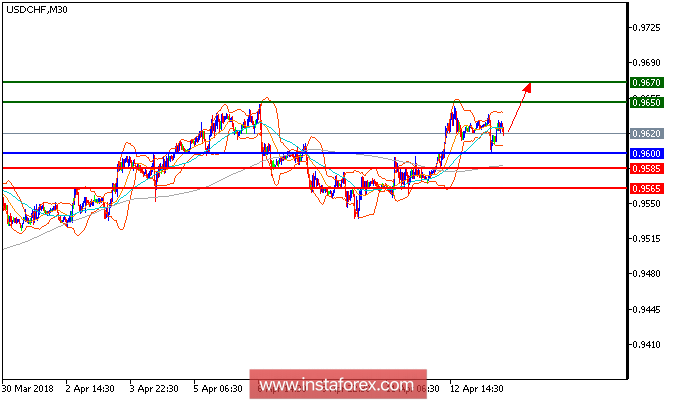

All our upside targets which we predicted in yesterday's analysis have been hit. USD/CHF is expected to trade with a bullish outlook. Despite the recent consolidation, the pair is still bullish above its key horizontal support at 0.9600, which is expected to limit any downward attempts. The rising 50-period moving average suggests that the prices may still have upside potential to go. In addition, the relative strength index is mixed to bullish. Hence, above 0.9600, look for a new rise to 0.9650 and 0.9670 in extension.

Chart Explanation: The black line shows the pivot point. The present price above the pivot point indicates a bullish position, and the price below the pivot point indicates a short position. The red lines show the support levels, and the green line indicates the resistance levels. These levels can be used to enter and exit trades.

Strategy: BUY, stop loss at 0.9500, take profit at 0.9650.

Resistance levels: 0.9650, 0.9670, and 0.9700

Support levels: 0.9585, 0.9565, and 0.9510.