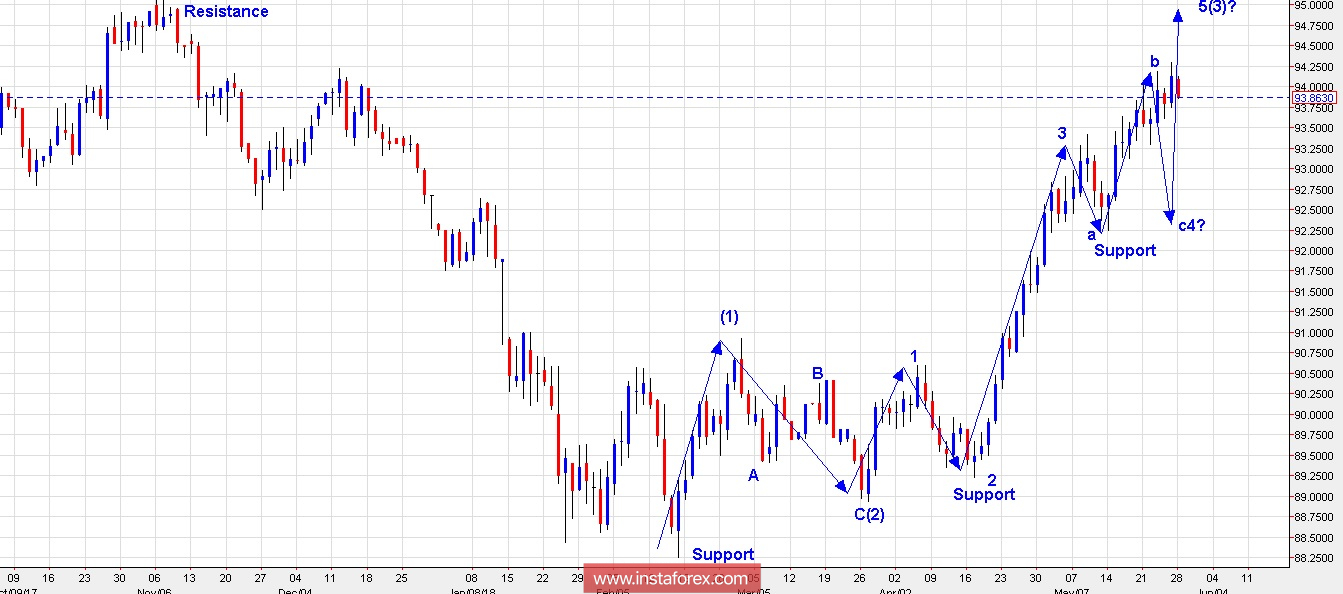

Technical outlook:

The US Dollar Index is now finally turning lower as expected and discussed last week. The index is unfolding into an expanded flat wave pattern as the 4th wave as depicted here, before rallying further higher into the wave 5 towards the 95.00/96.00 levels, which is its next resistance to be taken out by the bulls. As numbered here, the wave count suggests that the wave 4 within the wave (3) is under progression at this moment and is expected to terminate around the 92.50/92.00 levels, respectively. Once the 4th wave is terminated around the 92.30/50 levels, which is also the Fibonacci 0.382 support of the wave 3 (not shown here), we can expect the rally to continue higher towards the 95.00/96.00 levels, respectively. On an immediate short term basis, the US Dollar Index is expected to drop lower below the 93.50 levels, then pull back towards the 94.00 levels, before dropping again lower towards the 92.50 levels.

Trading plan:

Aggressive traders may go short around the 94.00/10 levels with stop above the recent highs; while more conservative traders should remain flat for now and go long again from lower levels.

Fundamental outlook:

There are no major events lined up for the day.

Good luck!