In the coming days, we will have a meeting between Trump - Kim, Fed rate hike meeting with revision forecast and press conference, and no ECB meeting, after which the market expects to present the prospects of the quantitative easing program and the results of a thorough analysis of inflation processes in the Euroland. Therefore, the Monday session should be quite calm. There is no longer any negative information from Italy, on the contrary: the finance minister said that the entire government is unequivocally and resolutely supportive of remaining in the eurozone. The factor of European policy comes back to where it belongs, that is, to the background.

It is widely expected that the FOMC meeting on Tuesday-Wednesday will bring interest rate hikes by 25 bps, but there is no strong justification for the Fed's influence on expectations for a total of four hikes in 2018. However, "dot plot" aggregates individual assessments of individual members, so shifting the median from three to four is not completely excluded, although it will be more important how fast the pace of tightening will be implemented in the following years. In general, the FOMC message should be neutral with the risk of moderate surprises both dovish and hawkish. The main risk for the dollar is the fact that a lot of positive information is already discounted (solid data, expectations ahead of FOMC) and it will be more difficult to trigger fresh demand at retail sales on Thursday and industrial production on Friday. Inflation data on Tuesday is to point to acceleration, but the market reaction may be delayed by waiting for the Fed's decision.

In the Eurozone, everything will be revolving around the ECB meeting on Thursday. After the comments of the members of the Governing Council, a debate broke out over the past week about whether we will now know the details of the future of the program. Although the debate on the QE suppression strategy is certain, we do not think that the ECB will announce a detailed plan for the extension after September (and the likely end of the program by the end of 2018). At the conference, President Draghi can be optimistic about the economic outlook, but he will not give any hint as to the timing of the first rate hike. Lack of particulars may be disappointing for market participants, but the decision period may bring about EUR appreciation.

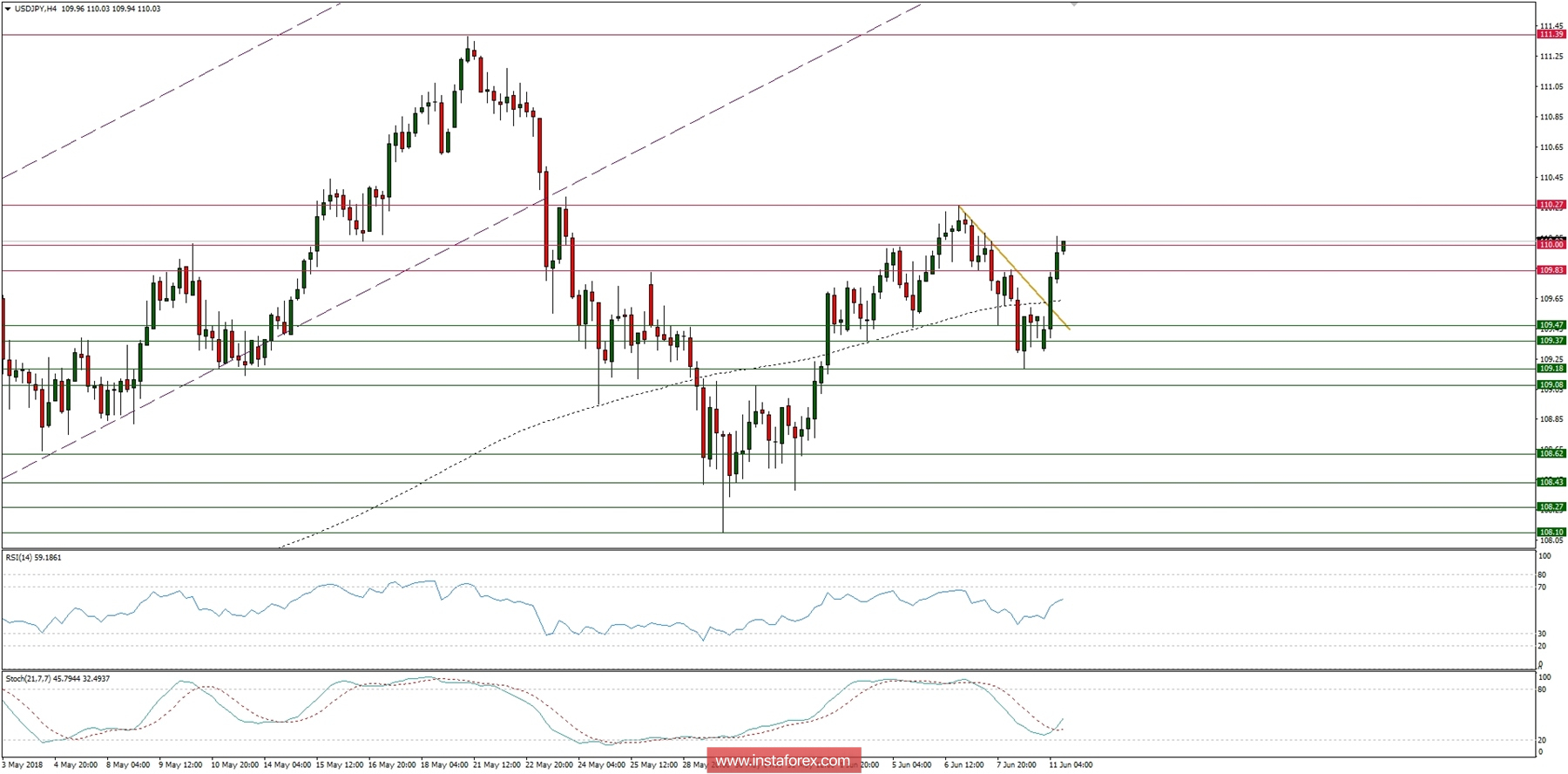

Let's now take a look at the USD/JPY technical picture at the H4 time frame. After the G-7 Summit, the market has broken above the short-term golden trend line and now is challenging the local swing high at the level of 110.27. The strong positive momentum and a bouncing stochastic support the bullish bias, at least in the short term. In order for bulls to restore the full control over the market, they would have to break out above the swing high level at 11.37. The immediate technical support is seen at the level of 109.83.