Hoy, la libra estuvo bajo presión desde un trasfondo fundamental, tanto desde el lado de los informes macroeconómicos como desde las perspectivas futuras del Brexit. La moneda británica no pudo resistir el ataque y colapsó frente al dólar en casi 200 puntos, dirigiéndose hacia la cifra 31. Por primera vez desde el anuncio de los resultados de las elecciones parlamentarias, el par GBP/USD ha mostrado un movimiento descendente muy poderoso.

El pesimismo habitual volvió al mercado con respecto a nuevas relaciones entre Londres y Bruselas, y esto a pesar de la probabilidad del 100% de que la nueva composición de la Cámara de los Comunes apruebe el acuerdo de larga data con Europa. Pero ahora, el mercado está discutiendo perspectivas más distantes, evaluando la "negociabilidad" de las partes en el período de transición. Hoy, Johnson dio el primer paso en esta dirección, que parecía muy "hostil" para los operadores. Aunque, según algunos expertos, el primer ministro comienza a escalar artificialmente la situación, mientras recurre al chantaje político banal.

Él utilizó mecanismos similares en los meses anteriores de su reinado, infundiendo miedo al Brexit "duro". En su opinión, Bruselas hizo ciertas concesiones solo después de ver la seriedad de sus intenciones. Según él, Theresa May estaba lista "indefinidamente" para prolongar el proceso de negociación, por lo que los europeos se mantuvieron firmes, sin temer las consecuencias del caótico Brexit. Sin embargo, la Unión Europea "mostró flexibilidad" en las negociaciones tan pronto como el escenario negativo comenzó a adquirir características reales, lo que Johnson aprovechó cuando concluyó el acuerdo. Al menos, el primer ministro actual ve la situación exactamente así. Por lo tanto, en preparación para un período de transición de meses, comienza a "apretar los tornillos" con anticipación, ocupando la posición más ventajosa (en su opinión) en las negociaciones.

So, today, it became known that Johnson's Cabinet of Ministers plans to legally exclude the possibility of prolonging the transition period after the approval of the Brexit deal. Members of the government made corresponding changes to the bill regulating the process of the country's exit from the Alliance. These amendments suggest that the transition period will end on December 31, 2020 and will not be extended regardless of the outcome of the negotiations.

On the one hand, conservatives with these amendments fulfill their party promises - Boris Johnson's election rhetoric was based on Britain leaving the EU as soon as possible. The impressive result obtained by the conservatives in the elections obliges the prime minister to pass from words to deeds, which he actually did. At the same time, he demonstrated to Brussels the seriousness of his intentions regarding his further actions. For several months, Johnson warned that he intends to withdraw the country from the European Union "with or without a deal." Now, this threat has survived reincarnation. However, we are talking about the timing of the transition period in this case. During 2020, London and Brussels need to conclude a free trade agreement, but many investors doubt that the parties will have time for such a relatively short time to find a common denominator, especially given the hard line of the British Prime Minister.

In particular, the EU's chief negotiator, Michel Barnier, said a few months ago that some points of future relations would have to be coordinated "for several years". If Britain does not have time to find a common denominator with the EU and refuses to extend the transition period, then the country will be forced to focus on the conditions of the WTO, with all the ensuing consequences. In addition, Mark Carney has repeatedly warned that this scenario will be one of the worst for the British economy.

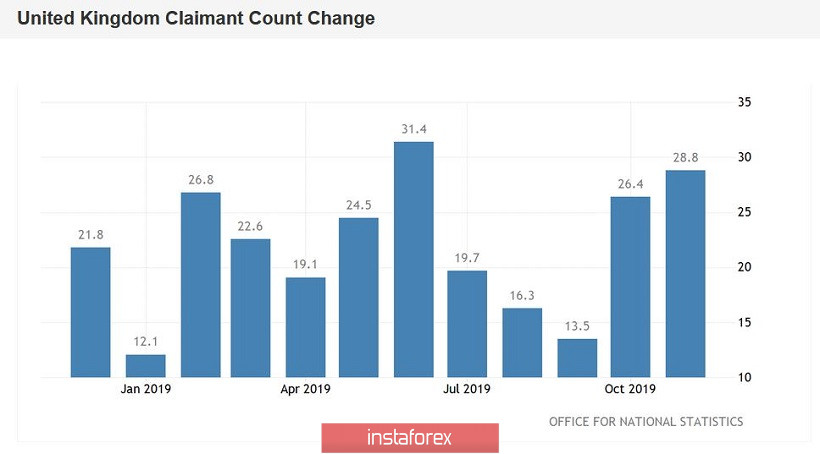

Against the backdrop of such prospects, the pound collapsed throughout the market, including paired with the US currency. Today, the labor market data that were released put additional pressure on the Briton. And although unemployment remained at the same level (3.8% with a forecast of growth of up to 3.9%), the number of applications for unemployment benefits increased significantly - to almost 29 thousand (with a forecast of 20 thousand). Salaries are also disappointing. In October, the average earnings level (including premiums) grew to just 3.2% - this is the weakest growth rate since April this year. However, this indicator came out better than expected without taking into account premiums, being at around 3.5%. Unfortunately, this fact did not help the pound, which continues to fall to the basket of major currencies.

However, the "political factor" may have a short-term effect on the market. The above amendments are likely to be adopted already at the end of this week, but this does not mean that Britain will draw the final line, indicating the deadline for the transition period. Obviously, if necessary, it will be possible to amend the text of the adopted law, thereby prolonging the transition period. After all, it is worth recalling that Johnson at one time almost swore to his party members that he would not postpone Brexit's term - but, after a few months, he still agreed to this step. Therefore, in this case, a similar scenario is not ruled out.

In other words, we are dealing with the populist behavior of an experienced politician, who marked the start of the next stage of negotiations with Brussels. But the transition period is still more than a year away, so the devaluation of the pound is now clearly too early.