The dollar remains supported across the board, although volatility at the start of the week is moderate. The stock market keeps up well with increases in China and Japan. Crude falls, feeling pressure from the growing number of wells in the US.

Changes in the main currency pairs from the beginning of the week do not exceed 0.3%. The strongest are NOK and SEK, the weakest NZD. EUR/USD, GBP/USD and USD/JPY are more or less at levels from Friday. Judging by the market behavior you can not see the risk on / risk off scheme, or rather it looks like a simple wandering. The climate on the stock market is positive with the growing optimism around global growth and hopes for the successful course of US-China trade negotiations. Chinese Shanghai Composite grows 0.3%, Hang Seng gains 1.1% and Japanese Nikkei 225 gains 0.5%.

On Monday 14th of May, the event calendar is light in important economic data releases. The global investors might keep an eye on speeches from ECB (Peter Praet, Sabine Lautenschager, Yves Mersch) and FED ( Loretta Mester, James Bullard) officials.

EUR/USD analysis for 14/05/2018:

After the week in which the US withdrew from the Iranian nuclear deal and because of that added fuel to a looming deterioration in risk sentiment, which has been building recently by a weakening business cycle, this week might develop on a more positive sentiment as hopes of a fading US-China trade war are mounting.

In the Eurozone, risk sentiment has been largely unmoved as well, mostly due to the weekend's news that revealed the increasing likelihood of a coalition government formed by the two anti-establishment parties in Italy, the Five-Star Movement, and Northern League. Today, both parties will reveal their political and economic program that will mostly include cutting taxes and boosting spending. This news might influence the EUR/USD rate today, together with speeches form the ECB officials.

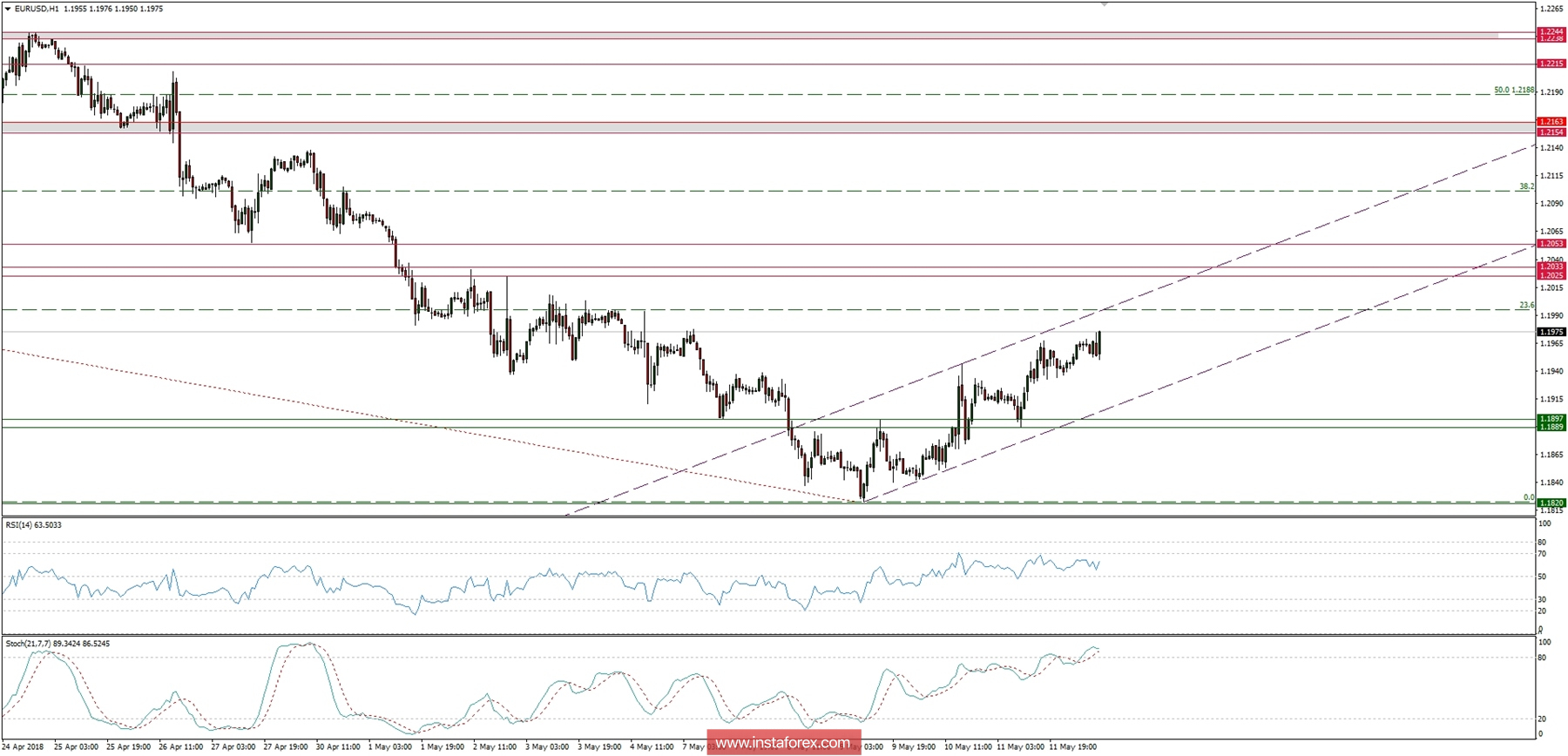

Let's now take a look at the EUR/USD technical picture at the H4 time frame. The pair exchange rate is maintained in the upward channel as it approaches the Friday's high at 1.1965. Thus, the level of 23.6% Fibo at the level of 1.1995 is also tested. In fact, for the development of the correction, the market behavior in the zone around 1.2020 will be crucial, where the 200-session moving average and the zone of local highs converge. The fact that the exchange rate may have a big problem with the continuation of the increase may be confirmed by the triple divergence with the RSI index calculated for the hourly interval made in overbought market conditions. The nearest technical support is seen at the level of 1.1889 - 1.1897. The key technical resistance is seen at the level of 1.2025 - 1.2053.