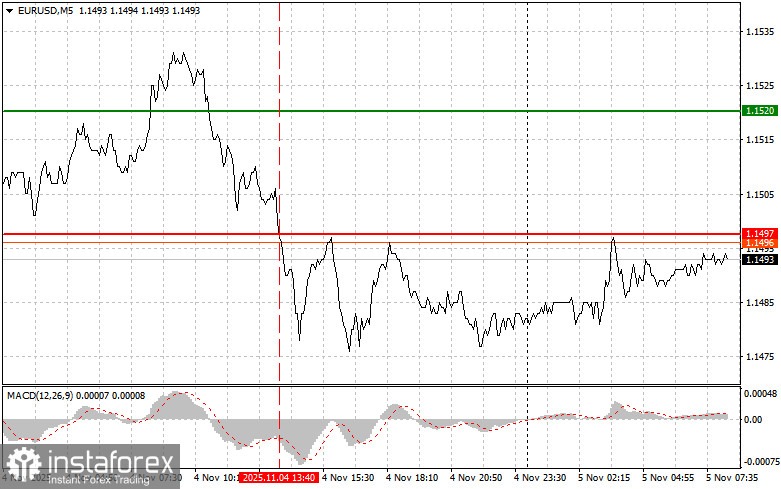

Cena otestovala úroveň 1,1497, keď indikátor MACD už výrazne klesol pod nulu, čo obmedzilo potenciál páru klesať. Z tohto dôvodu som euro nekúpil.

Vyhlásenia Federálneho rezervného systému majú významný vplyv na prostredie na globálnych finančných trhoch. Nedávne komentáre predstaviteľov regulačných orgánov o možnosti zmeny prístupu k znižovaniu úrokových sadzieb, s osobitným dôrazom na rozhodnutie na nadchádzajúcom decembrovom zasadnutí, viedli k výraznému nárastu hodnoty amerického dolára. Vyplýva to z toho, že obchodníci interpretujú takúto komunikáciu ako signál reštriktívnejšej menovej politiky, čím sa dolár stáva atraktívnejším pre investorov hľadajúcich stabilitu a vyššie výnosy. Pozitívny vplyv na americký dolár má aj uvoľnenie napätia v obchodných vzťahoch medzi USA a Čínou.

Dnes sa finančné trhy pripravujú na aktívny deň, pričom v prvej polovici dňa bude zverejnených niekoľko kľúčových makroekonomických správ. Osobitná pozornosť sa bude venovať údajom z Nemecka a eurozóny, ktoré by mohli výrazne ovplyvniť kolísanie mien a náladu na trhu. Obchodná seansa začne zverejnením údajov o zmenách priemyselných objednávok v Nemecku. Tento ukazovateľ sa považuje za dôležitý pre posúdenie stavu nemeckej ekonomiky a neočakávané výsledky by mohli viesť k volatilite na devízovom trhu. Investori budú zároveň sledovať index cien výrobcov v eurozóne, ktorý odzrkadľuje úroveň inflácie v regióne. Doobeda sa pozornosť presunie na indexy PMI v sektore služieb a kompozitný index PMI v eurozóne. Tieto prediktívne indikátory, založené na prieskumoch nákupných manažérov, dávajú dôležité signály o aktuálnom stave ekonomiky eurozóny. Vzhľadom na nabitý program zverejňovania ekonomických údajov je nepravdepodobné, že prejav prezidenta Bundesbanky Joachima Nagela bude mať významný vplyv na devízový trh. Nedávne vyhlásenia predstaviteľov Európskej centrálnej banky sú relatívne predvídateľné a trhy ich vo všeobecnosti zohľadňujú v cenách. Investori by však mali zostať ostražití a reagovať na neočakávané vyhlásenia, ktoré by mohli ovplyvniť náladu na trhu.

Pokiaľ ide o intradenné obchodovanie, plánujem postupovať na základe scenárov č. 1 a č. 2.

Nákupný scenár

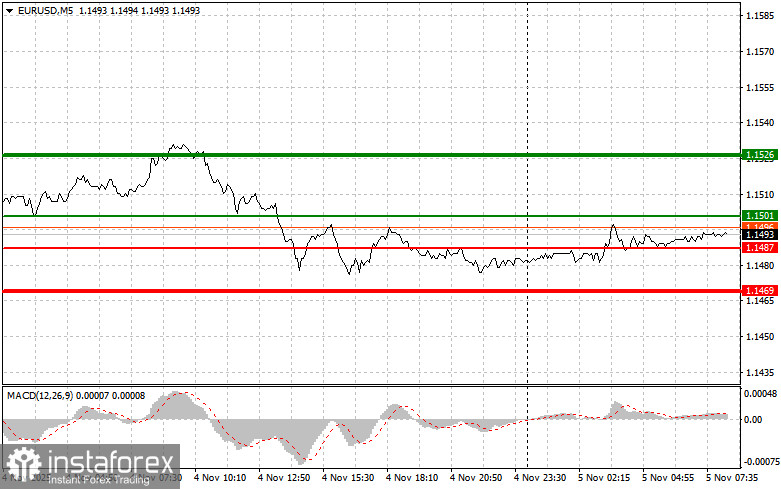

Scenár č. 1: dnes plánujem kúpiť euro, keď dosiahne oblasť úrovne 1,1501 (zelená čiara na grafe), pričom očakávam, že vzrastie na úroveň 1,1526. Na tejto úrovni zatvorím nákupné pozície a otvorím predajné pozície v opačnom smere, pričom počítam s pohybom vo veľkosti 30 ‒ 35 bodov od bodu vstupu na trh. Rast eura môžeme očakávať iba v rámci korekcie. Dôležité: pred nákupom sa uistite, že indikátor MACD je nad nulovou hodnotou a práve z nej začína rásť.

Scenár č. 2: nákup eura dnes plánujem aj v prípade, že cena dvakrát po sebe otestuje úroveň 1,1487, keď bude indikátor MACD v prepredanej oblasti. To obmedzí potenciál páru klesať a povedie k obratu trhu smerom nahor. Môžeme očakávať rast k úrovniam 1,1501 a 1,1526.

Predajný scenár

Scenár č. 1: dnes plánujem predať euro, keď dosiahne úroveň 1,1487 (červená čiara na grafe). Cieľ bude na úrovni 1,1469, kde ukončím predaj, a otvorím nákupné pozície v opačnom smere (počítam s pohybom vo veľkosti 20 ‒ 25 pipov od tejto úrovne). Tlak na pár sa dnes môže kedykoľvek obnoviť. Dôležité: pred predajom sa uistite, že indikátor MACD sa nachádza pod nulovou hodnotou a práve od nej začína klesať.

Scenár č. 2: dnes plánujem predať euro aj v prípade, že cena dvakrát po sebe otestuje úroveň 1,1501, keď bude indikátor MACD v prekúpenej oblasti. To obmedzí potenciál páru klesať a povedie k obratu trhu smerom nadol. Môžeme očakávať pokles k úrovniam 1,1487 a 1,1469.

Čo je na grafe:

- Tenká zelená čiara: vstupná cena, za ktorú môžete kúpiť obchodný nástroj.

- Hrubá zelená čiara: odhadovaná cena, pri ktorej môžete nastaviť take profit alebo manuálne vybrať zisky, pretože ďalší rast nad túto úroveň je nepravdepodobný.

- Tenká červená čiara: vstupná cena, pri ktorej môžete obchodný nástroj predať.

- Hrubá červená čiara: odhadovaná cena, pri ktorej môžete nastaviť take profit alebo manuálne vybrať zisky, keďže ďalší pokles pod túto úroveň je nepravdepodobný.

- Indikátor MACD: dôležitý pri identifikácii prekúpených a prepredaných zón s cieľom urobiť rozhodnutie o vstupe na trh.

Dôležité: Začínajúci forexoví obchodníci by mali robiť rozhodnutia o vstupe na trh veľmi opatrne. Aby ste predišli prudkým cenovým výkyvom, je najlepšie nevstupovať na trh pred zverejnením dôležitých fundamentálnych správ. Ak sa rozhodnete obchodovať počas zverejňovania správ, vždy nastavte príkazy stop, aby ste minimalizovali straty. Bez príkazov stop môžete rýchlo prísť o celý svoj vklad, najmä ak nevyužívate money management a obchodujete veľké objemy.

Nezabúdajte, že na úspešné obchodovanie potrebujete jasný obchodný plán, ako je napríklad ten, ktorý je uvedený vyššie. Prijímanie spontánnych obchodných rozhodnutí na základe aktuálnej situácie na trhu je pre intradenného obchodníka vo svojej podstate stratová stratégia.