Technical outlook:

The EUR/USD pair seems to be preparing for a corrective drop towards 1.2220 levels to terminate wave 4 within the 5th wave on one larger degree. The pair has been in an upswing since January 2017 and is now into its final leg, before giving in completely to bears again. High probable wave count from here looks to be lower first and then a rally to test 1.2600 levels and complete 5 waves impulse. Interim support comes in at 1.2170 levels for now, while resistance is seen at 1.2537 levels respectively. If the correction is taking shape of a standard flat, prices should stay below 1.2537 levels going forward. In case of an expanded flat, another high would be printed before dropping lower again.

Trading plan:

Look to remain short on intraday rallies with risk at 1.2537 levels for now.

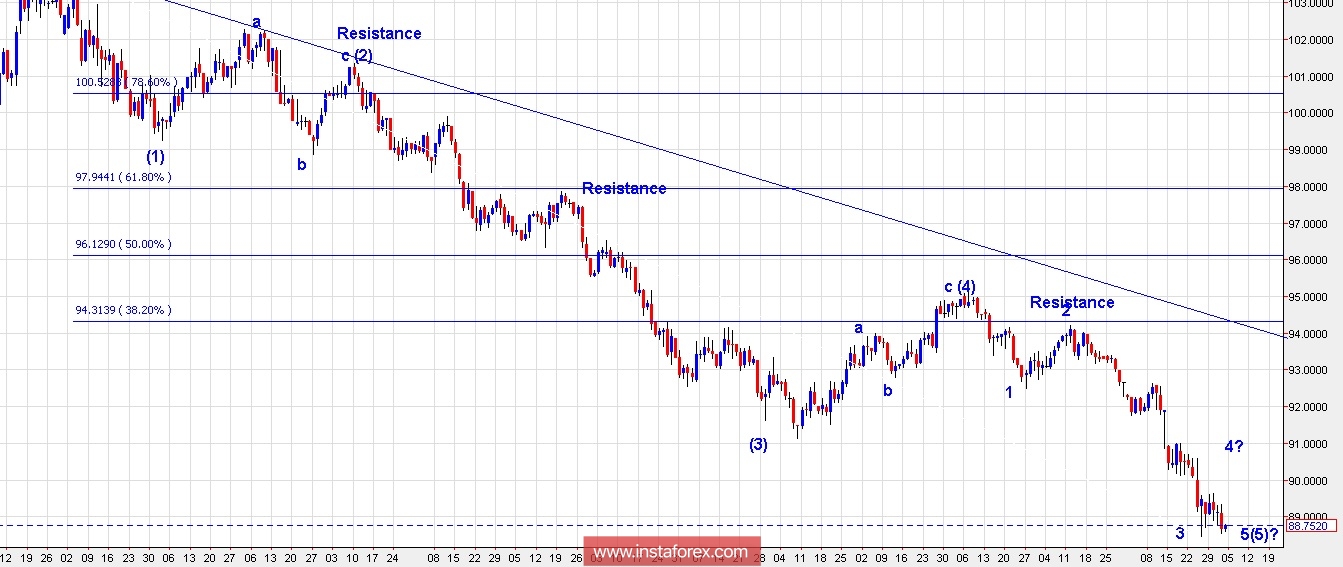

US Dollar Index chart setups:

Technical outlook:

The US Dollar Index is trading lower at the moment (88.70/75), but should ideally stay above 88.45 levels if it were to produce a standard flat correction. The index seems to be into its last leg drop, wave 5, of the impulse that began in January 2017. At the moment the index is looking to produce a counter-trend rally towards 91.00 levels, and terminate into wave 4 before dropping lower again. Interim support is seen at 88.40 levels, while resistance is seen at 91.00 levels respectively. Looking at the bigger picture and wave counts as depicted here, there should be one more drop after 91.00 levels, to terminate 5th of 5th wave and resume a meaningful rally towards 95.00 and 98.00 levels respectively.

Trading plan:

Look to remain long and buy on dips, with risk at 88.40 levels.

Fundamental outlook:

Watch out for the USD NFP at 0830 AM EST today.

Good luck!