AUD/USD has been quite impulsive, following the bearish bias today after certain indecision with the daily close yesterday. AUD has been recently struggling amid downbeat economic reports, whereas the recent rate hike in the US has been a great push for the currency to gain momentum in the process.

Today, Australia's Employment Change report was published with a decrease to 12.0k from the previous figure of 18.3k which was expected to increase to 18.8k but Unemployment Rate decreased to 5.4% from the previous value of 5.6% which was expected to be at 5.5%. Moreover, MI Inflation Expectation report was published with an increase to 4.2% from the previous value of 3.7%.

On the USD side, yesterday the FOMC held a policy meeting which was followed by the policy statement on the federal funds rate. The benchmark rate was lifted to 2.00% from the previous value of 1.75%. Though there has been certain indecision about the impact of the rate hike, USD managed to gain sustainable momentum over CAD for a while. Today, US Core Retail Sales report was published with an increase to 0.9% from the previous value of 0.4% which was expected to be at 0.5%, Retail Sales also increased to 0.8% which was expected to be unchanged at 0.4%, Unemployment Claims decreased to 218k from the previous figure of 222k which was expected to increase to 223k, and Import Prices remained unchanged at 0.6% which was expected to decrease to 0.5%.

As for the current scenario, USD is expected to gain further momentum in the coming days having backed by the recent positive economic reports followed by the rate hike, whereas AUD is struggling amid mixed economic reports published recently. To sum up, USD is expected to dominate AUD further, whereas certain correction and volatility can be observed along the way.

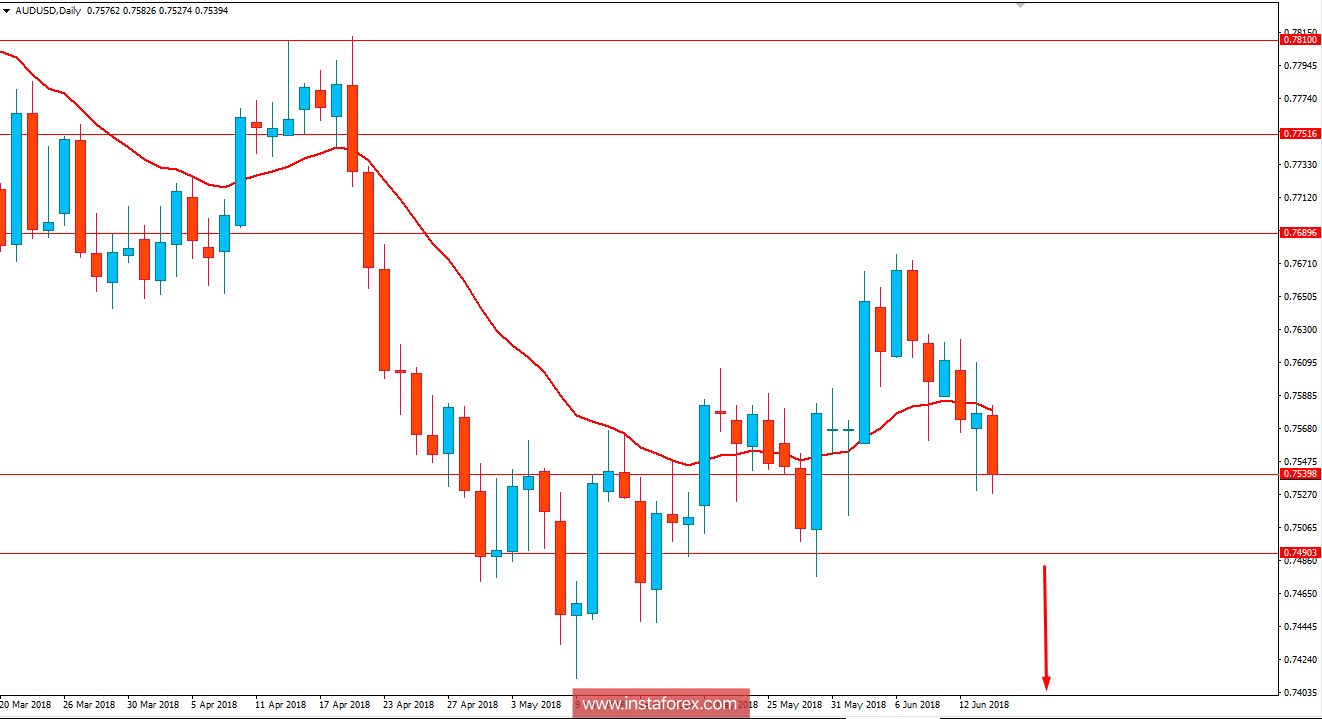

Now let us look at the technical view. The price is currently residing at the edge of support area 0.7500-50. If broken with a daily close, it is expected to push the price much lower towards 0.7350 area in the future. Though there has been certain corrections and volatility along the way but to have impulsive bearish momentum in the future, a break below 0.75 with a daily close is much needed.