EUR/JPY is currently struggling at the edge of 134.50 support area with impulsive bearish momentum which is expected to break lower to create lower highs in the process. Both EUR and JPY have been struggling with the mixed economic reports recently, whereas JPY Industrial Activity progress and Development in Tertiary Industry helped the currency to gain some momentum over EUR recently. Today, JPY Household Spending report was published with negative value of -0.1% which decreased from the previous value of 1.7%, which was expected to be at 1.6%, Unemployment Rate increased to 2.8% which was expected to be unchanged at 2.7%, and Retail Sales report showed an increase to 3.6% which was expected to be unchanged at 2.1%. Moreover, today, BOJ Core CPI report is yet to be published which is expected to decrease to 0.5% from the previous value of 0.6%. On the EUR side, today, German Prelim CPI report is going to be published which is expected to be negative at -0.5% decreasing from the previous value of 0.6%, French Consumer Spending is expected to decrease to 0.4% decreasing from the previous value of 2.2%, Spanish Flash GDP is expected to slightly decrease to 0.7% from the previous value of 0.8%, and Prelim Flash GDP is expected to be unchanged at 0.6%. As of the current scenario, JPY has been quite mixed with the economic reports, whereas EUR is forecasted to have negative results of the economic reports to be published today. If the EUR economic reports result as expected or worse than expected then JPY is expected to gain further momentum in the coming days or else a series of positive reports on the EUR side today will increase the bullish momentum resulting to a bullish pressure in the market. A daily close today will define the upcoming movement in the pair for the coming days.

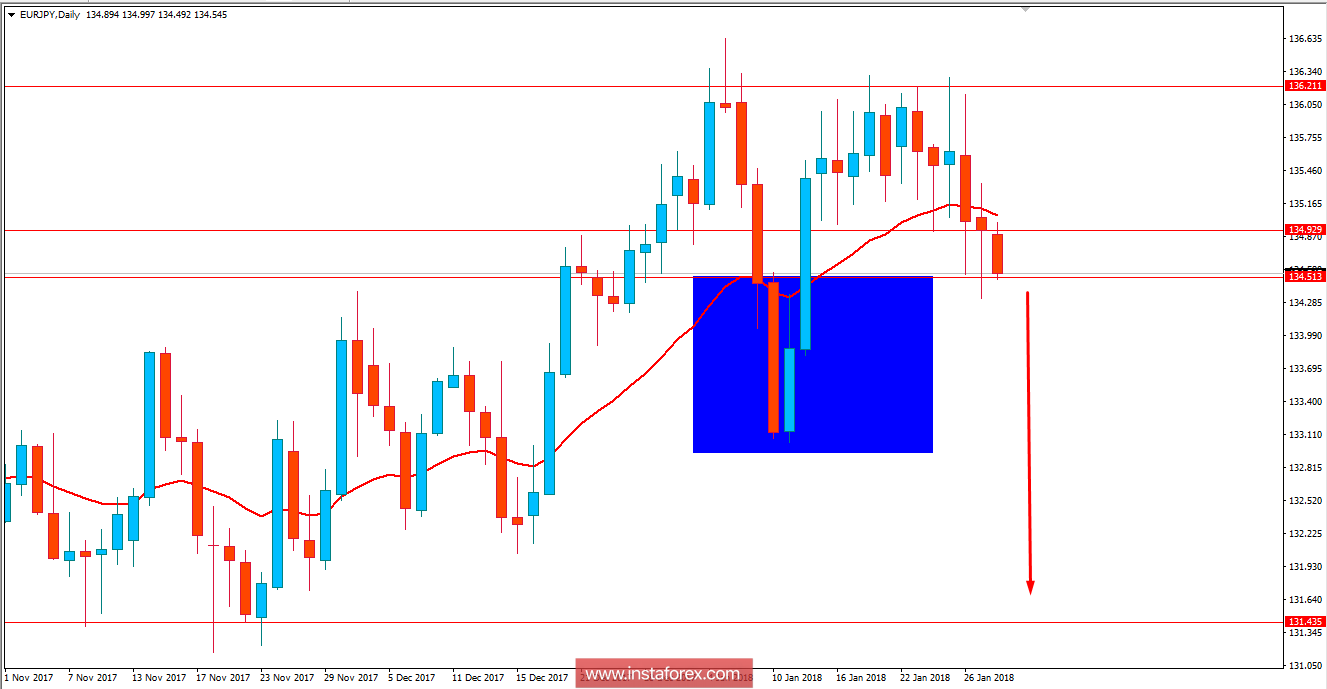

Now let us look at the technical view. The price is currently residing at the edge of 134.50 area which has breached below the dynamic level of 20 EMA recently with a daily close. Though the price is still above the 134.50 important price level but the pre-breakout structure is showing a bearish breakout is on the way. As the price breaks below 134.50 with a daily close, further bearish move is expected in this pair with target towards the 131.50 area.