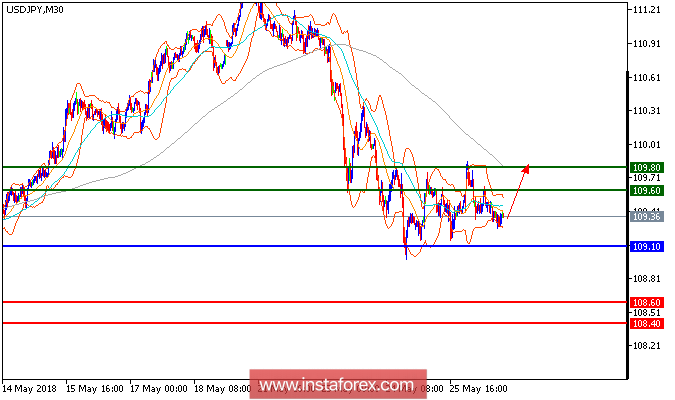

USD/JPY is expected to trade with a bullish outlook. The pair posted a rebound from 109.10 (the low of May 25) and broke above its 20-period and 50-period moving averages. The relative strength index is locating at 60s, calling for a further upside. Hence, as long as 109.10 is not broken, look for a rise with targets at 109.60 and 109.80 in extension.

Fundamentals:

USD is trading at its highest level since November. Economists expects USD to trade firmly this week for three reasons. First, trade developments can worsen again. President Trump's tariff exemptions on steel and aluminum imports from the European Union, Canada and Mexico expire on June 1. Second, financial market stress in emerging markets has increased lately. USD generally performs well in periods of heightened financial market concerns. Third, U.S. interest rate expectations can adjust a bit higher with payrolls due out on Friday.

Chart Explanation: The black line shows the pivot point. The present price above the pivot point indicates a bullish position, and the price below the pivot point indicates a short position. The red lines show the support levels, and the green line indicates the resistance levels. These levels can be used to enter and exit trades.

Strategy: BUY, stop loss at 109.00, take profit at 109.75.

Resistance levels: 109.60, 109.80, and 110.05 Support levels: 108.60, 108.40, and 108.00.