FX.co ★ Largest companies in the US military-industrial complex

Largest companies in the US military-industrial complex

This list is headed by Boeing. Military state orders amounted to about 12% of the company's total revenue. Over the year, shares rose by 86%. Last year, the company's revenue reached $93 billion, 61% of which came from commercial aircraft, 12% fell on military orders, 16% - service revenue, and the remaining 12% - revenue from fulfilling space industry orders.

So, 24% of the Boeing cash flow consists of orders from the state. Obviously, the military segment is not the main direction, but, nevertheless, it brings a stable income.

Among the products of Boeing are well-known brands of military aircraft, such as F/A-18 Super Hornet, A-10 Wing Replacement, B-1B Lancer, and others.

Unlike Boeing, Lockheed Martin is purely military, 82% of its revenue falls on government or commercial orders for the defense sector, the remaining 18% form orders for the space industry.

Thus, we can assume that Lockheed Martin works at the expense of the military sector. In 2017, the company earned $51 billion.

Among largest projects is the development of the F-35 fighter which began in 1912. LTM has every reason to become one of the leaders of the coming decade by the volume of state orders.

General Dynamics is considered the second largest contractor of the Ministry of Security. At the end of 2017, GD's revenue totaled $31 billion. The company earned more than half of this amount (61%) thanks to orders from the US government.

The company operates in four segments: Information Systems and Technology, Aerospace, Marine Systems and Combat Systems.

It is expected that the IT department, which develops navigation systems for missiles and deals with information security, will increase the company's revenues in the near future. The White House is planning to spend 8% more money in comparison with 2017 to protect the data amid the scandal with the hacking the resources of the Democratic Party. According to experts, the budget for security technology will be about $50 billion. In addition, GD products outperforms the production characteristics of Lockheed Martin or Raytheon products, thus providing a competitive advantage.

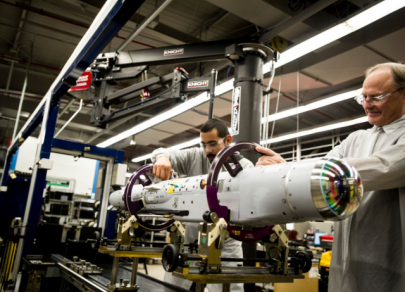

Raytheon has always been in the top list of Pentagon suppliers. The company produces rockets and navigation systems better than others. 69% of Raytheon's revenue comes from orders from the US Department of Defense. Almost in all conflicts involving the United States, Raytheon's weapons are used, in particular, Patriot, Sidewinner, and Tomahawk. The company also supplies NASA with radar and tracking sensors.

Raytheon receives 13% of revenue from foreign countries' orders and the remaining 18% - from private enterprises around the world.

The company's revenue is almost equally shared between four segments: Missile Systems, Space and Airborne Systems, Intelligence and Information Systems and Integrated Defense Systems. Therefore, even if a negative trend begins in one or two segments, the company will be able to continue creating free cash flow.

RTN business is characterized by high diversification of revenue, therefore, even if a negative trend starts in one or two segments, the company's ability to create free cash flow will not suffer.

The active development of the US military-industrial complex is expected in the coming years amid the higher military budget, including expenditures on military equipment and defense of the country. According to experts, the value of MIC leading companies' shares will rise by more than 30%, and shares of the S&P Aerospace&Defense ETF (XAR) fund - by 20%, also a good opportunity to invest.