The currency market shows slight overnight changes, but towards a drop in risk aversion. USD/JPY is pulling up to 110.30, USD only gains NZD (0.7040) and some AUD (0.7615). EUR/USD is bounced up after the nightly visit at 1.1750. The stock market is dominated by increases. The Japanese Nikkei225 grows by 0.5% and the Chinese Shanghai Composite gains 0.6%.

On Tuesday 12th of June, the event calendar is full of important data releases. France will post Change in Private Payrolls data, Italy will post Quarterly Unemployment Rate data, and the UK will present Claimant Count Change and Average Earnings Index data. Germany and Eurozone will present the ZEW Survey (Econ. Sentiment) data. Later during the New York session, the US will post Consumer Price Index data.

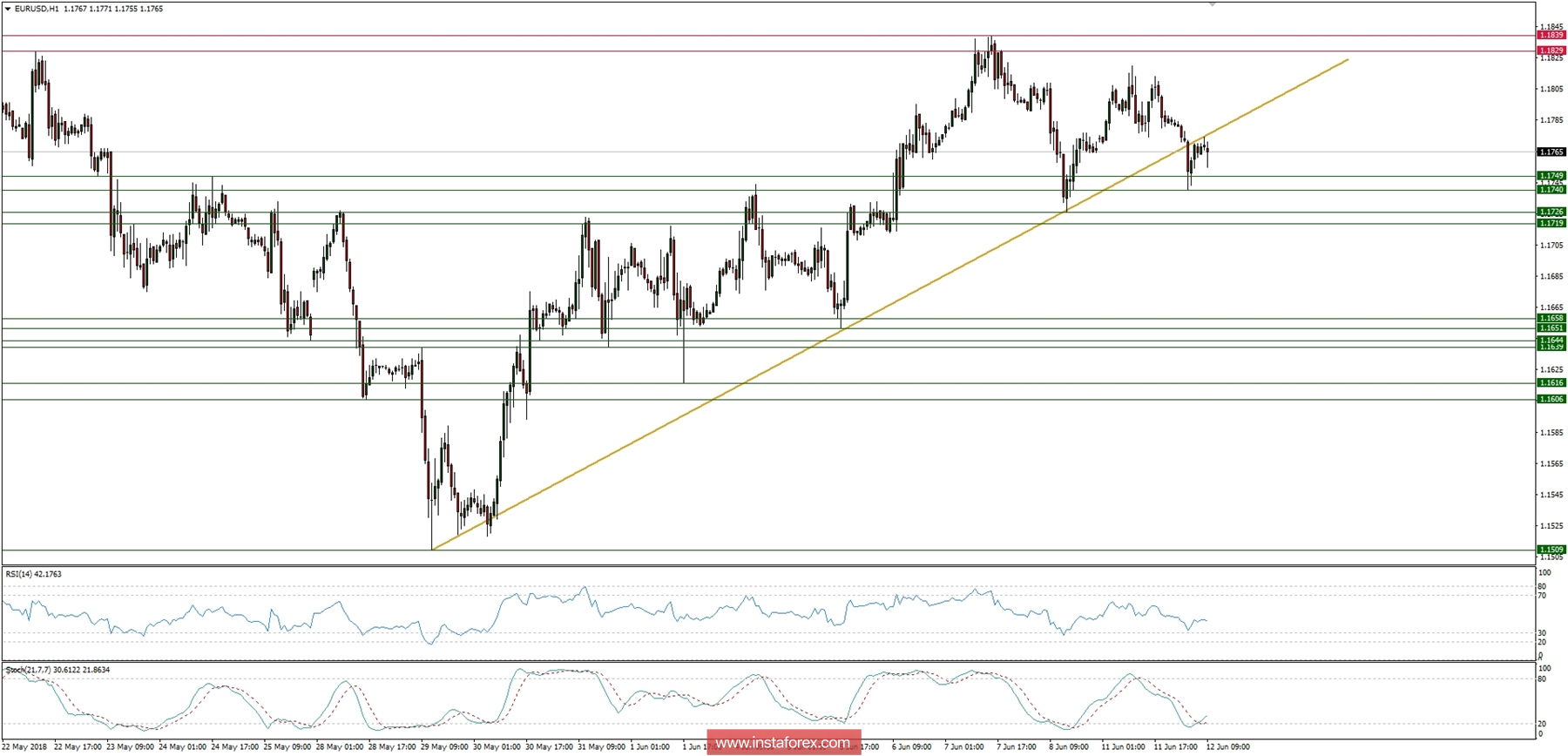

EUR/USD analysis for 12/06/2018:

President Trump's press conference is scheduled for 08:00 am GMT, but before the moment of the documenting ceremony Trump did not fail to share his impressions from the conversation with Kim Dzong Ung. Trump said he was signing a "very important" document and that he and Kim had formed a "very strong bond". According to the assets, you cannot see the reaction during quite a calm session of Asian trade. Moreover, he said the process of denuclearization would start "very fast" and "a lot of goodwill has been put into" this project. He added that Kim is "fantastic" and is a "valuable negotiator" and a "very talented man". Generally, a lot of politeness and little content. Whatever you can pull from the top, it could always be worse. This is not a reason for euphoria, so markets remain in a generally positive, though peaceful climate.

The financial media quote an interview by Ewald Nowotny from the ECB given to German newspaper Kleine Zeitung. Nowotny said that he "looks with concern" at events in Italy, but does not think that they will lead to a "real crisis" that would become a big problem for the European banking sector. Nowotny declined to comment on interest rates, but it looks that the recent big spike in the inflationary pressures will be treated more seriously by the ECB governing council.

Let's now take a look at the EUR/USD technical picture on the H1 time frame. The market broke below the golden trend line support and now is testing the breakout from below. The intraday low was set at the level of 1.1740 and if bears try to push the price lower from here, then this support will likely be broken and the price will head towards the levels of 1.1726 - 1.1719.