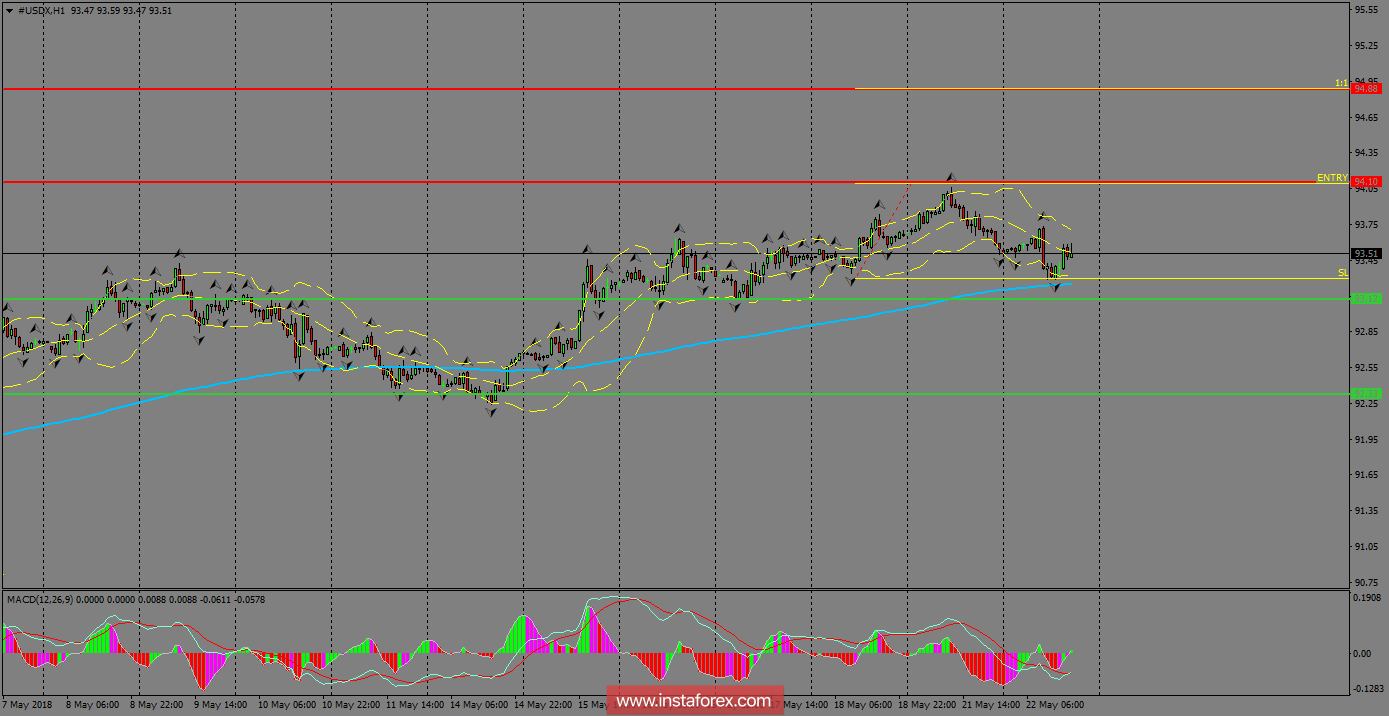

The index managed to make a retracement from the Monday's highs, but the 200 SMA remains as a dynamic support in the short-term, where also it has formed a fractal. We should remind that a breakout above 94.10 can open the doors for a testing of the 94.88 level. However, a breakout below the 200 SMA on H1 chart should strengthen the bearish bias.

H1 chart's resistance levels: 94.10 / 94.88

H1 chart's support levels: 93.12 / 92.33

Trading recommendations for today: Based on the H1 chart, place buy (long) orders only if the USD Index breaks with a bearish candlestick; the support level is at 94.10, take profit is at 94.88 and stop loss is at 93.30.