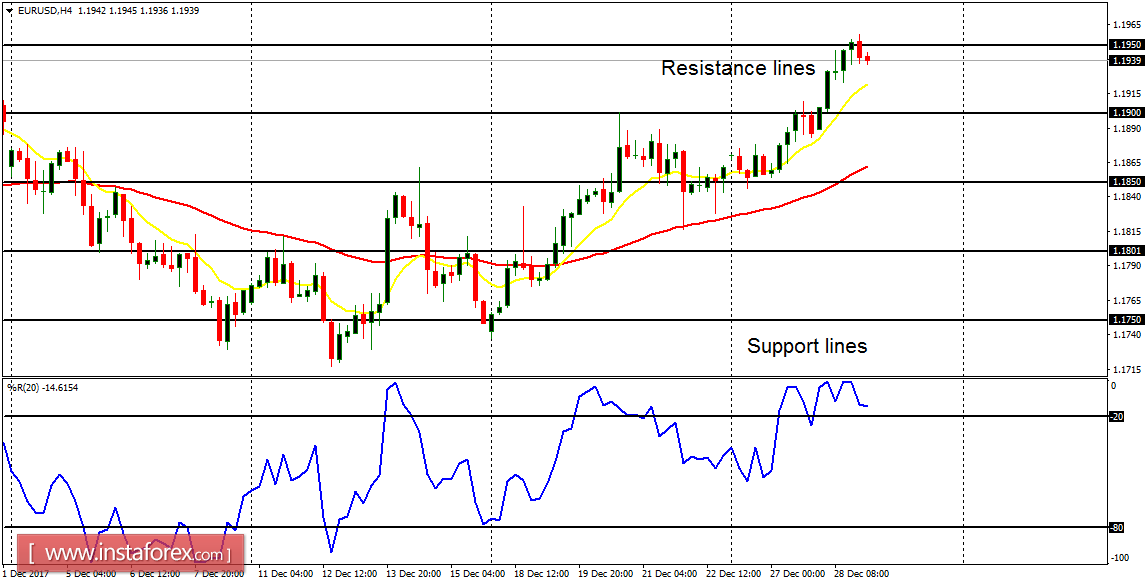

EUR/USD: The EUR/USD pair has risen this week, moving from the support line at 1.1850, and testing the resistance line at 1.1950. There is a Bullish Confirmation Pattern in the market, and further upwards movement is expected, which may make price reach the resistance lines at 1.2000 and 1.2050.

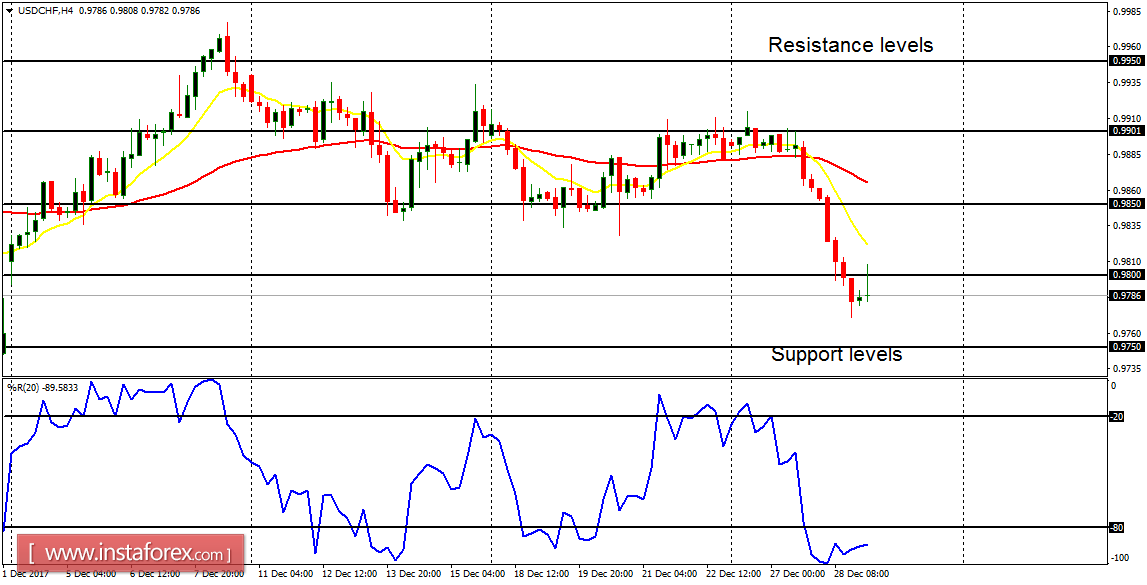

USD/CHF: The USD/CHF pair has dropped massively this week, moving from the resistance level at 0.9900 and now below the resistance level at 0.9800. There is a Bearish Confirmation Pattern in the market, and further downwards movement is expected, which may make price reach the support levels at 0.9750 and 0.9700.

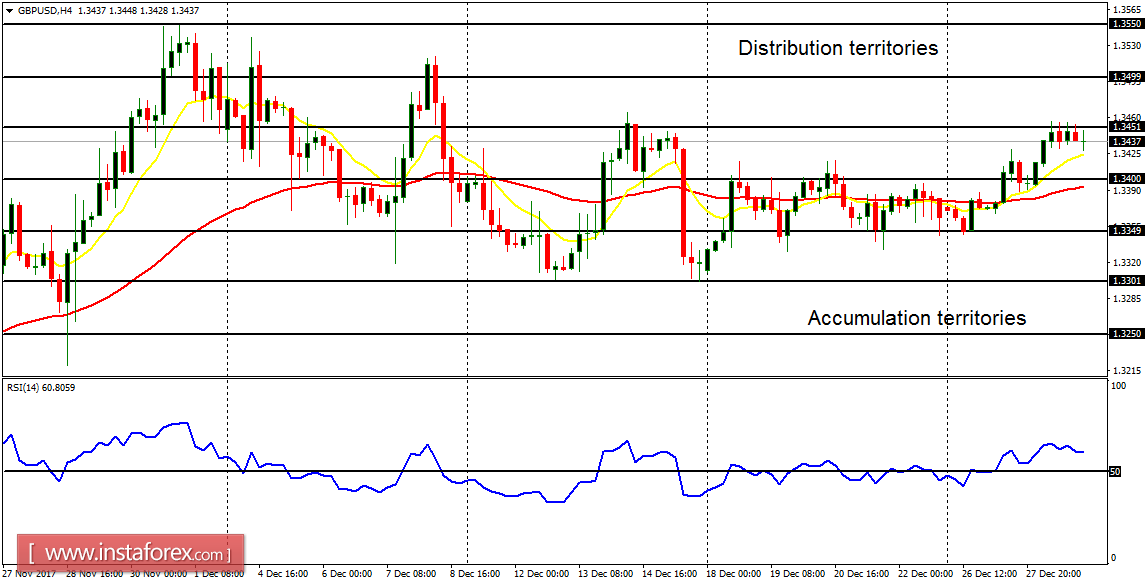

GBP/USD: Although the distribution territory at 1.3450, has been tested several times (now under siege), the market would be able to go further northwards when the distribution territory is eventually breached to the upside. The EMA 11 is above the EMA 56, and the RSI period 14 is above the level 50. The distribution territory at 1.3500 is the next target.

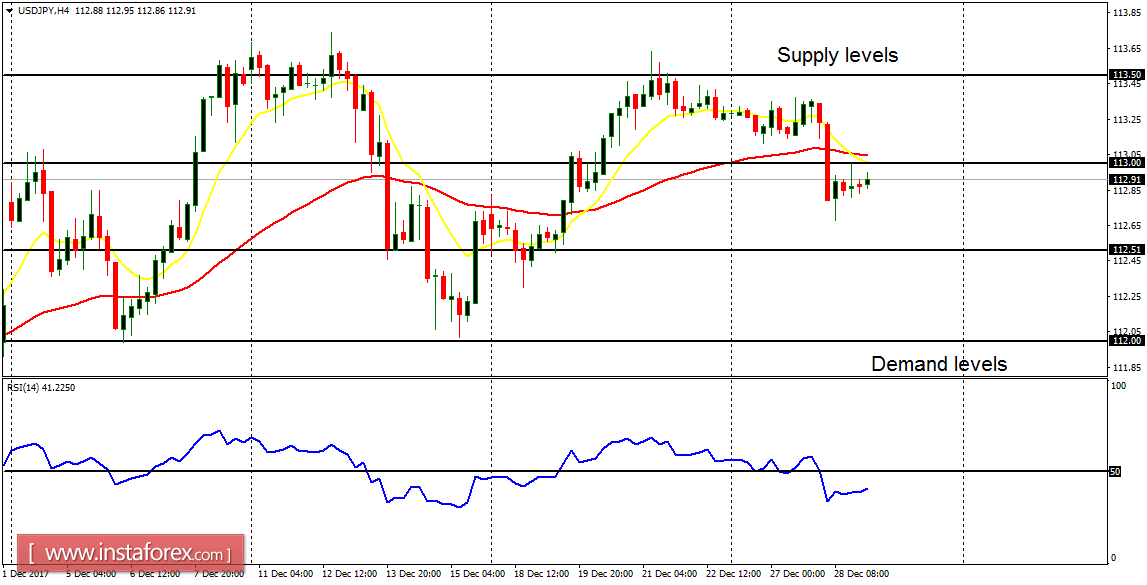

USD/JPY: This currency trading instrument is moving lower and lower; and as it is anticipated, a bearish signal has been generated in the market as price moves below the supply level at 113.00. The next targets are the demand levels at 112.50. However, a serious selling pressure is needed to reach the demand level at 112.00.

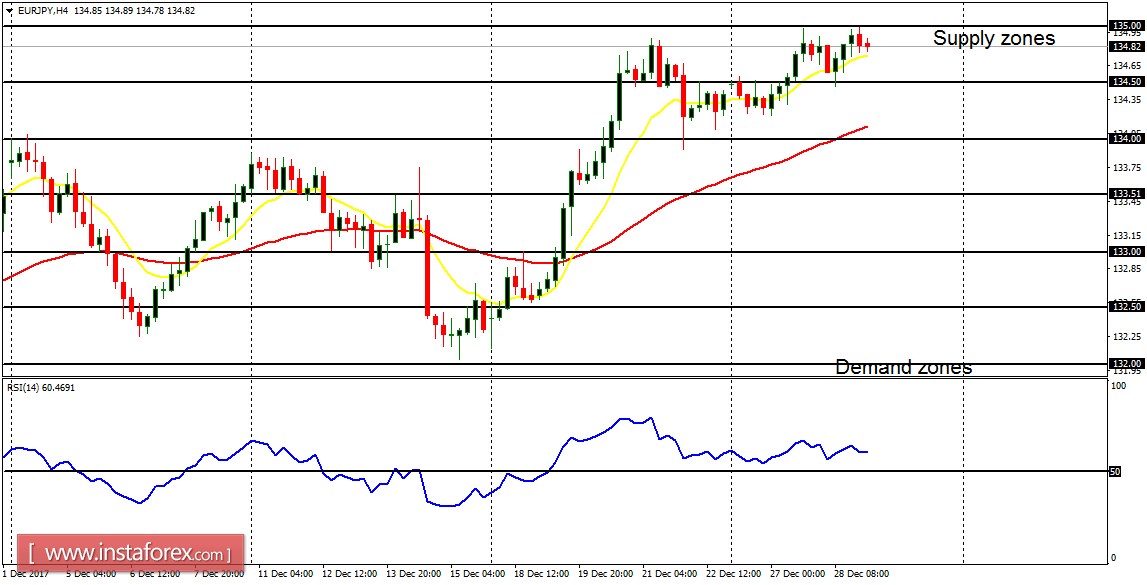

EUR/JPY: This cross is bullish – and unlike the USD/JPY pair – it has been able to maintain its bullishness. This is visible in the 4-hour chart, and also seen in the long-term. When the current short-term equilibrium movement ends, it could continue to favor bulls.