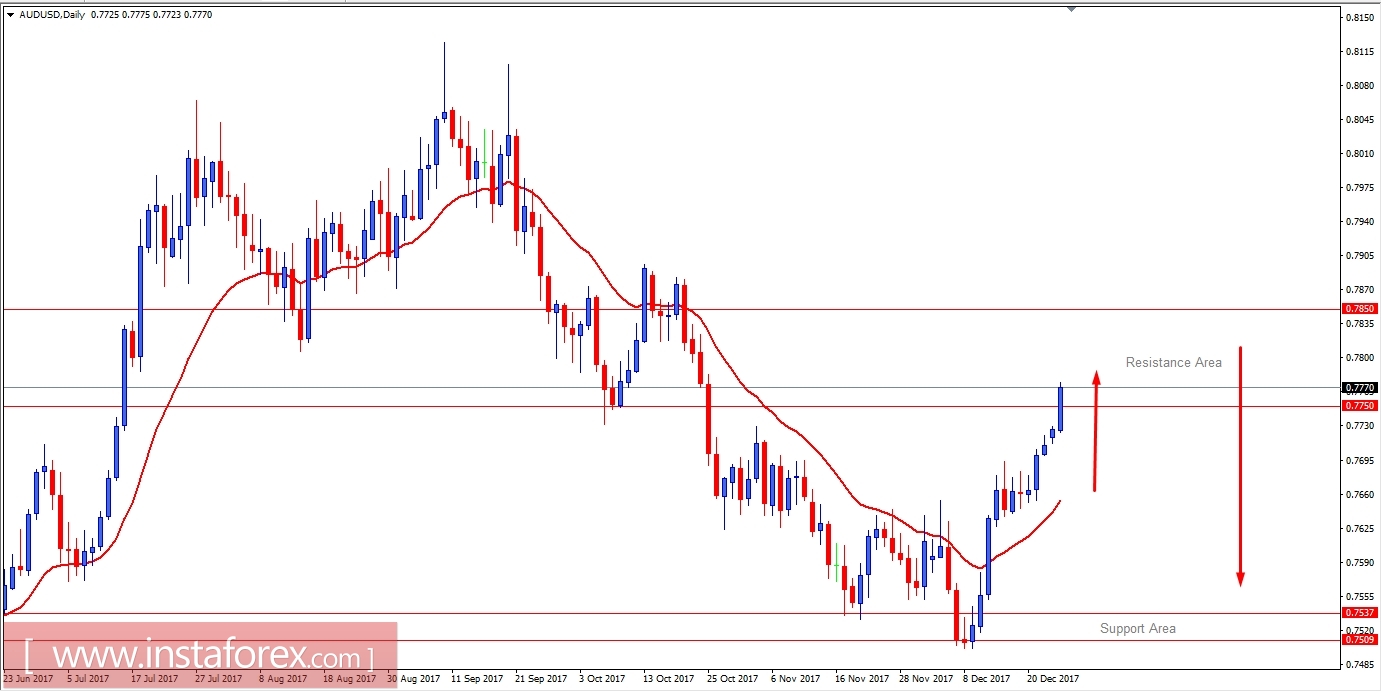

AUD has been dominating USD for a few days now and currently, the price is residing inside the resistance area of 0.7750 to 0.7850 area. The bullish pressure was very impulsive in this pair whereas the pullbacks were very limited which lead to a non-volatile price action as well. Today there was no AUD based economic report or event to help the currency to gain momentum but on Friday Private Sector Credit report is going to be published which is expected to be unchanged at 0.4%. The economic report may have a very little impact on the AUD if it comes negative but if it results to be better than expected than it may work as a fuel to upcoming impulsive move in this pair. On the USD side, today CB Consumer Confidence report was published with significant decrease to 122.1 from the previous figure of 128.6 which was expected to have slight decrease to 128.2 and Pending Home Sales report was also published with decrease to 0.2% from the previous value of 3.5% which was expected to be negative at -0.4%. As of the current scenario, AUD is expected to dominate USD further in the coming days due to several worse economic reports of USD published recently which weakened the momentum of the currency.

Now let us look at the technical view, the price is currently residing inside the resistance area between 0.7750-0.7850. The bullish trend is non-volatile which is expected to reject off the 0.7850 area and proceed down towards 0.7500 support area in the coming days. As the price remains below 0.7850 the bearish bias is expected to continue further.