Global macro overview for 26/10/2017:

Yesterday's data on US Durable Goods Orders outperformed estimates - the September increase was 2.2% on monthly basis and beat the expectations of 1.0%. Moreover, orders without transport and aviation increased 1.3% on monthly basis. Shipments of capital goods excluding aircraft and military equipment rose an annualized 10.6% in the three months ended in September. Those figures feed into calculations for the third-quarter gross domestic product that is scheduled for release this Friday.The September advance in durable goods orders was fairly broad-based with gains in fabricated metals, electronics, communications equipment and commercial aircraft.

The agencies also reported that US Treasury Secretary Steven Mnuchin expressed satisfaction with the progress of the tax bill reform, although speculation has yet to be made that further details will not be presented sooner than early November. Meanwhile, another Republican Senator, Jeff Flake of Arizona, has expressed his disapproval of a form of policy led by President Donald Trump. He also announced his withdrawal from politics in November 2018, and he will not seek re-election. This raised concerns about the gathering of sufficient support in the Senate for tax bills.

Today there will be a fairly important vote on the draft bill os next year's budget bill in the US House of Representatives, which will open the way to the procedure of key tax reform. The first voting in the beginning of October was smooth, but this time the number of oppositionists grew, so there may even come to a situation where you will not be sure that the bill will be accepted. The disagreement lies in a new proposal called SALT, which allows individual states to set tax rates independently of federal government proposals. If there is no agreement today in that matter, the US Dollar might depreciate across the board.

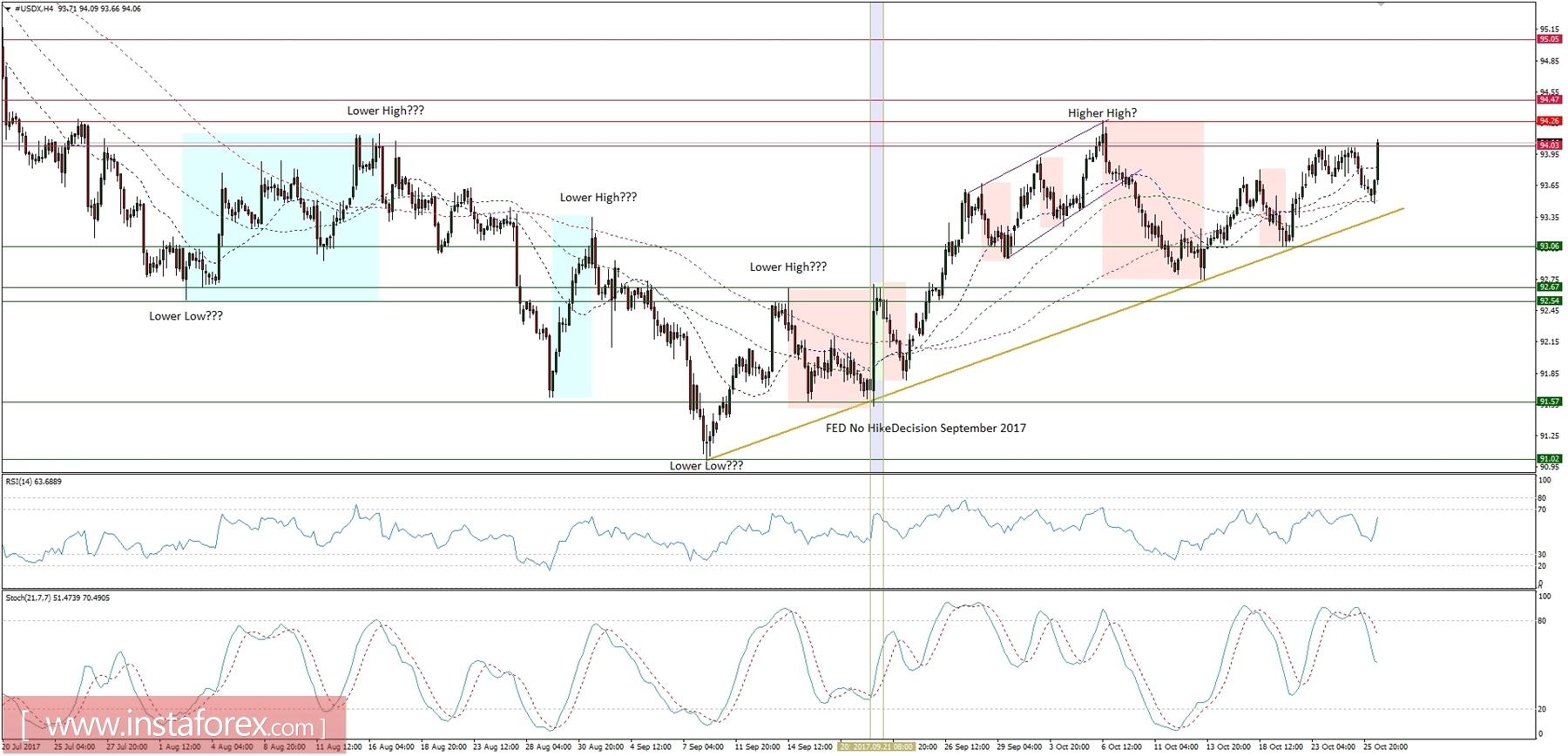

Let's now take a look at the US Dollar Index technical picture at the H4 time frame. The market has broken above the technical resistance at the level of 94.03 and now is heading towards the next resistance at the level of 94.26. Violation of this level will open the road towards the next target at the level of 95.05.