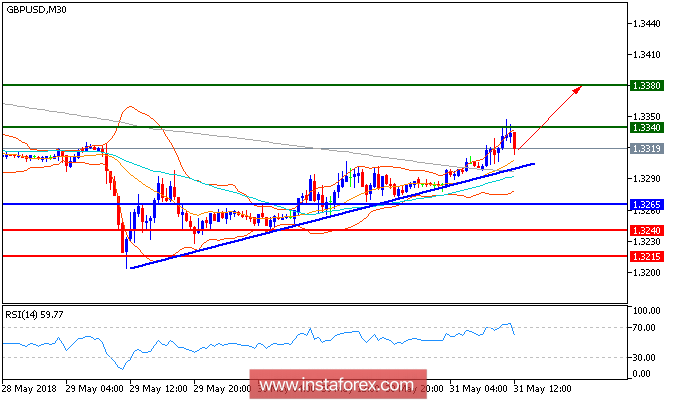

GBP/USD is expected to trade with a bullish outlook The pair stands firmly above its horizontal support at 1.3265, which should limit any downside room. Besides, the prices are also supported by a rising trend line. A bullish cross has been identified between the 20-period and 50-period moving averages, which confirms a positive outlook. Therefore, as long as 1.3265 is not broken, expect a new rise to 1.3340 and 1.3380 in extension.

Fundamentals:

Earlier data shows the amount Britons borrowed strongly rebounded in April, after a bout of weakness in March, in a signal that may strengthen the Bank of England's case for raising its key interest rate in the months to come. Figures released on Thursday showed the sharpest U.K. consumer-credit increase in almost 18 months, despite recent economic data releases signaling a torpid economic growth. The amount U.K. consumers borrowed in April jumped to GBP 1.8 billion after falling to GBP 400 million in March, which was the lowest rate in more than five years, the Bank of England said. The increase was driven by both credit-card spending and loan uptakes.

Chart Explanation: The black line shows the pivot point. The present price above the pivot point indicates a bullish position, and the price below the pivot point indicates a short position. The red lines show the support levels, and the green line indicates the resistance levels. These levels can be used to enter and exit trades.

Strategy: BUY, stop loss at 1.3265, take profit at 1.3340.

Resistance levels: 1.3340, 1.3380, and 1.3410

Support levels: 1.3265, 1.3240, and 1.3215