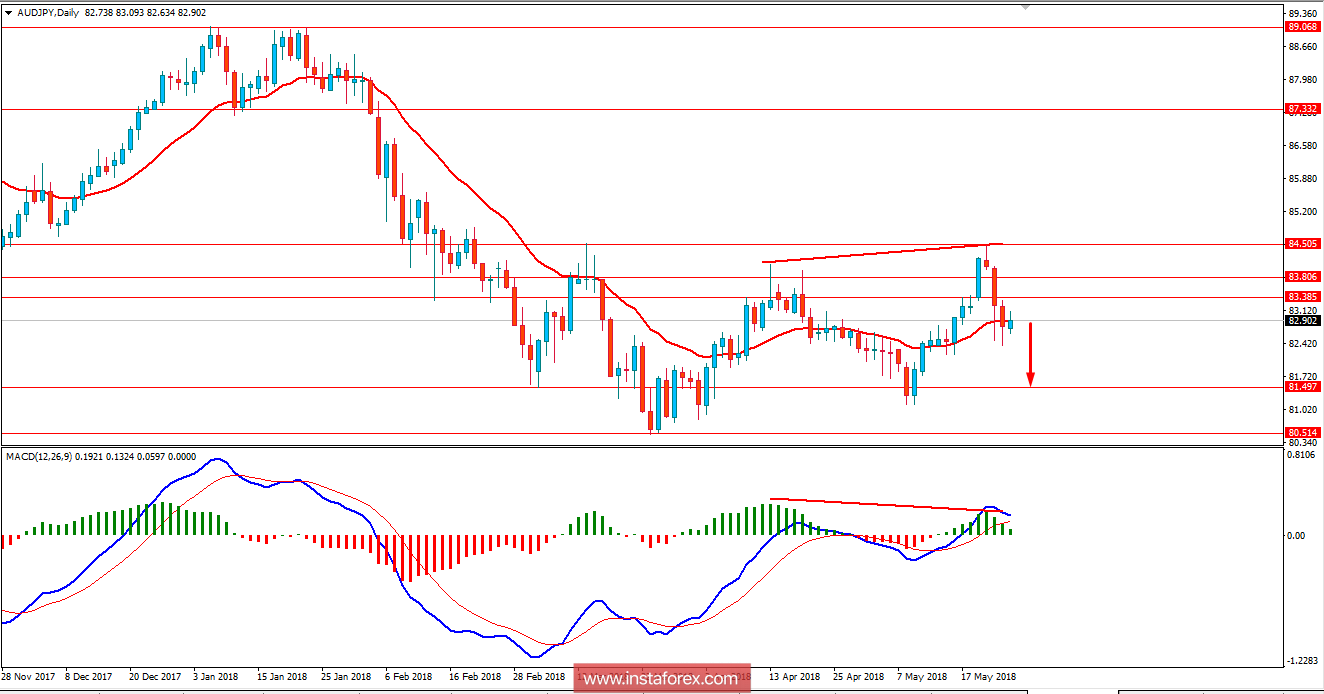

AUD/JPY has been trading with the bearish bias recently after bouncing back from 84.50 area, leading to reside below 83.00 area currently. JPY has been dominating recently over AUD that is expected to continue further in the coming days.

Today, RBA Assistant Governor Bullock is going to speak about the nation's key interest rates and future policy shift which is expected to have a moderate impact on the AUD gains against USD in the coming days. A positive outcome from this event is expected to inject some bullish pressure in the market leading to certain volatility in the process.

Today, JPY has been quite weak in comparison to previous bearish pressure amid Tokyo Core CPI report published today with a decrease to 0.5% which was expected to be unchanged at 0.6%. Though JPY has been quite negative with the economic reports this week but it managed to sustain its bearish bias in the market which indicates the sentiment of the market in this pair.

As for the current scenario, if AUD event comes up with better economic outcome today, then certain bullish pressure can be expected whereas JPY may step back for a certain amount of time. As today's Japan's economic report fell short of expectations, AUD may take the lead for a while in the process. To sum up, short-term AUD gains may be observed in the market before JPY continues to push the price lower in the future.

Now let us look at the technical view. The price is currently showing some bullish pressure in the pair at the edge of the dynamic level of 20 EMA from where the price is expected to push lower in the coming days. Having Bearish Divergence in place, certain bearish pressure will not be a surprise in the current market situation whereas short-term bullish pressure may not be quite efficient to create a strong counter in the market. As the price remains below 84.50 area, the bearish bias is expected to continue further.