AUD/USD has been in a bearish trend since it bounced off the resistance area of 0.8020-80 recently. Recently, AUD has been weakening amid downbeat economic reports and RBA dovish policy statements whereas USD has been extending gains. Today, Australia's HIA New Homes Sales report was published with an increase to 9.1% from the previous negative value of -3.7%, Building Approvals showed some increase to 0.4% from the previous value of -1.2% but could not meet the expectation of 1.1%. In the RBA Rate Statement, the regulator kept the official cash rate unchanged at a record low of 1.50%. On the USD side, today FOMC Powell is going to speak about the nation's key interest rates and upcoming monetary policies, his remarks are expected to be neutral in nature. Total Vehicle Sales report is expected to show an increase to 16.9M from the previous figure of 16.1M. To sum up, AUD has been quite bearish in nature in light of mixed economic reports today that signals AUD weakness against USD in the short and medium term. If US economic reports and event results are positive today, then we will expect a further bearish move in this pair for the coming days.

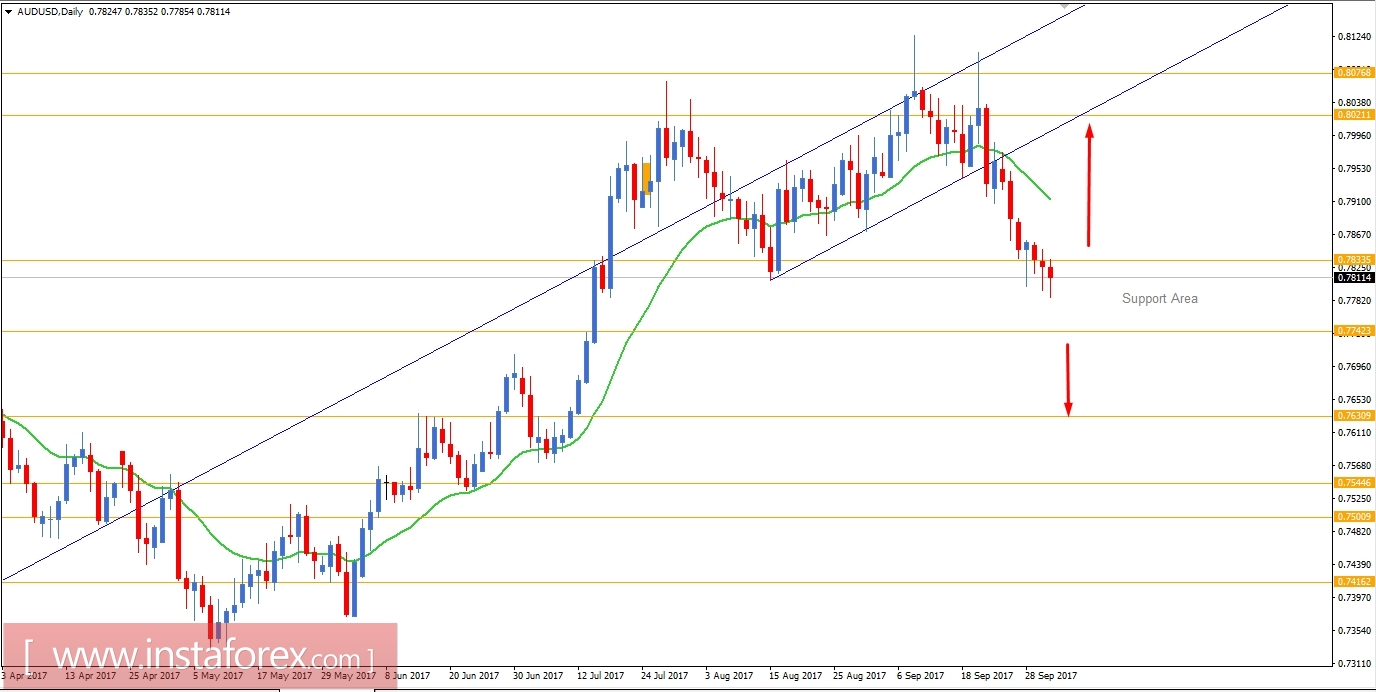

Now let us look at the technical chart. The price is currently residing in the support area of 0.7750-0.7830 which is expected to hold the price from further bearish pressure. If price breaks below the lower support of 0.7750 with a daily close, then we expect a further bearish move towards 0.7630 support level. On the other hand, if the price breaks above the 0.7830 higher support level with a daily close, then we will consider buy positions towards 0.80 again. As the price remains below the dynamic level of 20 EMA with a daily close, the will follow a bearish bias.