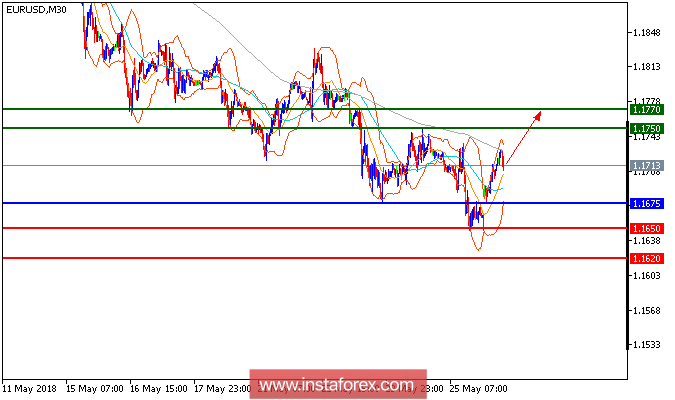

Technical Overview: EUR/USD is expected to trade with a bullish outlook. The pair made a rebound from 1.1645 (the low of May 25), it is still struggling against its declining 50-period moving average. The downward potential is likely to be limited by the resistance at 1.1675. To conclude, as long as 1.1675 is not surpassed, look for a new up leg with targets at 1.1750 and 1.1775 in extension.

Fundamental Overview: The euro is widely up some 0.5% in Asia after Italy's president blocked the formation of a new government supported by 2 anti-establishment parties because of concerns that the coalition could endanger the country's membership in the single currency. The move diminishes the immediate risk of Italy exiting the euro, though it doesn't resolve the political uncertainty that remain

Chart Explanation: The black line shows the pivot point. Currently, the price is above the pivot point which is a signal for long positions. If it remains below the pivot point, it will indicate short positions. The red lines show the support levels, while the green line indicates the resistance levels. These levels can be used to enter and exit trades.

Resistance levels: 1.1750, 1.1770, and 1.1800

Support levels: 1.1675, 1.1650, and 1.1620