In Canda, the central bank kept the overnight interest rate unchanged in a widely expected move, but in the monetary statement on the subject of future changes in interest rates, it showed greater caution than the market expected. The biggest concern for the BoC is a lack of progress in the labor market, despite rising employment and participation rates. As a result, the chances for another hike in March next year fell from 75% up to 60 percent.

The central bank raised rates in July and September for the first time in seven years but has since worried about a number of uncertainties that could have an impact on the country's economy, including renegotiation of the North American Free Trade Agreement.

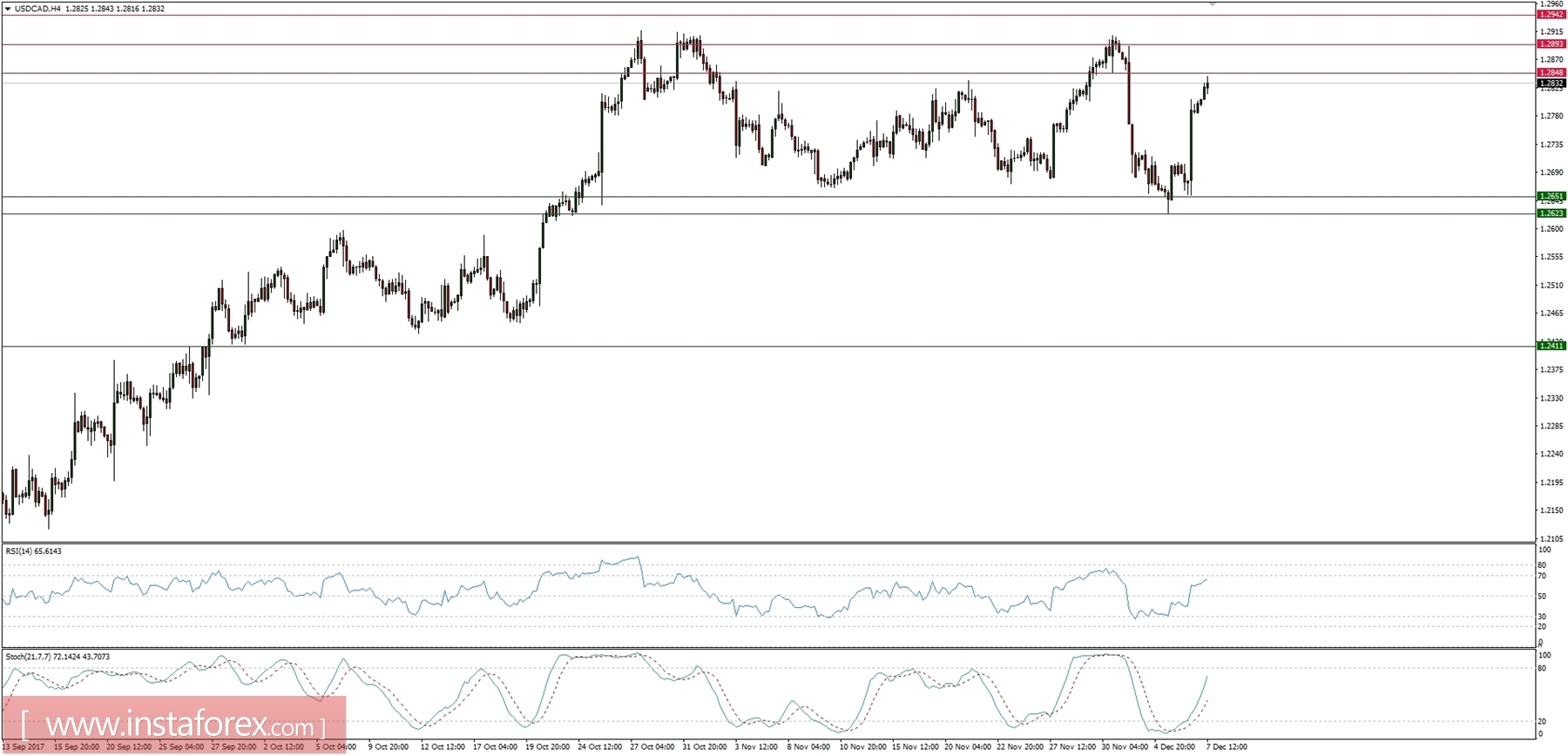

Let's now take a look at the USD/CAD technical picture at the H4 time frame. After the BoC decision, the USD/CAD is 1.0% higher, but with continuing pressure on crude oil prices, it is justified to assume further cutting of long positions in CAD. The market has bounced from the technical support at the level of 1.2623 and now it trying to test the technical resistance at the level of 1.2848. In a case of a further rally, the key technical resistance is seen at the level of 1.2942. Strong momentum supports the bullish bias.