GBP/USD has been very volatile recently residing above the 1.33 support area. Last week GBP gained some momentum having unchanged Official Bank Rate at 0.50% as expected whereas USD was struggling to provide sufficient push with an increased interest rate to 1.50% from the previous value of 1.25%. Despite the political and economic issues GBP has been quite weak recently but USD could not quite dominate in the meantime leading to indecision and correction in the pair. This week we do not have much GBP economic reports or events which can help the currency to gain momentum except the Current Account report which is going to be published on Friday, which is expected to have decreased in deficit to -21.3B from the previous figure of -23.2B. The positive result of this report is expected to help GBP gain some momentum against USD but it is expected not to be quite sustainable. On the USD side, today Building Permits report is going to be published which is expected to decrease to 1.28M from the previous figure of 1.32M, Current Account is expected to show less deficit at -117B from the previous figure of -123B, Housing Starts is expected to decrease as well to 1.25M from the previous figure of 1.29M and FOMC Member Kashkari is going to speak today about the interest rate decisions and upcoming monetary policies. As of the current scenario, USD is quite strong fundamentally in comparison to GBP, which is expected to have a greater impact in the long-term trading environment. USD is currently expected to dominate GBP and push the price lower in the future.

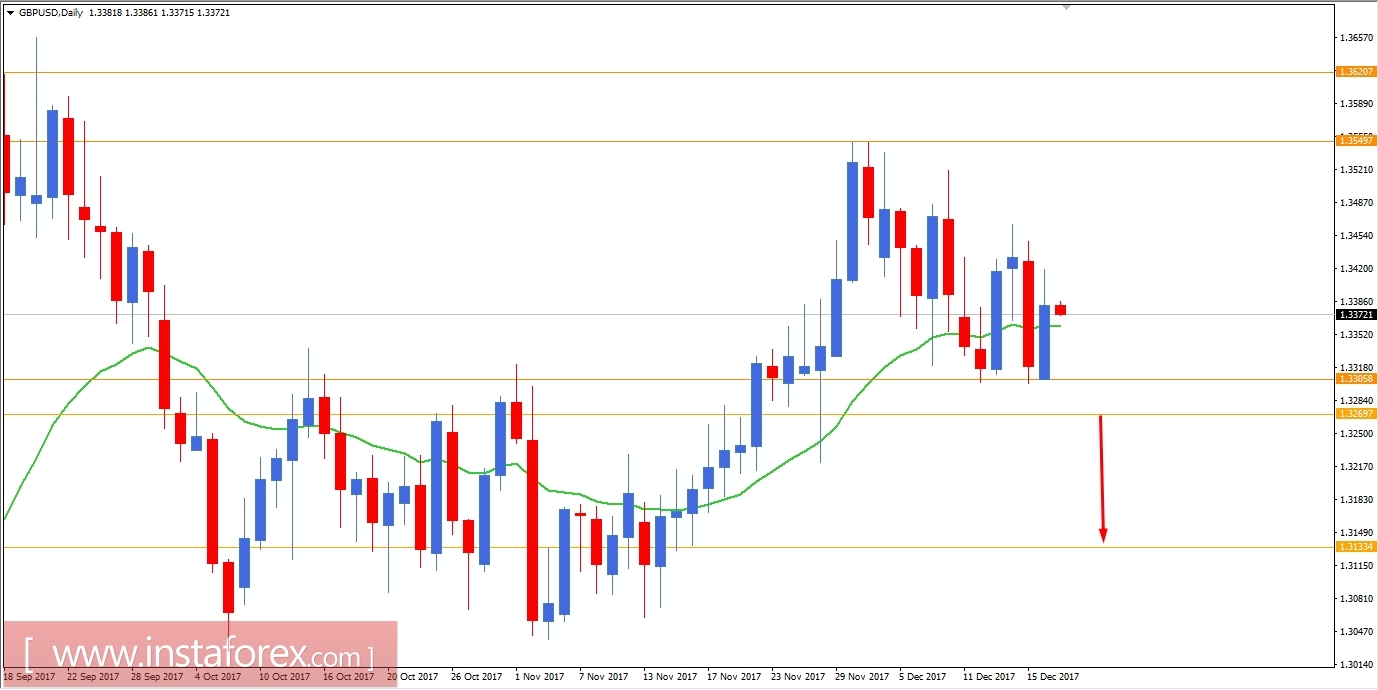

Now let us look at the technical view, the price is currently quite indecisive having back to back impulsive bearish and bullish daily candles. As of the context, the price is expected to move much down towards 1.31 support area if the price breaks below the support area of 1.3270-1.3300 with a daily close. As the price remains below 1.3450 the bearish bias is expected to continue further.