USD/CAD has been quite impulsive with the bearish gains yesterday which lead the daily candle to almost engulf a series of bullish and correction price actions of the previous days. Certain impulsive bearish pressure is analyzed as the reaction of the market sentiment due to worse PPI economic report published yesterday.

USD has been struggling with the economic reports, but it managed to dominate mostly all major currencies in the market, except CAD. The degree of USD domination on CAD was not such severe as it is on other major currencies. Today, USD CPI report is going to be published which is expected to increase to 0.3% from the previous value of -0.1%, Core CPI is expected to be unchanged at 0.2%, Unemployment Claims is expected to increase to 219k from the previous figure of 211k, and Natural Gas Storage is expected to increase to 81B from the previous figure of 62B. Though the forecasts are quite mixed, but ahead of the upcoming CAD high impact economic report to be published tomorrow, certain volatility is expected to hit the market in the coming days.

Ahead of the high impact Employment Change report tomorrow which is expected to decrease to 17.8k from the previous figure of 32.3k, and Unemployment Rate which is expected to be unchanged at 5.8%, today, CAD NHPI report is going to be published which is expected to increase to 0.0% from the previous negative value of -0.2%.

As of the current scenario, certain volatility is expected in this pair ahead of the upcoming CAD high impact economic reports which might lead to certain bearish pressure in the pair. Though the forecasts of the upcoming CAD economic reports are quite mixed, but any better results will result in certain bearish pressure to lead the price much lower in the coming weeks despite today's upcoming USD high impact CPI reports.

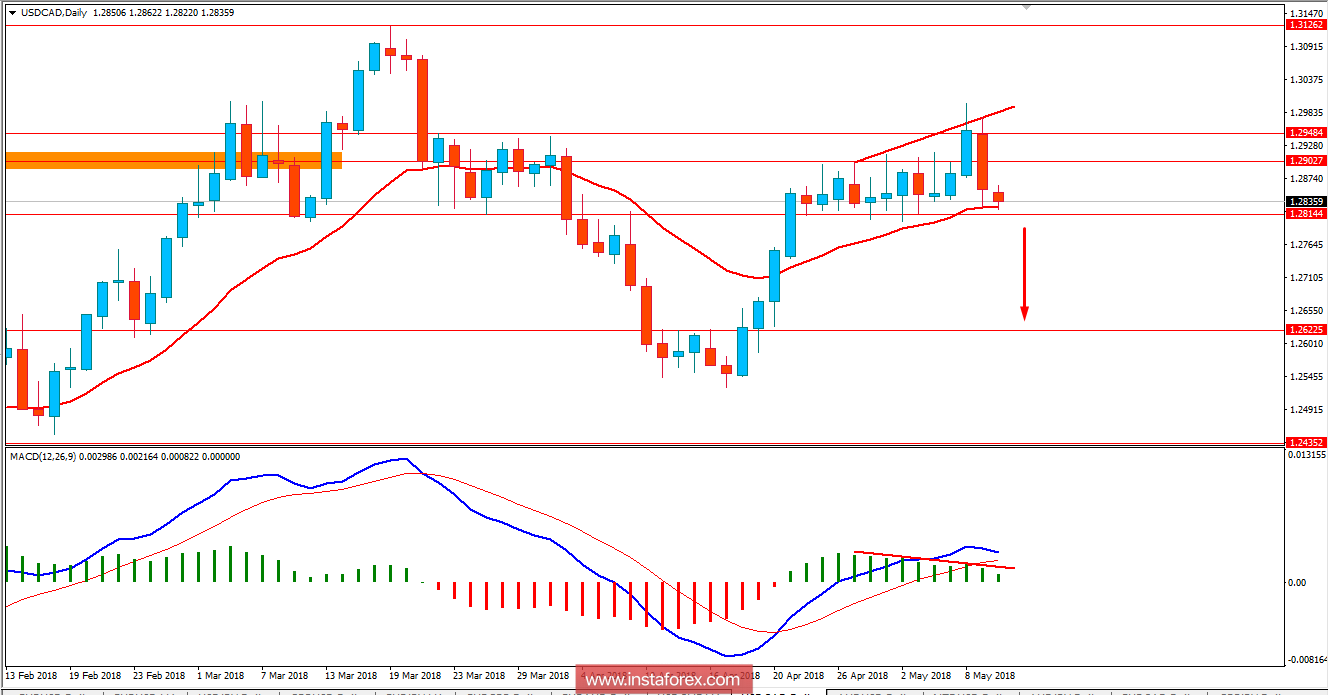

Now let us look at the technical view. The price is still residing inside the price range between the 1.28 to 1.2950 area with 20 EMA dynamic level of support along the way. The price has formed Bearish Divergence along the way which is expected to push the price much lower in the coming days. A daily close below the 1.2800 area will lead to further bearish momentum in this pair with target towards the 1.2620 support area in the coming days. As the price remains below 1.2950 with a daily close, further bullish momentum is expected in this pair.