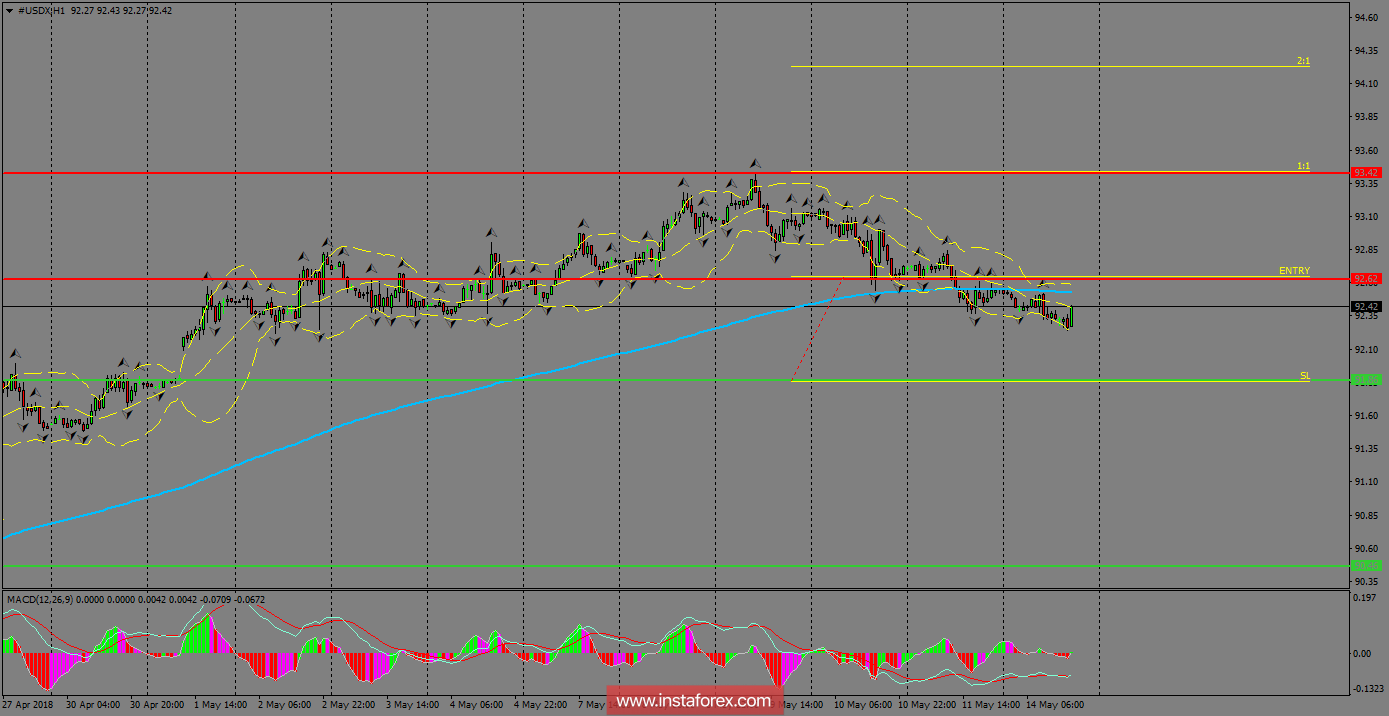

The index remains under pressure below the 200 SMA at H1 chart and it seems the bearish move could go towards the 91.86 level, which is a key support in the near-term. Such level should give up in order to allow a free fall to test the 90.46 level, in a decline that could strengthen the bearish bias in the short-term. MACD indicator remains steady in the neutral territory, calling for further sideways moves.

H1 chart's resistance levels: 92.62 / 93.42

H1 chart's support levels: 91.86 / 90.46

Trading recommendations for today: Based on the H1 chart, place buy (long) orders only if the USD Index breaks with a bearish candlestick; the support level is at 92.62, take profit is at 93.42 and stop loss is at 91.84.