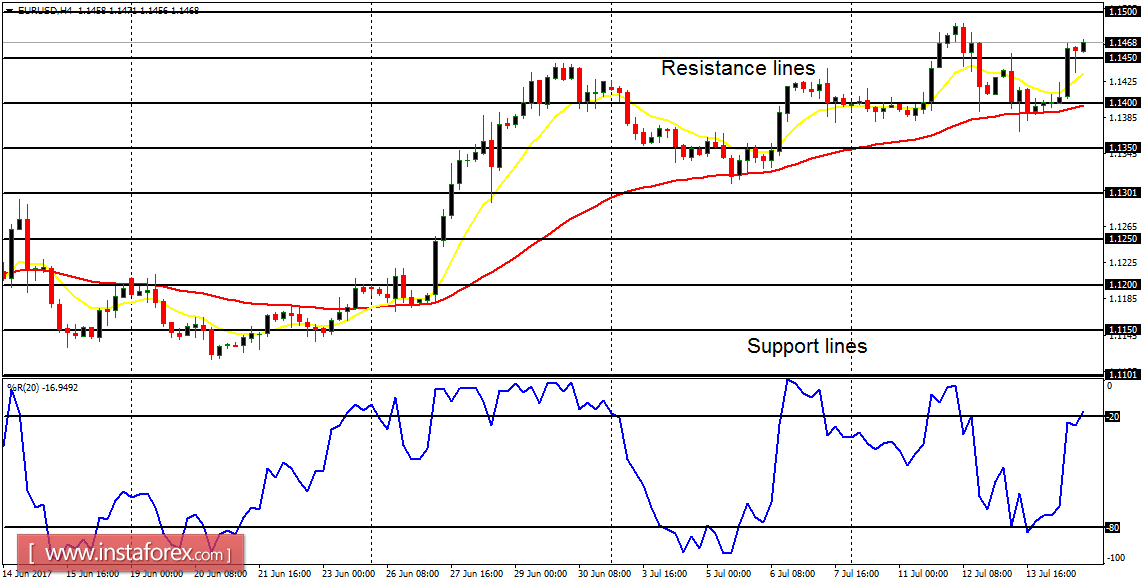

EUR/USD: This pair has been able to maintain its bullishness so far; though price moved in a zigzag manner. The pair closed above the support line of 1.1450 on July 14, now targeting the resistance line at 1.1500 (the initial target for the week). As soon as price exceeds the resistance line, it would go upwards to target additional resistance lines.

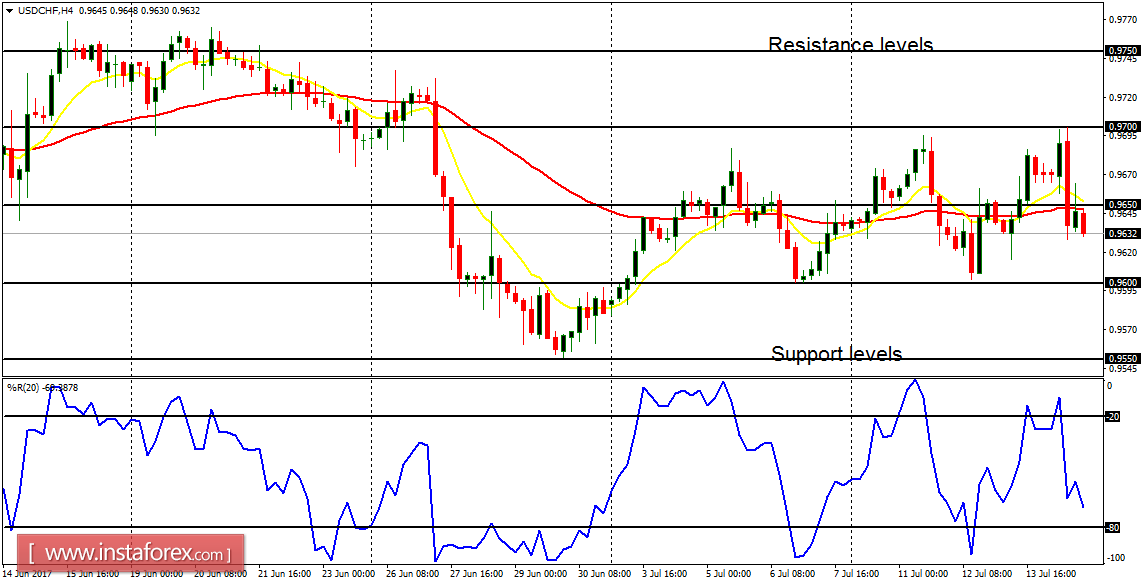

USD/CHF: This market is neutral in the short term and bearish in the long term. The neutrality in the market would continue as long as price does not go above the resistance level at 0.9750; and as long as it does not go below the support level at 0.9550. A movement above the aforementioned resistance level would result in a bullish bias, while a movement below the support level at 0.9550 would strengthen the current bearish bias.

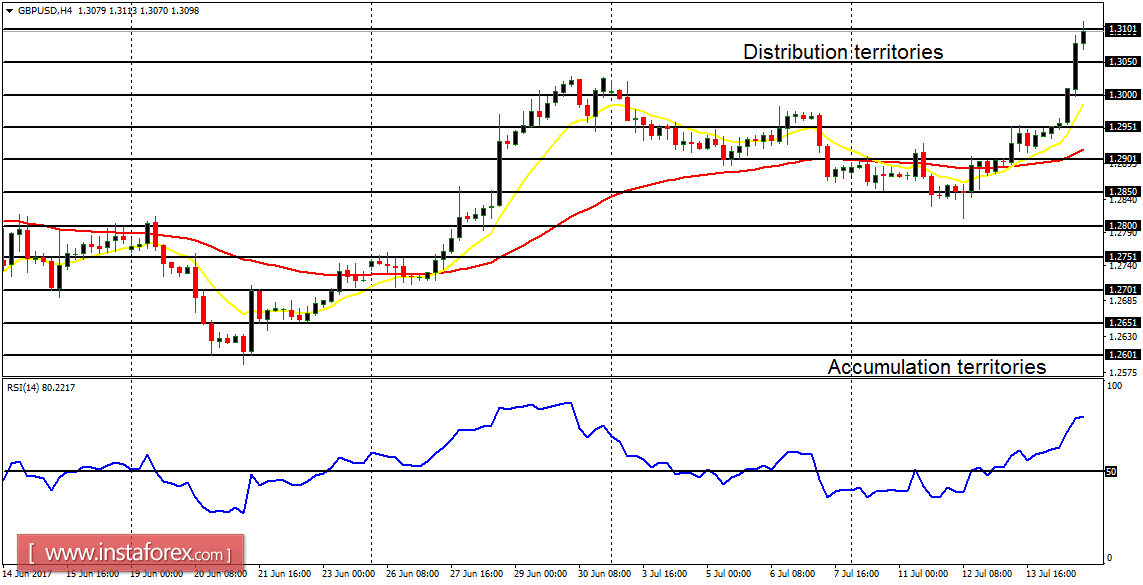

GBP/USD: The GBP/USD pair moved sideways early last week, and it shot seriously skywards in the last few days of the week. The distribution territory at 1.3100 has been tested and it would soon be breached to the upside, for price can move further upwards by 200 pips this week. The outlook on certain other GBP pairs is also bullish.

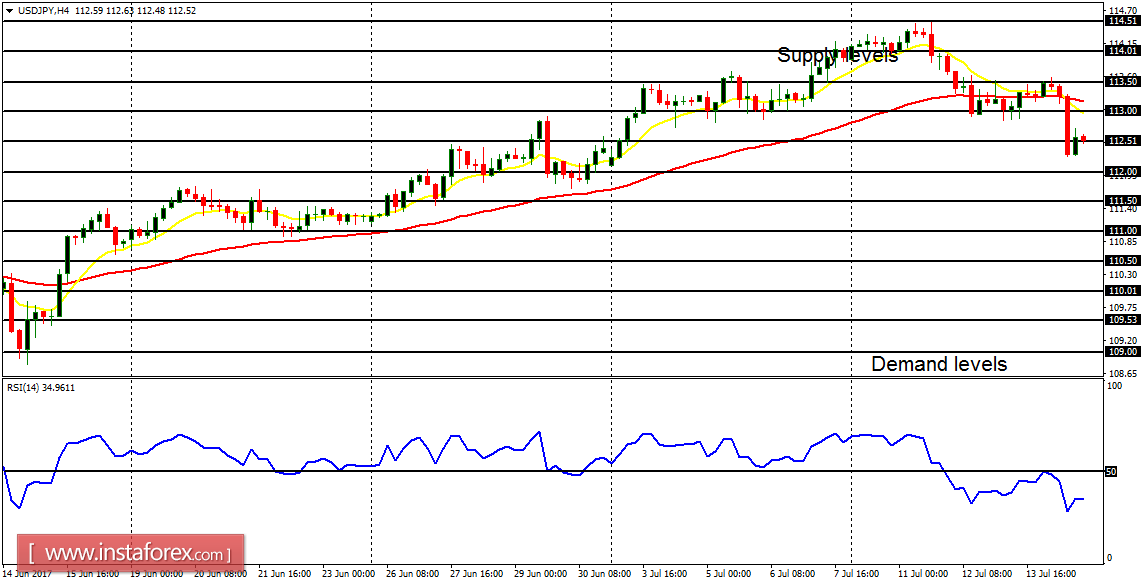

USD/JPY: The movement on this currency trading instrument was bearish last week, and that has become a threat to the recent bullish bias. Only an upwards movement from here would save the bullish bias. A movement below the demand level at 111.50 would invalidate the recent bullish bias, creating a clear "sell" signal. That is the expectation for this week.

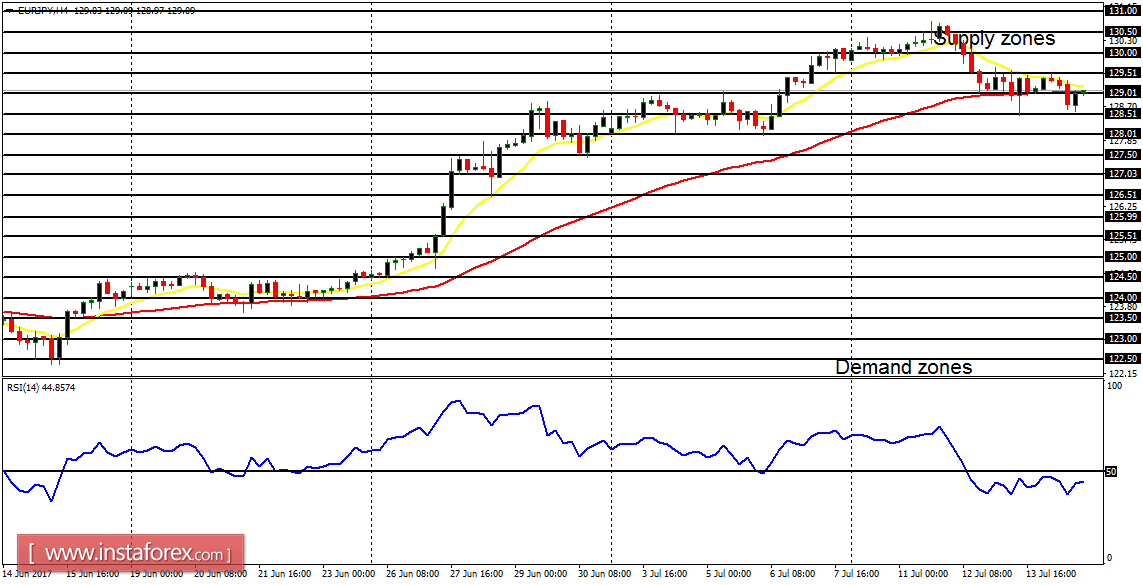

El par EUR/JPY se movió a la baja la semana pasada, en el contezto de una tendencia alcista. El precio fue primero ala alza para probar la zona de oferta en 130.50, antes que se corrija unos 180 pips. La zona de demanda en 128.50 procuró detener más corrección, pero el precio rompería debajo de este mientras va más al sur, por tanto invalida la tendencia alcista. Debemos tener en cuenta que la perspectiva sobre los pares es bajista para julio.