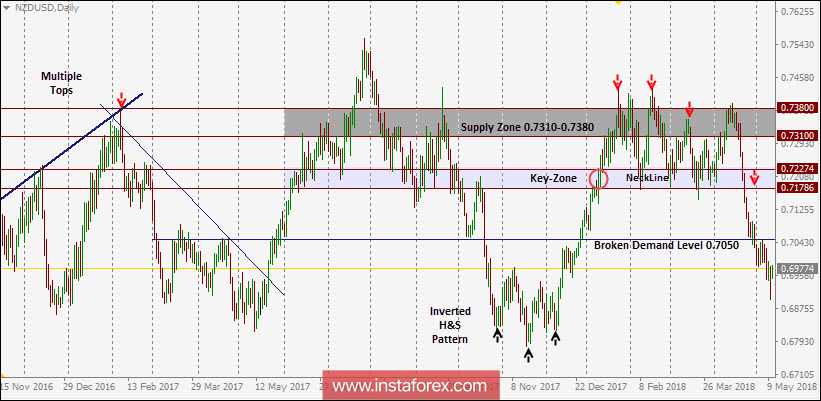

The price zone of 0.7320-0.7390 stood as a significant supply zone during a recent bullish pullback. The bulls failed to execute a successful Bullish breakout above 0.7400 during the previous week's consolidations.

The NZD/USD pair had been trapped between the price levels of 0.7170 and 0.7350 until bearish breakdown of 0.7200 occurred yesterday.

Since April 13, significant bearish pressure has been applied. This probably turns the short-term outlook for the NZD/USD pair into bearish giving considerable significance to the multiple-top reversal pattern.

That's why, a bearish breakdown of 0.7220-0.7170 (neckline zone) was needed to confirm the depicted reversal pattern. Bearish target levels around 0.7050 and 0.7000 have been achieved already.

The bearish scenario needs obvious bearish persistence below 0.7050 to maintain significant bearish momentum towards 0.6860 and 0.6820. That's why, the price level of 0.7050 is currently considered a key-level for the NZD/USD bears.

Any bullish breakout above the price level of 0.7050 hinders a further decline, allowing a bullish pullback to occur towards 0.7170-0.7220.

On the other hand, conservative traders can wait for a bullish pullback towards the price zone of 0.7220-0.7170 (a neckline zone and significant supply zone) for a valid SELL entry. S/L should be placed above 0.7260.