Fed raised interest rates by 25 bps and signaled readiness for two more hikes before the end of the year and another three in 2019, but this was not enough to sustain the appreciation of the USD. An obstacle may be the lack of a signal for further strengthening on the part of the debt market, where yields of 10-year bonds have failed to reach over 3%. (today, 2 bp are falling at 2.95%).

In the press release, the decision does not have too many changes in the assessment of the economic situation. It emphasized continued improvement in the labor market, increase in consumption and investment. As expected, the extract removed that economic conditions require slow interest rate increases and that interest rates will remain below the long-term level for some time. This is the adjustment of the communication to the forecast of the federal reserve rate, which in 2020 shows a higher level than in the long run. The Fed also decided to raise the interest rate from the surplus reserve by 20 bp (in line with expectations).

The projection of the optimal level of interest rates at the end of subsequent years (the so-called "dot chart") shows that the Fed will raise rates twice this year. In 2019, the base scenario is three more increases, and in 2020, after one increase in the cost of money, rates would be 3.5%.

The Fed Chairperson Jerome Powell at the press conference in every opinion confirms faith in the US economy and the accuracy of Fed decisions. Raising the rate from surplus reserves by 20 bp is a small technical adjustment, the process of balance reduction goes smoothly, the strength of the economy allows for changing communication strategies with the market. It emphasizes that trends on the energy commodity market temporarily hinder inflation, but calms down, that the Fed will not show over-reactivity to this situation. Raising rates too slow or too fast could, in his opinion, be harmful.

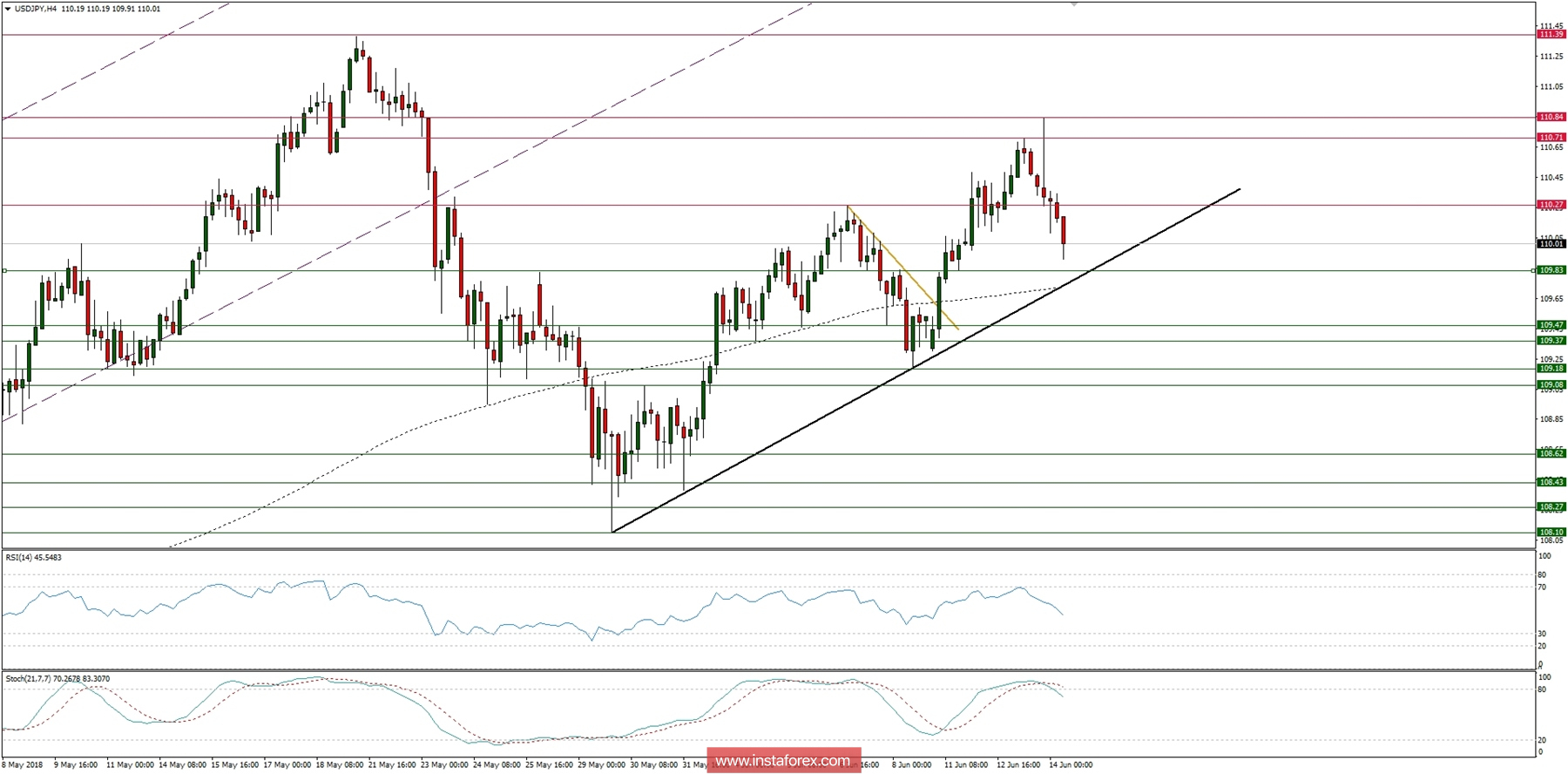

Let's now take a look at the USD/JPY technical picture at the H4 time frame. In the first reaction, the price has started to rallying towards the level of 110.84, but the H4 candle closed near the lows eventually. Currently, the price is dropping towards the technical support at the level of 109.83. The market conditions are overbought and the momentum is pointing downwards, which confirms the intraday bearish bias. Any violation of the black trend line will be considered as even more bearish sign and weakness of the market.