GBP/USD has been extremely volatile and corrective recently above the 1.3300 support area. GBP is currently struggling to gain over USD despite the recent market sentiment which is not in favor of USD to gain some momentum. Currently, the pair is expected to make some corrective moves on the thin market as the holidays are being observed all over the world. So, most of traders are out of the market, taking a break. Despite the holiday, there are certain economic reports which are going to be published this week which might help to establish a clear trend in the coming days. Today, US S&P/CS Composite-20 HPI report is going to be published which is expected to have a slight increase to 6.3% from the previous value of 6.2% and Richmond Manufacturing Index is expected to decrease to 22 from the previous figure of 30. Moreover, this week US CB Consumer Confidence report and Unemployment Claims report are going to be published which might play a vital role to establish good momentum for USD against GBP. On the other hand, today there are no economic reports or events meaningful for GBP amid the observance of Boxing day. However, tomorrow UK High Street Lending report is going to be published which is expected to show a slight increase to 40.6k from the previous figure of 40.5k. Though the economic report is expected to have minimum impact on GBP, a better-than-expected result might help to cap USD gains. As for the current scenario, USD is expected to gain momentum with more high impact economic reports this week. So, positive results will lead to much impulsive bearish pressure in the pair.

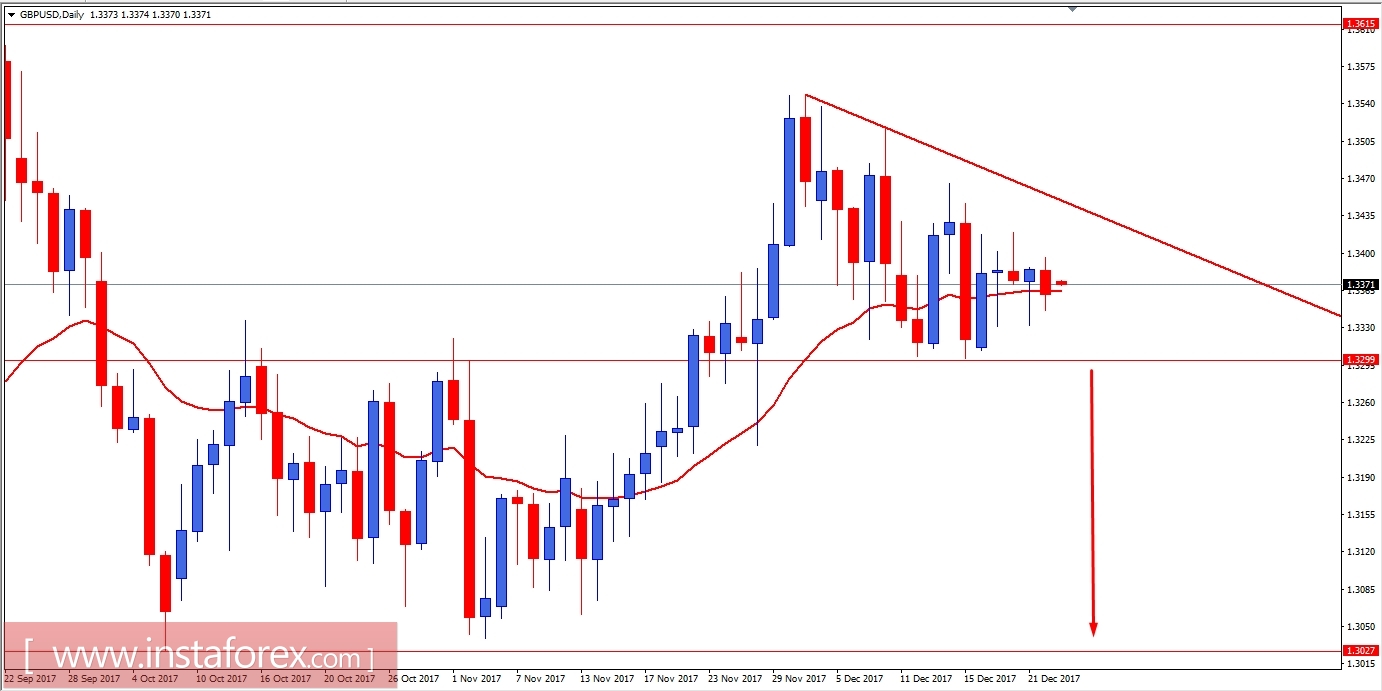

Now let us look at the technical chart. The price is currently being squeezed with bearish pressure forming a Triangle pattern which is also recognized as a Pre-breakout Structure as well. As for the current price movement, the price is expected to break below 1.33 in the coming days. If the price breaks and closes below 1.33 with a daily close, then we will consider sell positions with a target towards 1.3030-50 support area. As the price remains below 1.3450, the bearish bias is expected to continue further.