Not much has happened during the night, when investors from Asia seemed to not to know what to do with Thursday's US rally and hit in the emerging markets. Positive sentiment on the stock market has been undermined, but gold is not able to use this fact to its advantage. The biggest loser was AUD, which goes back to 0.76 USD, USD/CAD is drawn towards 1.30. EUR/USD stopped growth and parked just above 1.18. The increase in risk aversion pushed USD/JPY to 109.60. The stock market has been interrupted by a series of increases: Japanese Nikkei 225 falls 0.4% and Chinese Shanghai Composite loses 1.5%.

On Friday 8th of June, the event calendar is light in important news releases. The main event of the day is the Canadian job market data in form of Unemployment Rate, Employment Change, Part-Time Employment Change and Participation Rate. The market participants might also keep an eye on German Industrial Production as well as Trade Balance data and Consumer Inflation Expectations data from the UK.

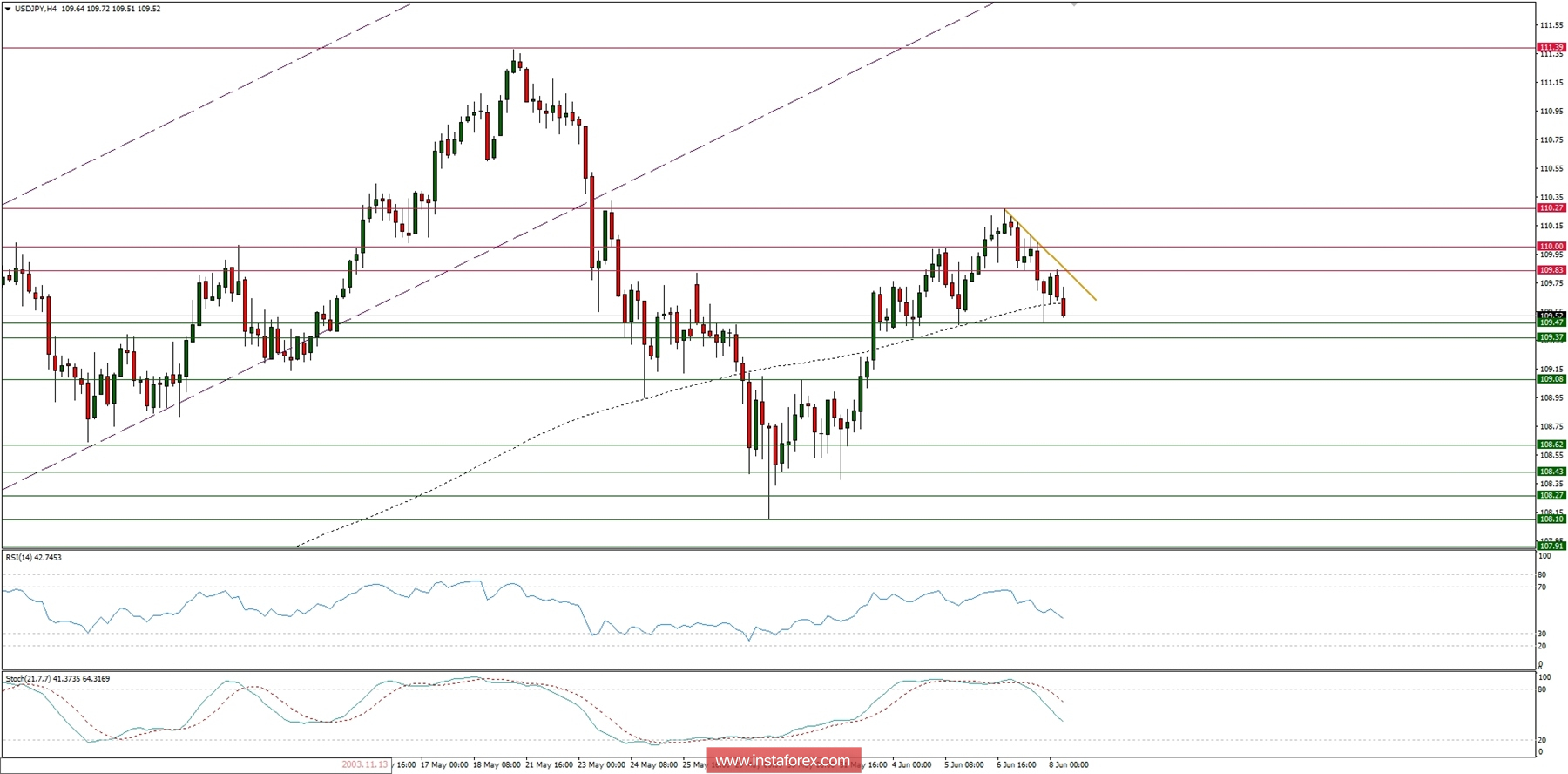

USD/JPY analysis for 08/06/2018:

The final estimate of Japan's GDP for the first quarter brought a correction from -0.1% to -0.2%. Moreover, the Economy Watchers Survey data (which asks business-cycle sensitive workers their thoughts on existing and future economic conditions, giving a detailed picture of economic trends in Japan; the survey is based on questionnaires from 'man on the street' sectors that are particularly vulnerable to business cycle turns) decreased again from 49.0 to 47.1, while the global investors expected an increase to 49.4 points, which only fueled downward pressure on the Tokyo Stock Exchange. The same path was followed by USD/JPY pair after the data was released.

Let's now take a look at the USD/JPY technical picture on the H4 time frame. The market is sliding from the local top at the level of 109.83 towards the intraday support at the level of 109.47. Any breakout below this support will likely result in another slide towards the level of 109.37 and then 109.08 as weak momentum might be fueling this move. The key level for the bulls is still the support at the level of 108.10. Bulls can regain the control over the market if they manage to break through the golden trend line resistance and head towards the swing top at the level of 110.28.