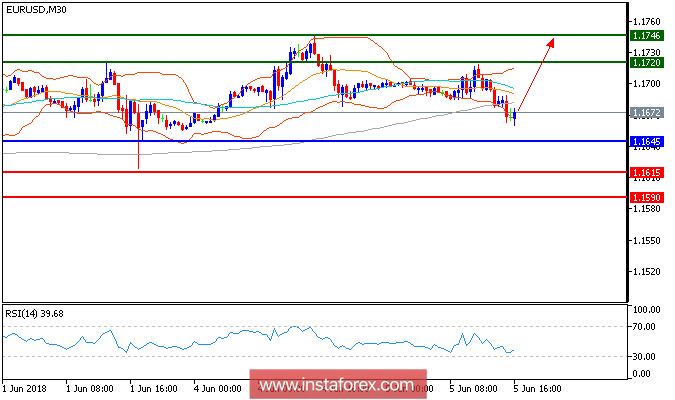

EUR/USD is expected to trade with a bullish outlook. Despite the recent pullback from 1.1745 (the high of June 4), the pair is still trading above a support base at 1.1645, which has allowed for a temporary stabilization. The relative strength index lacks downward momentum. Even though a continuation of consolidation cannot be ruled out, its extent should be limited. To conclude, above 1.1645, look for a further advance with targets at 1.1720 and 1.1745 in extension.

Fundamental Overview: The U.S. dollar is slightly higher versus the euro on Tuesday, helped after eurozone retail sales data came in below market expectations.the dollar is under the radar as global trade war uncertainties come back on the agenda. With the G7 summit in Canada, the trade issue is even more prominent. The near term focus for financial markets is very much whether U.S. President Donald Trump can be talked down from his protectionist perch by fellow G7 leaders at their weekend meeting in Quebec.

Chart Explanation: The black line shows the pivot point. Currently, the price is above the pivot point which is a signal for long positions. If it remains below the pivot point, it will indicate short positions. The red lines show the support levels, while the green line indicates the resistance levels. These levels can be used to enter and exit trades.

Resistance levels: 1.1720, 1.1745, 1.1785

Support levels: 1.1615, 1.1590, 1.1550