Analýza obchodov a tipy na obchodovanie s britskou librou

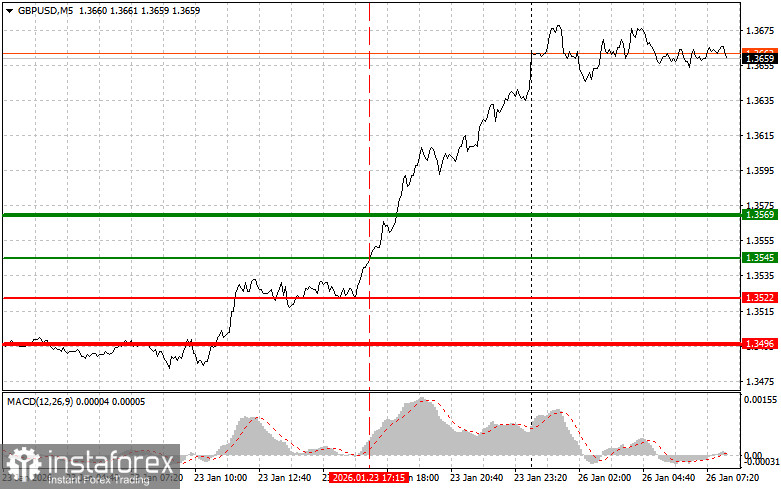

Cena otestovala úroveň 1,3545, keď indikátor MACD už výrazne vzrástol nad nulu, čo obmedzilo potenciál páru rásť. Z tohto dôvodu som libru nekúpil a premeškal som celý pohyb smerom nahor.

Dolár prudko klesol po tom, ako sa zvýšilo riziko dočasného prerušenia činnosti americkej vlády. Obchodníci okamžite reagovali na rastúcu neistotu predajom dolárov a investovaním do bezpečnejších aktív. Dôvodom na obavy je pretrvávajúca neochota niektorých členov Kongresu schváliť financovanie Ministerstva vnútornej bezpečnosti kvôli činnosti ICE, ktorú Trump zriadil na boj proti imigrantom. Nesúhlas sa týka politiky tohto ministerstva v súvislosti s ochranou hraníc, čo je kľúčová otázka, ktorá rozdeľuje politickú scénu v USA. Ak sa do 31. januára nedosiahne kompromis, mnohé dôležité funkcie ICE a Ministerstva vnútornej bezpečnosti môžu byť pozastavené, čo predstavuje významné ekonomické riziko pre USA a svetovú ekonomiku.

Vzhľadom na to, že dnes neboli zverejnené žiadne správy z Veľkej Británie, možno očakávať ďalší rast tohto menového páru. Udržateľná konsolidácia nad týždenným maximom bude ďalším signálom pokračujúceho rastu. Na druhej strane, ak rastové momentum oslabí a kurzy začnú korigovať smerom nadol, je dôležité sledovať najbližšie úrovne podpory. Technický obraz páru GBP/USD vyzerá celkom pozitívne, ale pri konečnom rozhodovaní je potrebné zohľadniť mnoho faktorov, najmä politických, a je potrebné postupovať opatrne.

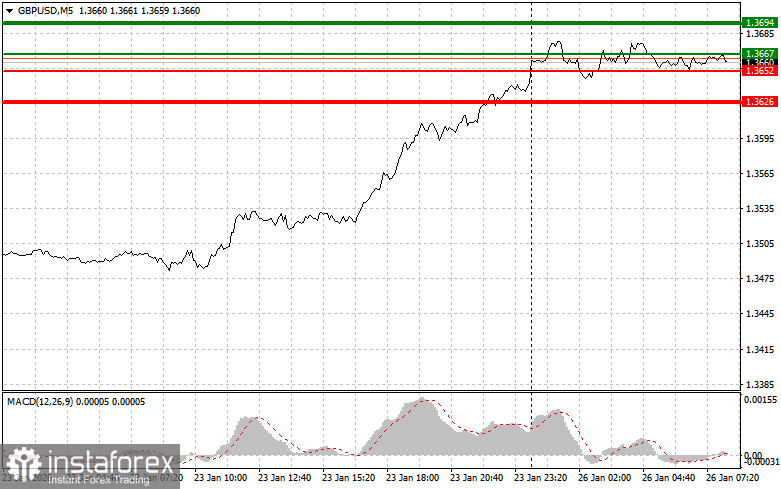

Pokiaľ ide o intradenné obchodovanie, plánujem postupovať na základe scenárov č. 1 a č. 2.

Nákupný scenár

Scenár č. 1: dnes plánujem kúpiť libru, keď cena dosiahne bod vstupu na trh na úrovni 1,3667 (zelená čiara na grafe), pričom očakávam, že vzrastie na úroveň 1,3694 (hrubšia zelená čiara). V blízkosti tejto úrovne zatvorím dlhé pozície a otvorím krátke pozície v opačnom smere (počítam s pohybom vo veľkosti 30 ‒ 35 pipov v opačnom smere od tejto úrovne). Libra by dnes mohla vzrásť v rámci pokračovania trendu. Dôležité! Pred nákupom sa uistite, že indikátor MACD je nad nulovou hodnotou a práve z nej začína rásť.

Scenár č. 2: nákup libry dnes plánujem aj v prípade, že cena dvakrát po sebe otestuje úroveň 1,3652, keď sa indikátor MACD bude nachádzať v prepredanej oblasti. To obmedzí potenciál páru klesať a povedie k obratu trhu smerom nahor. Môžeme očakávať rast k úrovniam 1,3667 a 1,3694.

Predajný scenár

Scenár č. 1: dnes plánujem predať libru po dosiahnutí úrovne 1,3652 (červená čiara na grafe), čo povedie k rýchlemu poklesu páru. Hlavný cieľ predávajúcich je na úrovni 1,3626, kde zavriem krátke pozície a okamžite otvorím dlhé pozície v opačnom smere (počítam s pohybom vo veľkosti 20 ‒ 25 bodov v opačnom smere od tejto úrovne). Je nepravdepodobné, že predávajúci dnes budú veľmi aktívni. Dôležité! Pred predajom sa uistite, že indikátor MACD sa nachádza pod nulovou hodnotou a práve z nej začína klesať.

Scenár č. 2: dnes plánujem predať libru, keď cena dvakrát po sebe otestuje úroveň 1,3667, keď sa indikátor MACD bude nachádzať v prekúpenej oblasti. To obmedzí rastový potenciál páru a povedie k obratu trhu smerom nadol k úrovniam 1,3652 a 1,3626.

Čo je na grafe:

Tenká zelená čiara predstavuje vstupnú cenu, za ktorú môžete kúpiť obchodný nástroj;

Hrubá zelená čiara je odhadovaná cena, pri ktorej môžete nastaviť take profit alebo manuálne vybrať zisky, pretože ďalší rast nad túto úroveň je nepravdepodobný;

Tenká červená čiara označuje vstupnú cenu, pri ktorej môžete obchodný nástroj predať;

Hrubá červená čiara je odhadovaná cena, pri ktorej môžete nastaviť take profit alebo manuálne vybrať zisky, keďže ďalší pokles pod túto úroveň je nepravdepodobný;

Indikátor MACD: dôležitý pri identifikácii prekúpených a prepredaných zón s cieľom urobiť rozhodnutie o vstupe na trh.

Dôležité: Začínajúci forexoví obchodníci by mali robiť rozhodnutia o vstupe na trh veľmi opatrne. Aby ste predišli prudkým cenovým výkyvom, je najlepšie nevstupovať na trh pred zverejnením dôležitých fundamentálnych správ. Ak sa rozhodnete obchodovať počas zverejňovania správ, vždy nastavte príkazy stop, aby ste minimalizovali straty. Bez príkazov stop môžete rýchlo prísť o celý svoj vklad, najmä ak nevyužívate money management a obchodujete veľké objemy.

Nezabúdajte, že na úspešné obchodovanie potrebujete jasný obchodný plán, ako je napríklad ten, ktorý je uvedený vyššie. Prijímanie spontánnych obchodných rozhodnutí na základe aktuálnej situácie na trhu je pre intradenného obchodníka vo svojej podstate stratová stratégia.