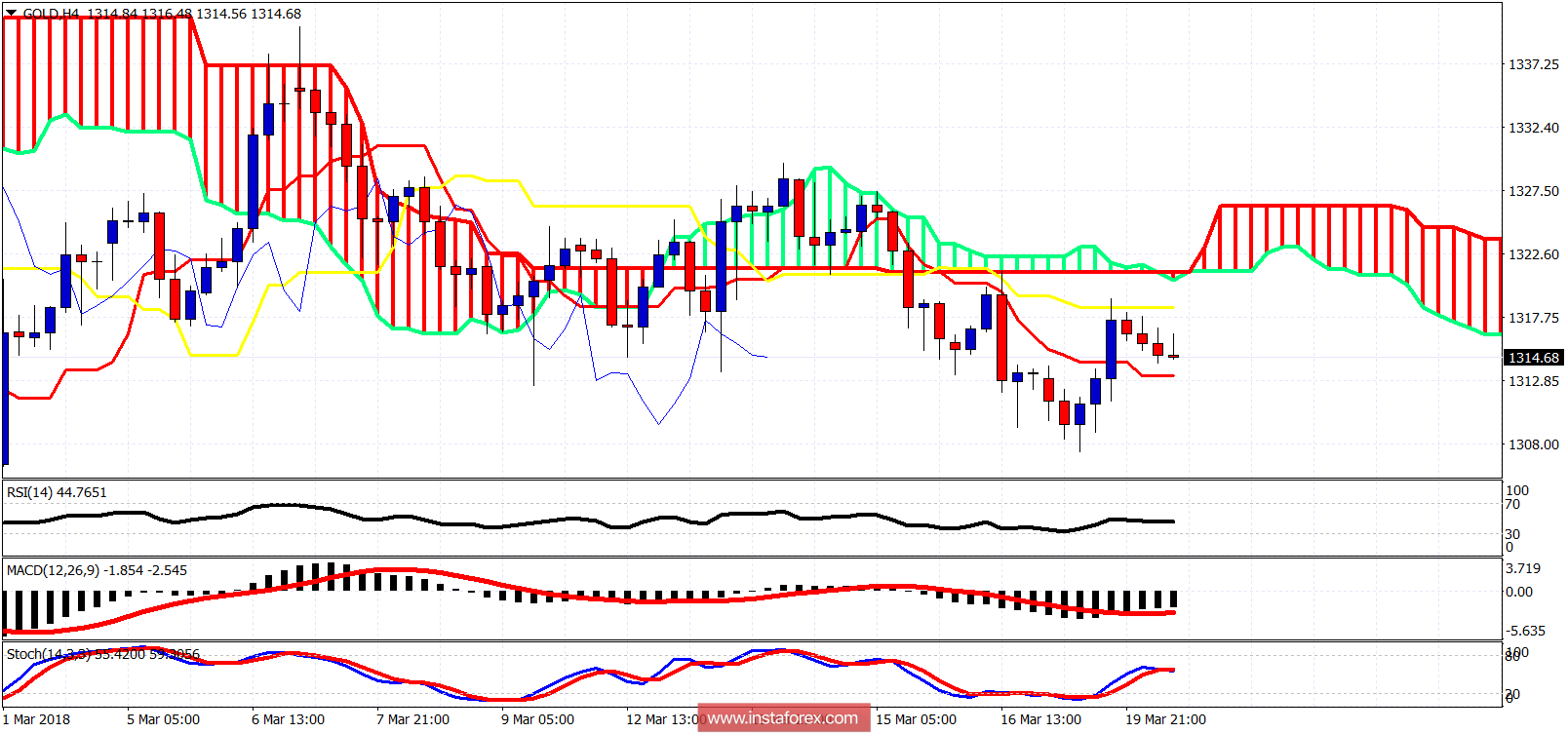

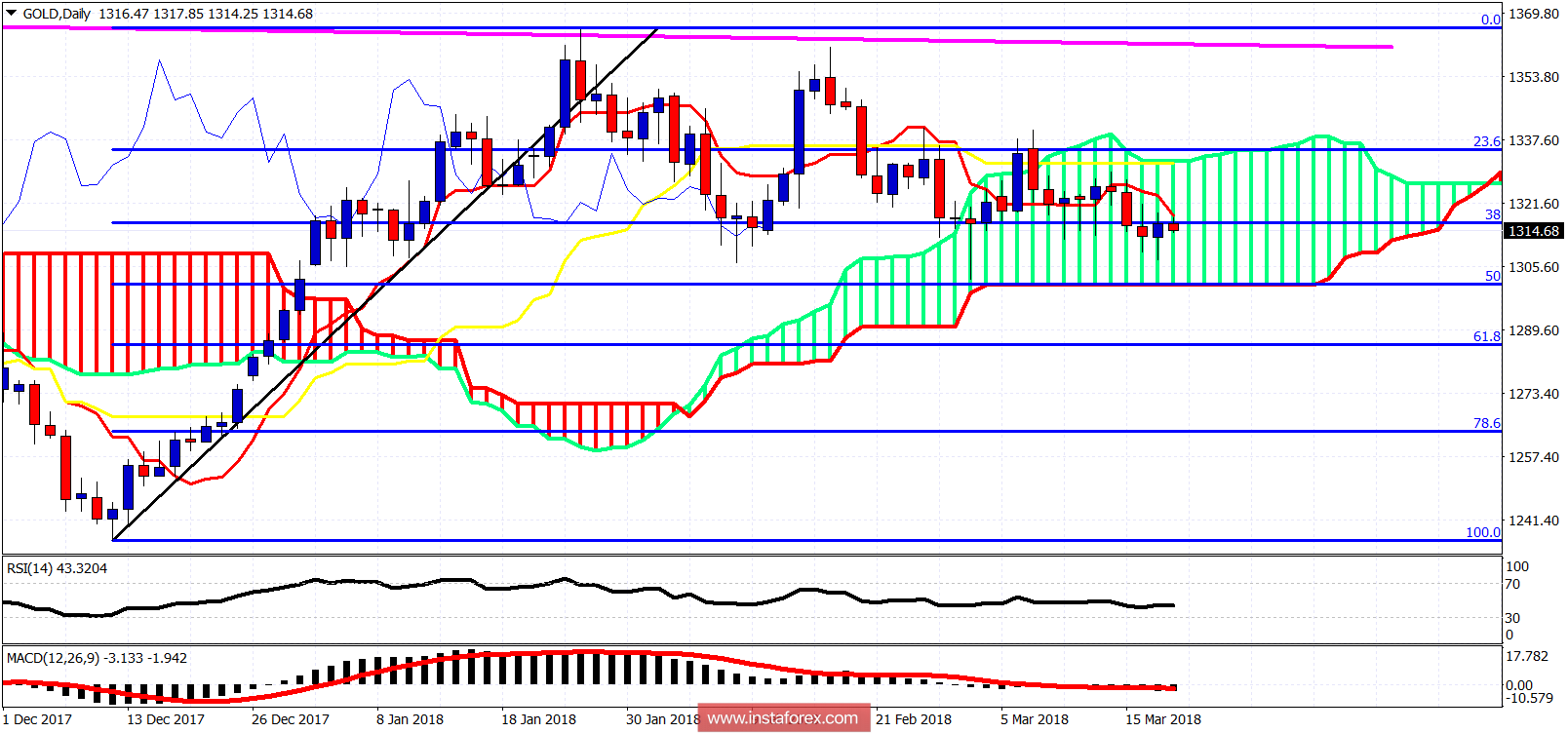

Gold price bounced yesterday but got rejected at the kijun-sen. Short-term trend remains bearish as price remains below the Ichimoku cloud. Medium-term trend remains neutral as the daily candles remain inside the Kumo and still inside the $1,350-$1,300 trading range.

Short-term support is at $1,313 where the 4-hour tankan-sen is found. Resistance is at $1,318.50 (kijun-sen) and at $1,321.50 (Kumo). Trend remains bearish in the short term. Price continues to mainly move sideways between $1,350-$1,300.

On a daily basis, Gold price is in a neutral trend as price is inside the Kumo. Resistance is at $1,334 and support at $1,300 where we also find the 50% Fibonacci retracement. If the support at $1,300 is breached, we should expect at least a move lower towards the 61.8% Fibonacci retracement. On the other hand, in case the resistance at $1,334 is broken, we could see a test of the long-term resistance at $1,350.