The Dollar index has broken through cloud support in the short-term and got rejected by the Daily Kumo. Both signs are bearish for the Dollar. As long as price is below 90.40 we should expect new yearly lows for the index.

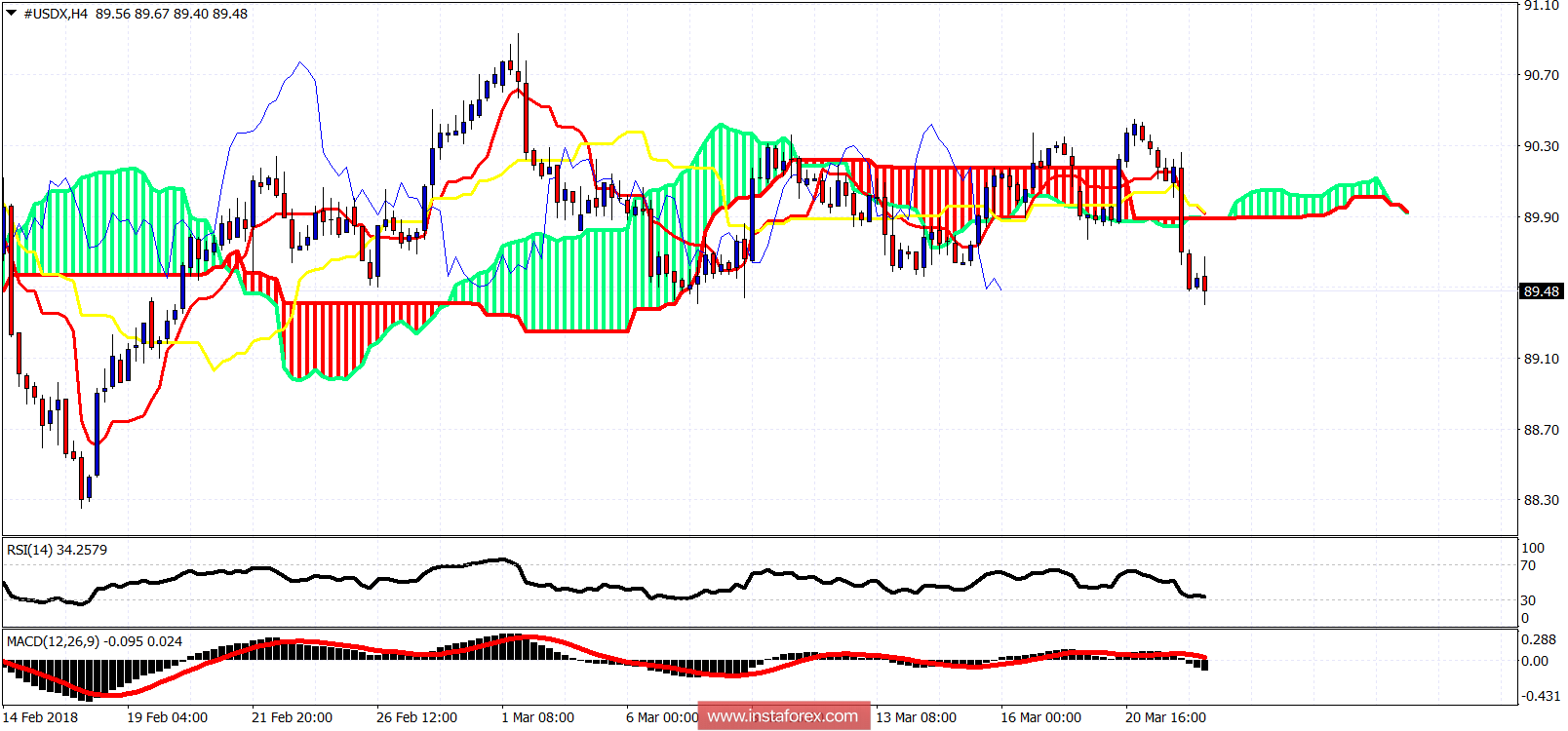

Resistance is found at 89.90 in the 4-hour chart. Price has broken below the Ichimoku cloud. Trend is bearish. Support is at 89.40. Next support is at 89.20. Break below it and the decline is expected to accelerate.

In the daily chart, the Dollar index not only got rejected at the Daily Kumo, price is now breaking below the kijun-sen. A daily close below the kijun-sen will be a bearish sign. Daily resistance is at 90. Bulls will need to break at least that level in order to have hopes. As long as price is below the Kumo, I'm bearish about the Dollar.