Analýza obchodov a tipy na obchodovanie s eurom

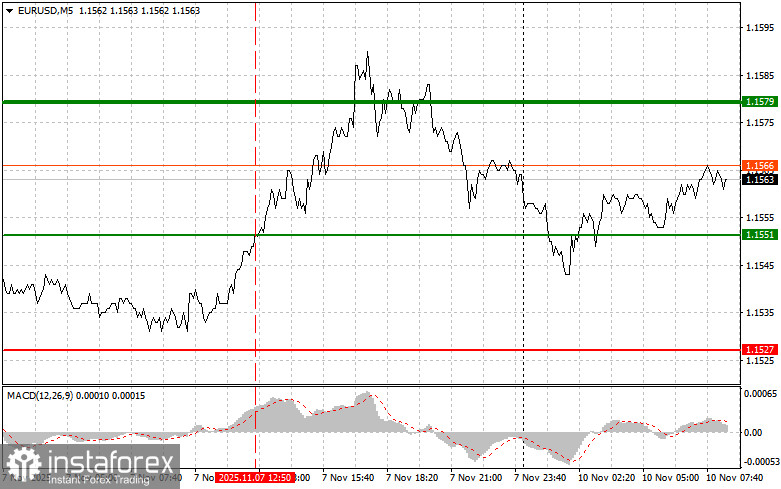

Cena otestovala úroveň 1,1551, keď indikátor MACD už výrazne vzrástol nad nulu, čo obmedzilo potenciál páru rásť. Z tohto dôvodu som euro nekúpil a premeškal som celý silný pohyb páru nahor.

Prudký pokles indexu spotrebiteľského sentimentu Michiganskej univerzity v USA oslabil americkú menu voči euru. Účastníci trhu to interpretovali ako predzvesť spomalenia hospodárskeho rastu v USA, čo negatívne ovplyvnilo status dolára ako bezpečného útočiska. Klesajúci trend dolára možno vysvetliť očakávaniami ďalších opatrných opatrení zo strany Federálneho rezervného systému USA, napriek niektorým varovaniam zo strany jeho tvorcov politiky o potrebe vyhnúť sa unáhlenému uvoľňovaniu. Európska centrálna banka medzitým naďalej uplatňuje konzervatívnejšiu politiku, čo poskytuje dodatočný stimul pre rast eura. Rozdiely v prístupoch k menovej politike dvoch vedúcich centrálnych bánk majú významný vplyv na dynamiku mien a súčasná situácia je toho jasným potvrdením.

Dnes nebudú v eurozóne zverejnené žiadne významné makroekonomické údaje, jedinou udalosťou je zverejnenie indexu dôvery investorov Sentix. Hoci index Sentix nie je rozhodujúcim faktorom v politike ECB, poskytuje hodnotenie výhľadov investorov a prognóz hospodárskeho rastu v regióne. Pokles dôvery odzrkadlený v tomto indexe by mohol naznačovať potenciálnu zraniteľnosť eura. Na druhej strane, pozitívne údaje Sentixu by mohli dočasne podporiť euro tým, že zmiernia predajný tlak. Je však dôležité mať na pamäti, že ide len o jeden z mnohých faktorov ovplyvňujúcich výmenný kurz. Dlhodobá dynamika eura bude závisieť predovšetkým od menovej politiky ECB, indikátorov inflácie a celkového stavu európskej ekonomiky.

Pokiaľ ide o intradenné obchodovanie, plánujem postupovať na základe scenárov č. 1 a č. 2.

Nákupný scenár

- Scenár č. 1: dnes plánujem kúpiť euro, keď dosiahne oblasť úrovne 1,1571 (zelená čiara na grafe), pričom očakávam, že vzrastie na úroveň 1,1599. Na tejto úrovni zatvorím nákupné pozície a otvorím predajné pozície v opačnom smere, pričom počítam s pohybom vo veľkosti 30 ‒ 35 bodov od bodu vstupu na trh. Rast eura môžeme očakávať v prípade silných údajov. Dôležité! Pred nákupom sa uistite, že indikátor MACD je nad nulovou hodnotou a práve z nej začína rásť.

- Scenár č. 2: nákup eura dnes plánujem aj v prípade, že cena dvakrát po sebe otestuje úroveň 1,1554, keď bude indikátor MACD v prepredanej oblasti. To obmedzí potenciál páru klesať a povedie k obratu trhu smerom nahor. Môžeme očakávať rast k úrovniam 1,1571 a 1,1599.

Predajný scenár

- Scenár č. 1: dnes plánujem predať euro, keď dosiahne úroveň 1,1554 (červená čiara na grafe). Cieľ bude na úrovni 1,1534, kde ukončím predaj, a otvorím nákupné pozície v opačnom smere (počítam s pohybom vo veľkosti 20 ‒ 25 pipov v opačnom smere). Tlak na pár by dnes nemal byť výrazný. Dôležité! Pred predajom sa uistite, že indikátor MACD sa nachádza pod nulovou hodnotou a práve od nej začína klesať.

- Scenár č. 2: dnes plánujem predať euro aj v prípade, že cena dvakrát po sebe otestuje úroveň 1,1571, keď bude indikátor MACD v prekúpenej oblasti. To obmedzí potenciál páru klesať a povedie k obratu trhu smerom nadol. Môžeme očakávať pokles k úrovniam 1,1554 a 1,1534.

Čo je na grafe:

- Tenká zelená čiara: vstupná cena, za ktorú môžete kúpiť obchodný nástroj.

- Hrubá zelená čiara: odhadovaná cena, pri ktorej môžete nastaviť take profit alebo manuálne vybrať zisky, pretože ďalší rast nad túto úroveň je nepravdepodobný.

- Tenká červená čiara: vstupná cena, pri ktorej môžete obchodný nástroj predať.

- Hrubá červená čiara: odhadovaná cena, pri ktorej môžete nastaviť take profit alebo manuálne vybrať zisky, keďže ďalší pokles pod túto úroveň je nepravdepodobný.

- Indikátor MACD: dôležitý pri identifikácii prekúpených a prepredaných zón s cieľom urobiť rozhodnutie o vstupe na trh.

Dôležité: Začínajúci forexoví obchodníci by mali robiť rozhodnutia o vstupe na trh veľmi opatrne. Aby ste predišli prudkým cenovým výkyvom, je najlepšie nevstupovať na trh pred zverejnením dôležitých fundamentálnych správ. Ak sa rozhodnete obchodovať počas zverejňovania správ, vždy nastavte príkazy stop, aby ste minimalizovali straty. Bez príkazov stop môžete rýchlo prísť o celý svoj vklad, najmä ak nevyužívate money management a obchodujete veľké objemy.

Nezabúdajte, že na úspešné obchodovanie potrebujete jasný obchodný plán, ako je napríklad ten, ktorý je uvedený vyššie. Prijímanie spontánnych obchodných rozhodnutí na základe aktuálnej situácie na trhu je pre intradenného obchodníka vo svojej podstate stratová stratégia.