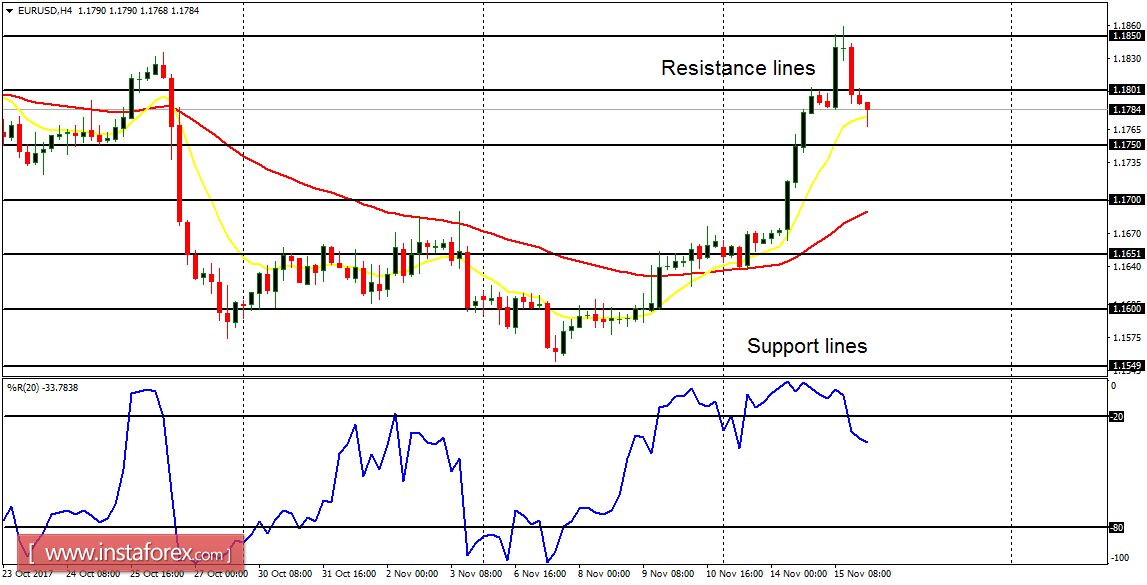

EUR/USD: The EUR/USD tested the resistance line at 1.1850 and then pulled back. Price has gained 200 pips this week; and thus, the pullback pales into insignificance when compared to the ongoing buying pressure in the market. The resistance line at 1.1850 would be tested again, and then beached to the upside as the market goes further northwards.

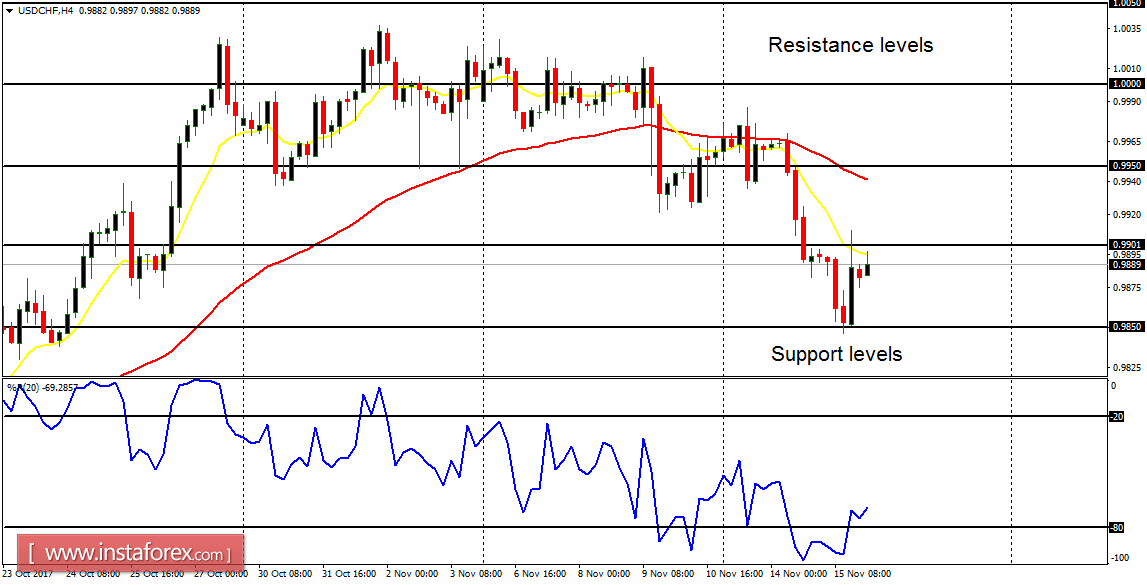

USD/CHF: The USD/CHF tested the support level at 0.9850 and then bounced upwards. Price has lost 110 pips this week; and thus, the upwards bounce is inferior when compared to the ongoing selling pressure in the market. The support level at 0.9850 would be tested again, and then beached to the downside as the market goes further southwards.

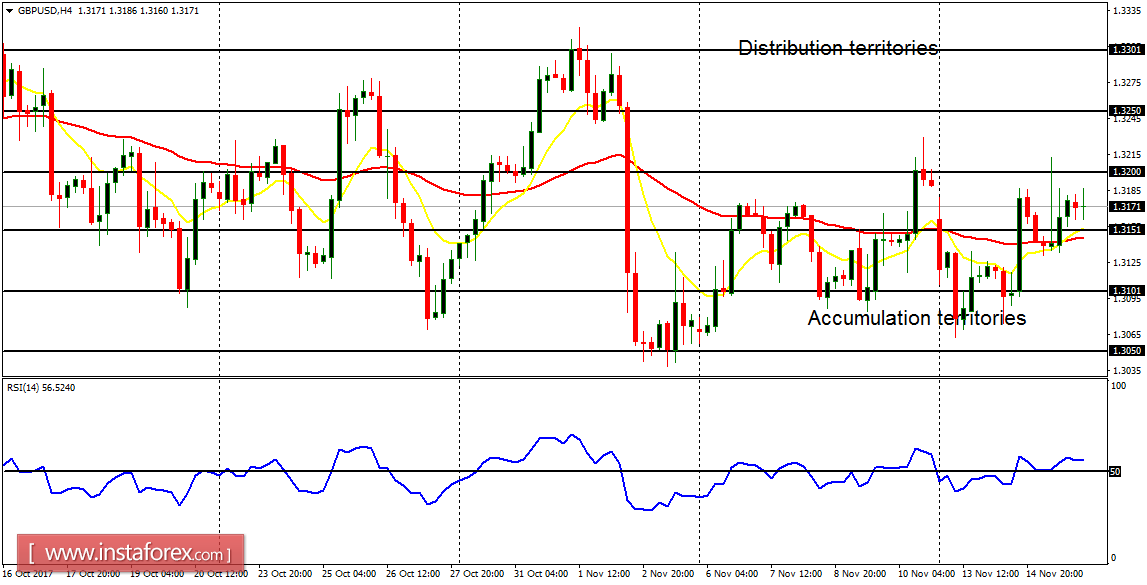

GBP/USD: The choppy situation on the GBP/USD remains unchanged. A directional bias is expected this week, when price either goes above the distribution territory at 1.3300, or it goes below the accumulation territory at 1.3050 (either of these would require a strong buying or selling pressure).

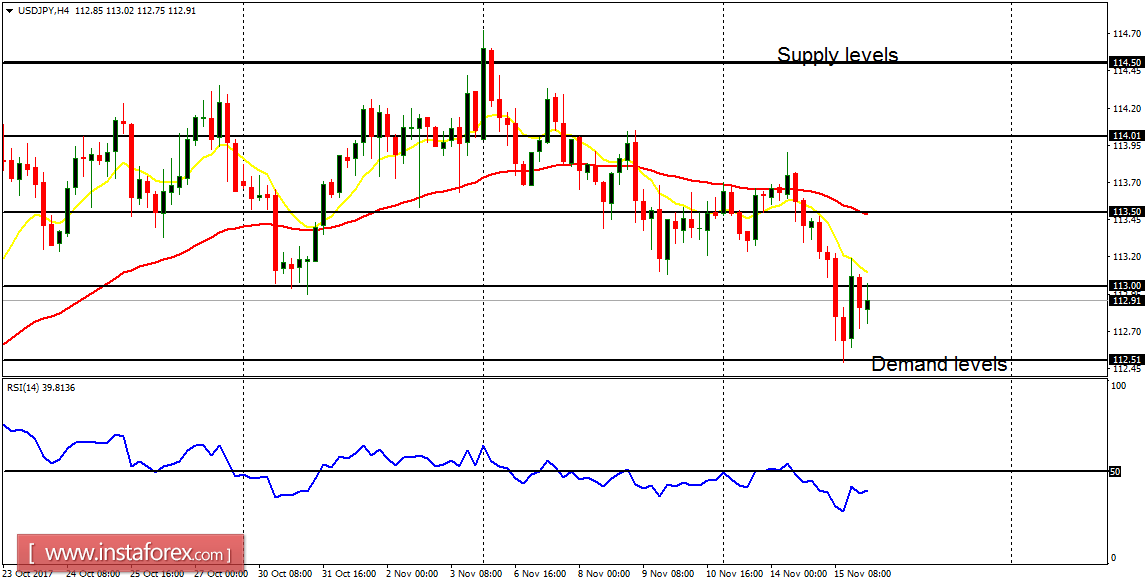

USD/JPY: The USD/JPY tested the demand level at 112.50 and then bounced upwards. However, the bias on the market is bearish, and so, it is expected that price would go downwards again, testing the demand level at 112.50, and breaching it to the downside. Some fundamental figures are expected today and they would have an impact on the market.

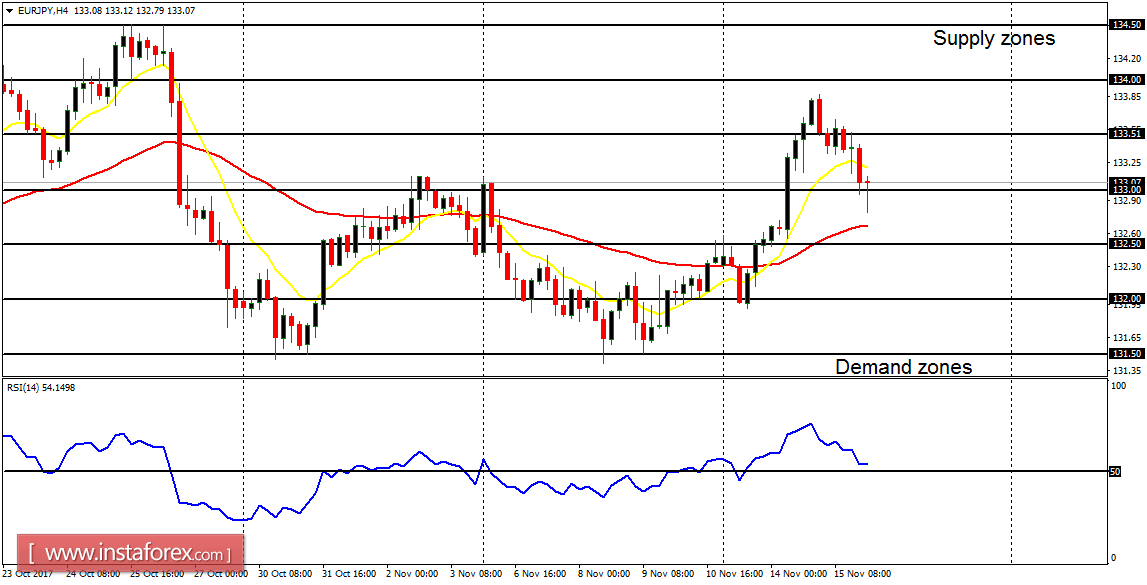

EUR/JPY: This cross made a commendable bullish effort on Monday and Tuesday and then pulled back on Wednesday. There is still a Bullish Confirmation Pattern in the market. The RSI period 14 remains above the level 50, while the EMA 11 is above the EMA 56. Unless the demand zone at 132.00 is breached to the downside, the bullish outlook would be logical.