USD/JPY has recently rejected off the 113.60 resistance area in a bullish volatile trend. USD has been dominating the JPY for a few months now whereas currently, JPY is showing some momentum to get over it. Today, JPY Household Spending report was published with an increase to 1.7% from the previous value of 0.0% which was expected to be at 0.6%, National Core CPI report showed increase to 0.9% which was expected to be unchanged at 0.8%, Tokyo Core CPI increased to 0.8% from the previous value of 0.6% which was expected to be at 0.7%, SPPI was published unchanged as expected at 0.8% and Unemployment Rate has decreased to 2.7% which was also expected to be unchanged at 2.8%. The positive economic report results helped JPY to gain some momentum currency but any positive economic report from USD side may put the market into correction again. On the USD side, USD S&P/CS Composite-20 HPI report is going to be published which is expected to have a slight increase to 6.3% from the previous value of 6.2% and Richmond Manufacturing Index is expected to decrease to 22 from the previous figure of 30. Additionally, this week USD CB Consumer Confidence report and Unemployment Claims report is going to be published which is also forecasted to be quite mixed with the outcome. To sum up, JPY is currently quite positive with the bearish momentum backed by positive economic reports today which is expected to help the currency to gain good momentum over USD in the coming days.

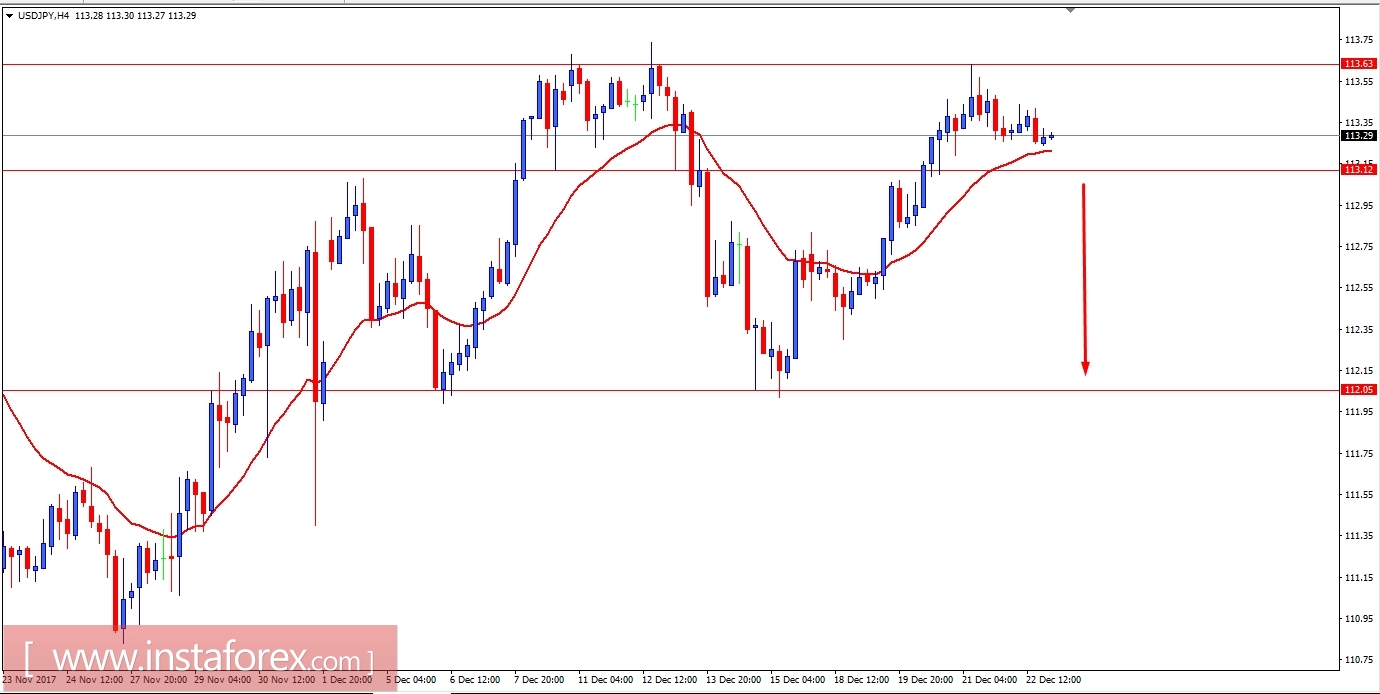

Now let us look at the technical view, the price is currently residing above the support area of 113.10 where a daily close below this area will lead to impulsive bearish pressure in the coming days with the target towards 112.00 support area. As the price remains below 113.60 resistance area the bearish bias is expected to continue further.