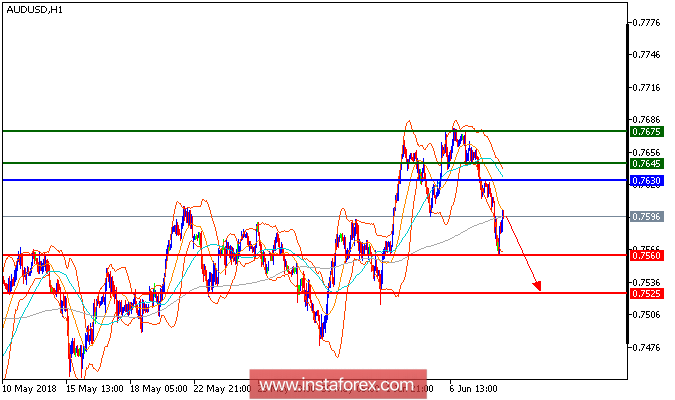

AUD/USD is expected to trade with a bearish outlook. The pair keeps trading on the downside after retreating from a high of 0.7675 seen yesterday. Currently it remains capped by the descending 20-period moving average, which has just crossed below the 50-period one. And the relative strength index is yet to recover the neutrality level of 50, showing a lack of upward momentum for the pair. Unless the key resistance at 0.7630 is breached, a return to 0.7560 and 0.7525 on the downside is expected.

Fundamental Overview: The Australian economy looked healthy in 1Q, it was not without some serious flaws. It grew 3.1% on-year, which was above trend, but the household sector wasn't part of the party. The household savings ratio dropped to a decade low. The things that drove growth like exports, may not have the same repeat performance. Citi argues household consumption growth is unlikely to accelerate without a pick-up in wages growth. Inflation therefore looks set to remain mild, keeping the RBA on hold.

Chart Explanation: The black line shows the pivot point. Currently, the price is above the pivot point which is a signal for long positions. If it remains below the pivot point, it will indicate short positions. The red lines show the support levels, while the green line indicates the resistance levels. These levels can be used to enter and exit trades.

Resistance levels: 0.7630, 0.7645, 0.7675

Support levels: 0.7560, 0.7525, 0.7495