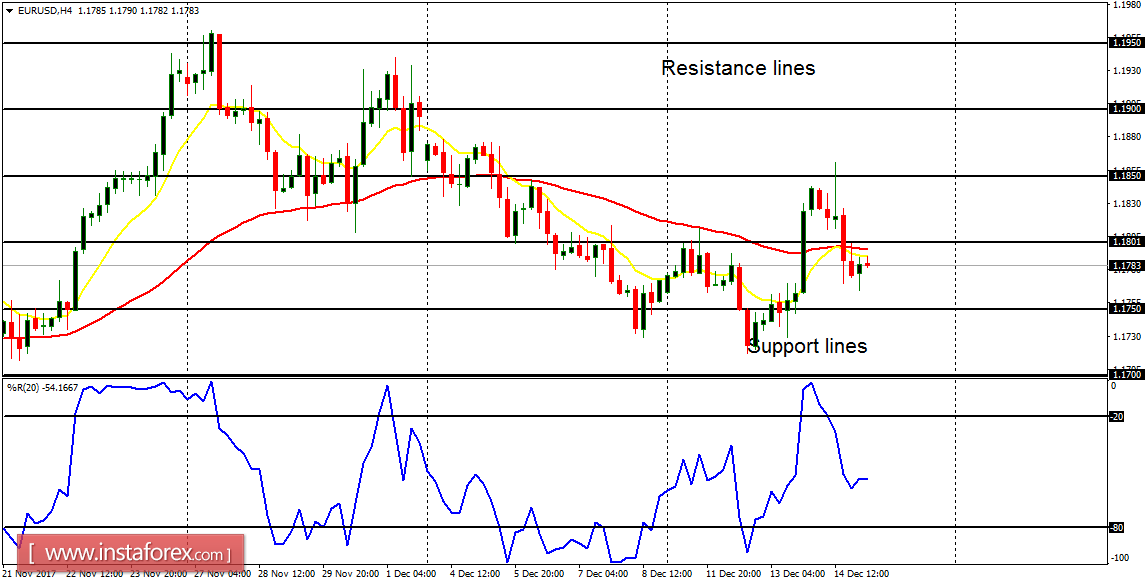

EUR/USD: The EUR/USD pair rose upwards on Wednesday and came down on Thursday. That action has put some emphasis on the bearish bias, which would not be overridden, until the resistance line at 1.1900 is breached to the upside (and that will require a heavy buying pressure).

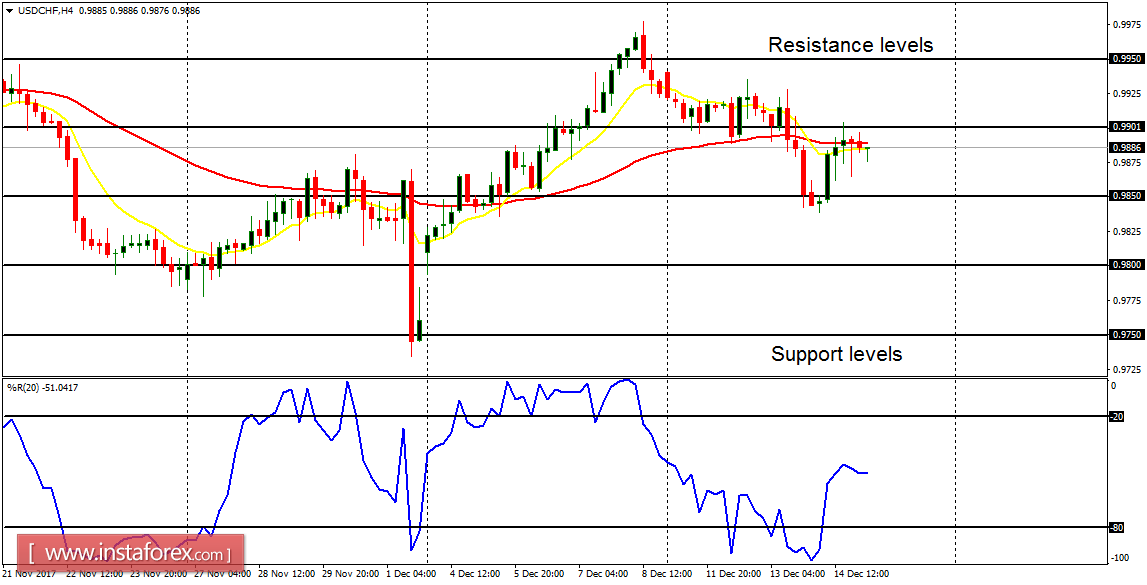

USD/CHF: The USD/CHF pair generated a short-term "sell" signal this week, which is supposed to propel price further southwards. The market has lost about 80 pips this week, and it may reach the support levels at 0.9800 and 0.9750. Right now, consolidation is in progress, but it would soon translate into volatility.

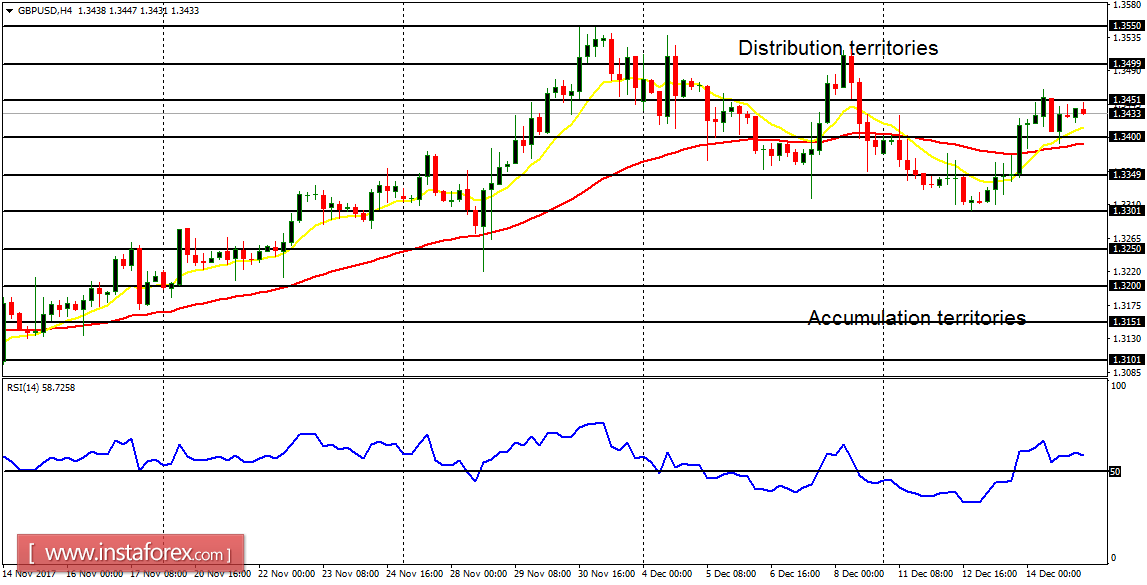

GBP/USD: The "sell" signal that was generated earlier has been rendered ineffectual by the bullish effort that was witnessed yesterday (which has also resulted in some bullishness). A rise above the distribution territory at 1.3500 would result in a bullish bias, while a drop below the accumulation territory at 1.3250 would result in a bearish bias.

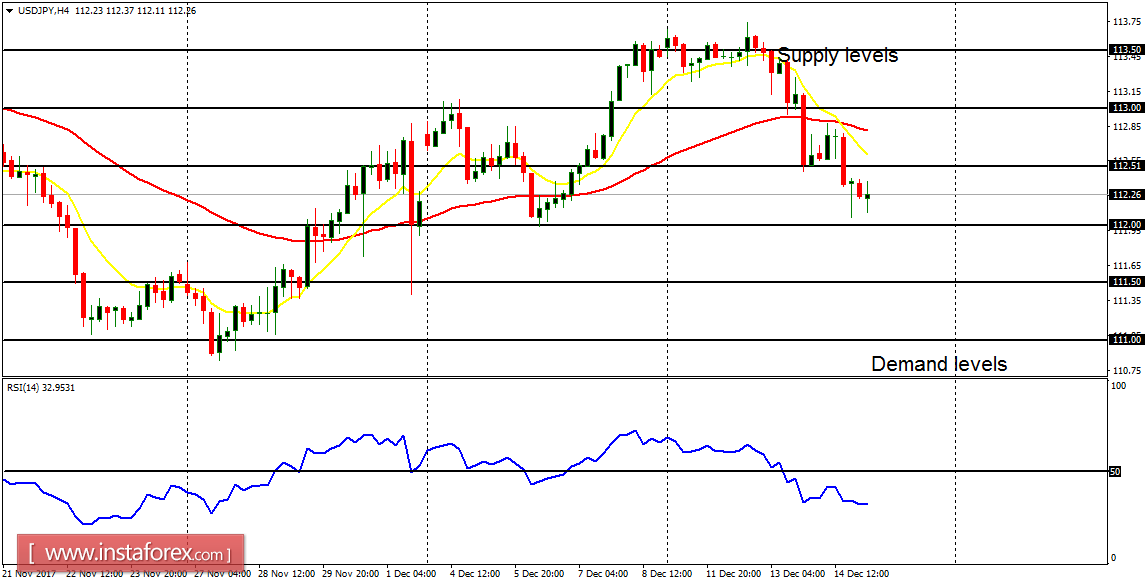

USD/JPY: On the USD/JPY pair, the relentless bearish effort that has been witnessed this week has resulted in a Bearish Confirmation Pattern in the 4-hour chart. Price has gone downwards by 130 pips, and it is now below the supply level at 112.50, going towards the demand level at 112.00. There is another target at the demand level of 111.50.

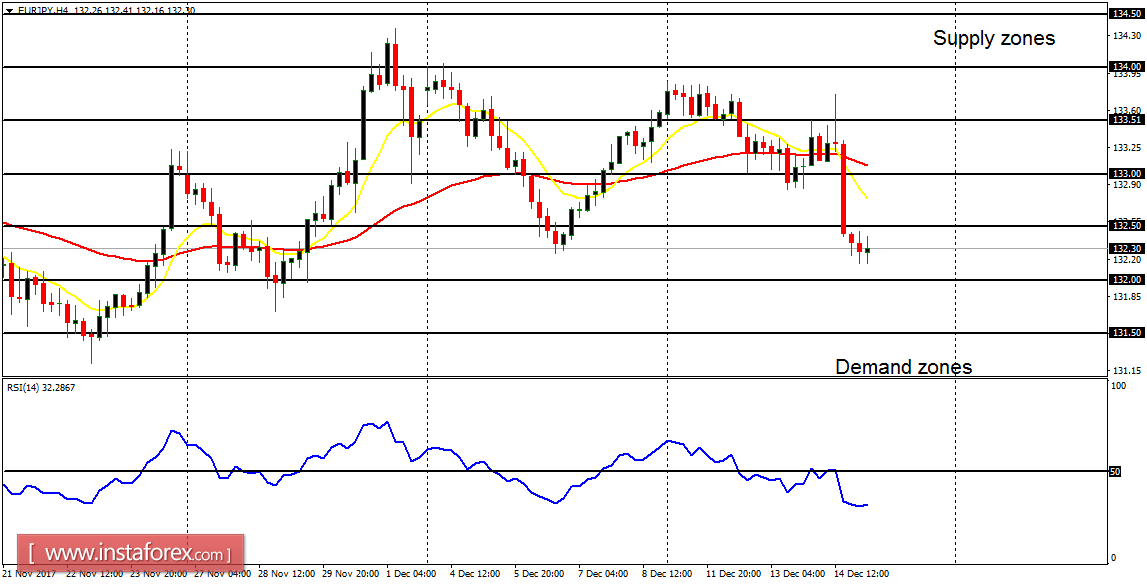

EUR/JPY: This cross has gone downwards gradually this week – shedding 150 pips. The EMA 11 is below the EMA 56 and the RSI period 14 is below the level 50. There is a bearish Confirmation Pattern in the chart and price is expected to go further southwards, reaching the demand zones at 132.00 and 131.00.